03 Feb a Chinese slowdown, manageable inflation, and cash over bonds

As published by IOL on 29 Jan, 2022 by Pieter Hundersmarck

Three major asset allocation themes currently dominate our thinking. Firstly, the slowdown in China and its effect on the global economy and businesses, secondly, the outlook for inflation, and finally, the investment case for bonds versus equities.

Slowing Chinese economic growth

Much of China’s economic growth remains investment-led, and a large proportion of investment has gone into home construction. The chart below (and there are many others that corroborate this) shows that instead of the tailwind it has been for nearly 2 decades. the contribution from housing is set to become a headwind to GDP growth. Simplistically, this means the 6% GDP growth rate we have become accustomed to can halve if other sectors of the economy (consumption, government spending or net exports) don’t fill the gap.

There are severe knock-on effects. China’s economic growth has been the enabler of growth across the western world, where many listed businesses generate their revenues. As the Chinese economy slows, investors will need to calibrate their expectations across the commodity, trade and manufacturing industries.

Inflation

While we do believe inflation will slowly reassert itself from ultra-low levels of the past decade, we remain unconvinced that inflationary forces are greater than the deflationary forces of demographics, technology and financialization over our investment time horizon. According to Viktor Shvets (Macquarie) “Evidence for the regime change is weak”. Three data points support the view that change will be gradual (and manageable).

1. The markets are not signalling higher inflation. US 30-year bond yields are below 2% and the US 5-year / 5-year (the five-year expectations of inflation in five years’ time) also remain low. Inflation in Europe remains very low, and monetary policy remains accommodative.

2. While wages, especially in the US, are rising, increases are heavily concentrated in disrupted segments (i.e., transport and warehousing, travel-related). In other areas we see no such increases. In Europe and Asia, we see no evidence of wage growth.

3. Social inequalities are high on government agendas, as expressed by the rising percentage of the population that are asset owners (who benefit from higher inflation) versus those that own relatively fewer assets. Interest rates must keep abreast of this dynamic, making a sharp reset incredibly unpopular, and thus unlikely.

The investment case for Bonds

Since the GFC, and the financial repression that has taken place in world’s fixed income markets, the pressure for investors to move up the risk curve is high. For the past 3 years, the decision to steer clear of bonds in favour of equities has been the correct one. But as inflation rises, is this still the correct stance?

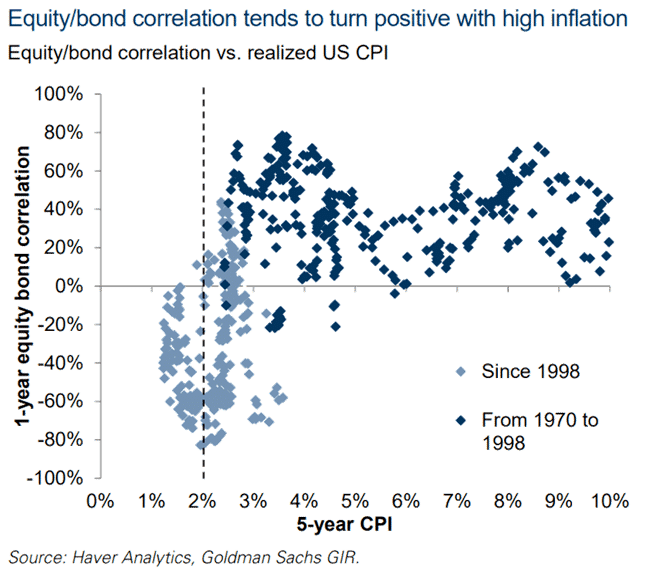

The chart below shows that the correlation between equities and bonds tends to turn positive in times of higher inflation. Therefore, the risk of investing in bonds relative to equities increases with greater inflation as returns (both up and down) will be more correlated, but with bonds carrying arguably more price risk.

In the absence of an attractively priced fixed income allocation, the current environment suggests a higher allocation to cash. A large cash allocation doesn’t help in terms of real returns, but allows the managers greater discretion to adjust to market conditions aggressively when the time is right. It also greatly reduces fund volatility.

About Pieter Hundersmarck:

Pieter is a fund manager and member of Flagship’s global investments team.

Pieter has been investing internationally for over 13 years. Prior to Flagship, he worked at Coronation Fund Managers for 10 years in the Global and Global Emerging Markets teams, and also co-managed a global equities boutique at Old Mutual Investment Group. Pieter holds a BCom (Economics) from Stellenbosch University and an MSc Finance from Nyenrode Universiteit in the Netherlands.