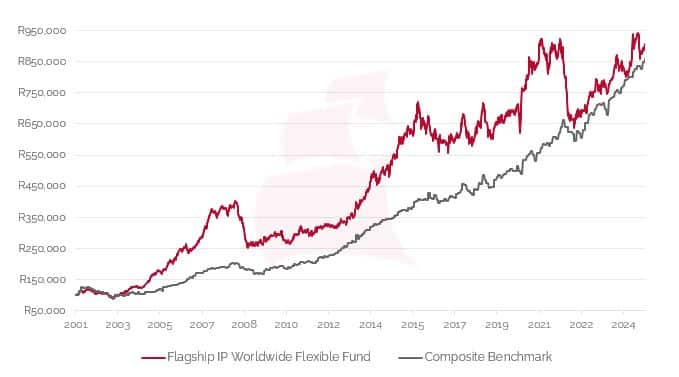

Our Global Flexible strategy offers investors balanced exposure to international growth assets. Asset allocation is equity centric and is adjusted depending on valuation levels.

Invest with us

Investing with Flagship Asset Management is a simple process. You can download the investment form or fill it out online. If at any stage in the process you are uncertain, please call us on +27(0)21 794 3140.

Invest with us

Investing with Flagship Asset Management is a simple process. You can download the investment form or fill it out online. If at any stage in the process you are uncertain, please call us on +27(0)21 794 3140.