11 Mar Changing of the guard: understanding and valuing the generational shifts in society

By Pieter Hundersmarck

When were you born?

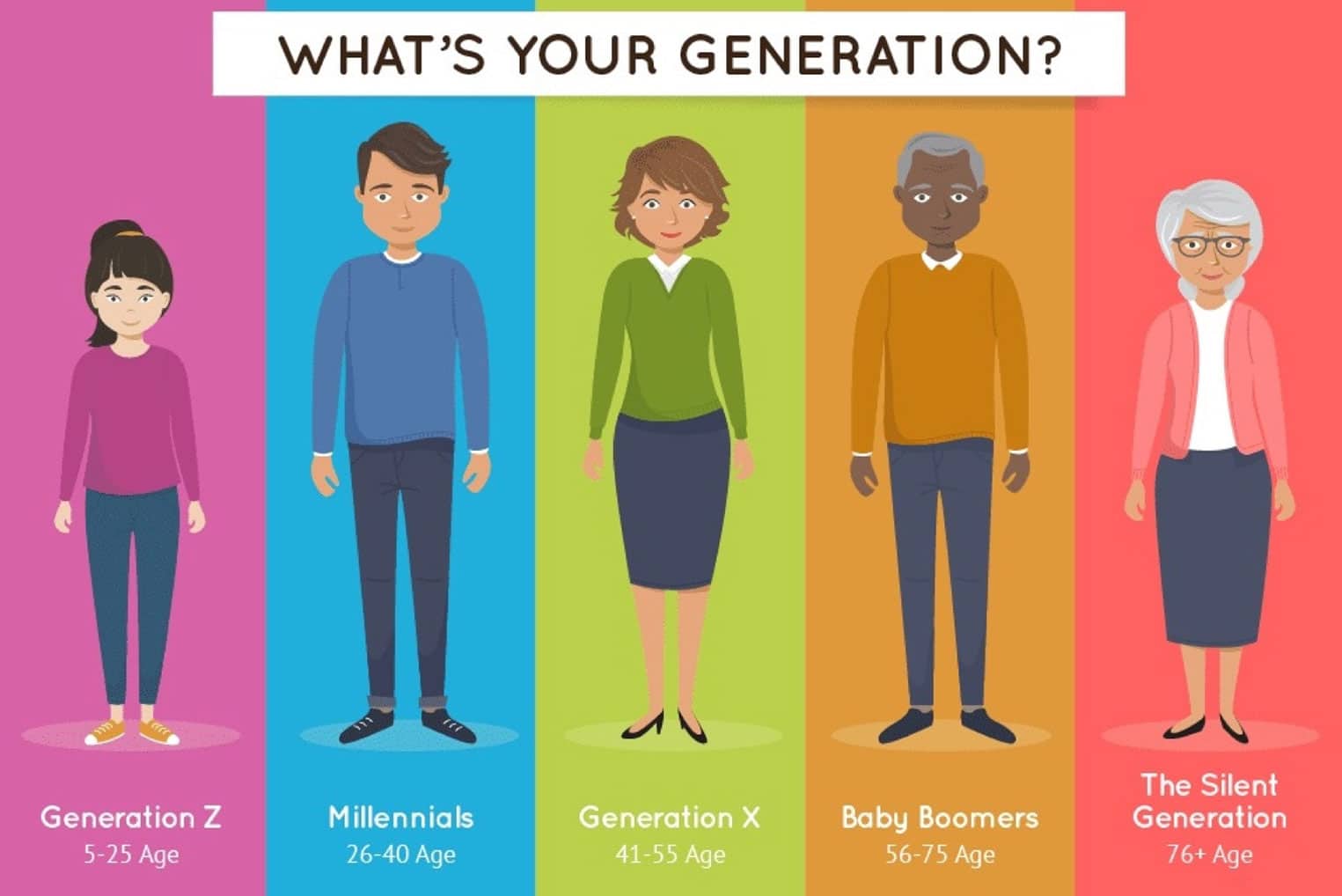

- Silent Generation (born 1928-1945, current age 92-75)

- Baby Boomers (born 1946-1964, current age 74-56)

- Generation X (born 1965-80, current age 55-40)

- Generation Y or Millennials (born 1981-1995, current age 39-25)

- Generation Z or Centennials (born 1996-2016, current age 4-24)

- Generation Alpha (born 2017-present, current age 3)

A generation is defined as “the average period, generally considered to be about 20–30 years, during which children are born and grow up, become adults, and begin to have children”. Generation is also often used synonymously with cohort in social science; meaning “people within a delineated population who experience the same significant events within a given period of time”.

By this definition there are currently 6 generations on planet earth.

Generations are defined by, amongst other things, the available means, technology and popular culture of their day. For example, the silent generation (of which there are only 25 million left in the United States) are defined by their work ethic. Raised by turn-of-the-century farmers and tradesmen, this generation value loyalty, respect and temperance. While technological advancement was slower for this generation than subsequent ones, their wealth accumulation was staggering, bested only recently by their children, the baby boomers. In contrast, the rise of the internet, social media, and a renewed focus on the individual as opposed to the collective has defined the millennial generation. Millennials are also far less wealthy than the boomers were at the same age, seeing 28% declines in median wealth for the <35-year-olds compared with those in the same age bracket in 1989 according to the Federal Reserve.

While current spending power sits with the baby boomers and Generation X, next in line are Generation Y (millennials) and Z, which includes those born between 1981 – 2016.

Generation Y and Z exhibit different views towards society and consumer goods and services than their parents.

The lives of both these generations are conducted online and they are financially conservative (perhaps because they have to be……?). Importantly, 90% of them live in emerging markets. Why is it important to understand this, and what conclusions can we draw from it?

The average millennial attention span is now 10 seconds, which means they might not catch the end of th…

On the one hand, generation Y and Z have youth on their side. One might say “who cares” what the current crop of young kids wants? We all had desires, limited means (and not much wisdom) when we were young. This is the defining theme of generation Y and Z: they are young. As we grow older, our understanding of the world, and how we participate in it, changes, and with it so will our needs and wants.

Durable investment conclusions cannot be drawn on the fact that young people today don’t use credit cards, like to play video games or don’t currently drive a car.

Some of these phenomena can be explained by their current stage of life, and their means. Financial success (and differing payment methods like credit cards), as well as responsibility (you can’t play video games all day when you have children) and driving habits (at the right price or if you live outside a city you will own a car) change as you age.

Which brings us to an important point. Interpreting generational change is intertwined with technological change. To a certain extent we could say some generational changes are shaped by technology, which in turn shapes the way people consume, save and invest. For example, many of the pastimes we currently enjoy were unavailable to previous generations due to technology: the smart phone is easy to point out. Going a step further, a third of generation Z would trust a robot to make their financial decisions, and they watch eSports more often than traditional sports. As a result of the internet, interactions are increasingly conducted online: Chart 2 shows that a staggering 40% of 16-18-year-olds prefer to interact virtually.

Source: BofA Thematic Proprietary Survey n=14,592, conducted Aug 2020 “How do you prefer to spend the majority of your interactions with friends?”

Core, cultural needs will likely remain the same. Mothers and fathers of thirty years ago will desire the same things as mothers and fathers in the next thirty: a good education for their children, a safe environment, a stable income and food on the table. Disposable income then, and in future will be spent on apparel, the outdoors, and travel for as far as we can anticipate. Money earned will need to be spent: unless generation Y and Z become massive savers, which at the current rate seems unlikely. On that note, a savings industry, as far as the continuation of a capitalist, free market economy exists, will be vital.

Some of the mainstays of previous generations (independent of technology) are changing. For example, surverys reveal that only half of US teens can drive, less than half of Gen Z over 18 drink alcohol (versus a third of millennials), and more than half have some kind of meat eating restriction. For both generations, mobile phone usage, social media, cultural participation, awareness of the environment and social awareness are essential themes.

There is no doubt that generation Y and Z are delaying marriage, children, and home ownership, as well as postponing other traditional consumer purchases. Commercial intentions are also affected – 80% of Generation Y and Z factor ESG investing into their financial decisions, and they are also quick to drive sustainability campaigns, such as green energy (much of this campaigning is conducted from relative safe perches behind their mobile phones or tablets).

Much as all children born in South Africa since 2007 have known load shedding, in the technological era, Baby Boomers, Gen X and Millennials have known digital for most of their lives.

They see technology as inseparable from human life, an extension of themselves, and they master digital skills with ease.

There is money to be made in understanding the nuances of changing consumption habits, but also in understanding that some things don’t change. Investors need to concern themselves with the changes that will endure, and understand those drivers that will not change.

What conclusions can we draw from this?

Extracting the first order conclusions is, in part, simple. Cable television, like compact discs and records before them, will go the way of the horse and buggy. Disposable plastics and petrol engines will follow in the not-too-distant future. Meat and alcohol consumption may change, or be supplanted by other proteins and recreational drugs. Second order changes, based on changing demographics, become more subtle. How will companies get their message across to consumers when everyone is an influencer on their own platform? How does delaying marriage and changing social models affect financial goals and retirement? What is the future of nation-states – and even nationality – when successive generations view themselves more as global citizens? The answers to these questions aren’t readily apparent.

For investment conclusions, by far the most important factor that can be gleaned from a study of upcoming generations in relation to the past is the enormous, far reaching impact that the internet is going to have on human society.

For investment conclusions, by far the most important factor that can be gleaned from a study of upcoming generations in relation to the past is the enormous, far reaching impact that the internet is going to have on human society. Many before us have said it, modelled it and bought into it, but the truth is we don’t believe we are even scratching the surface of the social, consumption and investment changes that will occur as we grow ever more interconnected and online. Our global funds participate in many of the themes we have identified in the newer generations, and we continue to look for more ways to invest behind them.

- 9 out of 10 of Gen Z thinks it’s appropriate to use their phone in the bathroom, and 36% think it’s appropriate to use it in a place of worship

- Gen Z & Millennials have a much weaker handshake than other generations

- Gen Z will spend nearly 6 years of their life on social media… that’s more time spent than eating, studying & socializing combined

- Young surgeons are losing the dexterity to stitch up patients because they’re spending too much time swiping smartphone screens

- Gen Z have a shorter attention span than goldfish, at 8 seconds

- 70% of Millennials would consider buying a lab-grown diamond, when getting married, which costs around a third less than a mined one

A second, just as important, conclusion that goes beyond the understanding of what is happening between generations, is stepping back and understanding what is happening to society as a whole.

In our lifetime, the elderly will outnumber the children.

Declining birth rates alongside longer lifespans mean the demands on a smaller working population to support ageing populations are increasing year by year. In particular, according to Euromonitor, Europe is expected to see the ratio of 3.6 workers to each over 65-year-old in 2020 decrease to 2.5 workers/over 65-year-old by 2040. By 2031, the over-60s will outnumber the under-10s.

The impacts of ageing are multi-disciplinary. They affect all asset markets, economies and currencies. Even succinct conclusions are far too numerous to lay down here. This makes our jo of delivering growth on your investments increasingly important.

About Pieter Hundersmarck:

Pieter is a fund manager and member of Flagship’s global investments team.

Pieter has been investing internationally for over 13 years. Prior to Flagship, he worked at Coronation Fund Managers for 10 years in the Global and Global Emerging Markets teams, and also co-managed a global equities boutique at Old Mutual Investment Group. Pieter holds a BCom (Economics) from Stellenbosch University and an MSc Finance from Nyenrode Universiteit in the Netherlands.