22 Apr Are REITs the best place to hide in a 1970s inflation scenario?

As published by Sanlam Glacier on 22 Apr, 2022 by Kyle Wales

In last week’s Funds on Friday, I explained why inflation above a certain level is bad for the economy while acknowledging that most economists still expect inflation will be transient. I concur with this view. However, I believe risks remain to the upside.

In this week’s article I will draw upon the historical precedent of the 1970s to show how the experience during that decade might suggest that the risk of an outlier scenario of persistent high inflation may be greater than what many think. In the words of Mark Twain “History doesn’t often repeat itself but it often rhymes”.

I will then look at which asset classes provided the best protection during that period and which asset classes might provide the best protection today should this type of outlier scenario materialize today.

Similarities with the 1970s are troubling

Unfortunately, rather than allaying one’s fears, any comparison of the situation today with the 1970s provides additional cause for concern.

Firstly, the decade of the 1970s began with monetary debasement, which draws an obvious parallel with the era of easy money that has followed the Global Financial Crisis (GFC). Secondly, the high inflation experienced during that period was also made worse by two exogenous shocks, similar to the two shocks – re-emergence from Covid, the Ukraine crisis – that have contributed to the situation today.

Looking back, the stage for the stagflation of the 1970’s was set at the beginning of that decade with the “Nixon Shock”. This refers to the announcement made by Nixon on the 15th of August 1971 when he announced a combination of wage and price freezes, import surcharges and, most importantly, suspended the convertibility of the dollar into gold with immediate effect.

This action dismantled the Bretton Woods fixed exchange rate system. In terms of that system the US dollar was pegged to (and redeemable) in gold at a fixed price of USD 35 per ounce and all other currencies were pegged to the dollar.

Bretton Woods had served the world well but the fiscal imprudence of the US during the 1960s (partly to finance the Vietnam war), as well as its negative balance of payments ultimately made it unviable because the US gold reserves became insufficient to cover its dollar liabilities. Because of this, some of the US’s trading partners began requesting redemption of their dollars for gold and this posed a risk that there would be a run on the US’s gold reserves.

It was not just the Nixon Shock which contributed to the high inflation of the 1970’s, however. The situation was worsened by two oil crises during that decade.

The first of these, in 1973, was caused by OPEC countries embargoing countries which supported Israel during the Yom Kippur War. This saw the price of oil rise from US$3 per barrel to US$12 per barrel. The second, in 1979, was caused by the Iranian Revolution which removed Iran’s production from the oil market. This saw a doubling in the oil price from US$20 per barrel (immediately prior to the crisis) to US$40 per barrel.

Fast forward to today and the notion of a “hard” anchor for currencies has been absent for a while but it is hard not to wonder whether a currency debasement of another type, in this case the easy money era following the GFC, might pose a problem. This view gains further credence if we look at the popularity of cryptocurrencies like Bitcoin whose adherents take a lot of comfort from the fact there is a fixed number of Bitcoins that may be issued and no monetary authority can issue them at will. As stated above, two exogenous shocks – re-emergence from Covid, the Ukraine crisis – have also contributed.

Which asset classes provide the best protection against outlier high inflation?

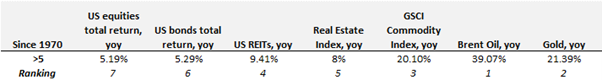

The chart which I supplied in last week’s Funds on Friday shows the returns provided by various asset classes under different inflation scenarios is a good place to start. I will, however, limit my discussion to that part of the chart which consists of inflation observations exceeding 5%. Most of these observations were recorded in the 1970s.

Source: Bernstein

Historically when inflation exceeds 5%, commodities have been the best performers (oil as well a broader commodity index take the first and second places respectively). They have been followed by gold in third place and then by US REITs in fourth place.

Interestingly, while both performed poorly, US bonds actually outperformed US equities which is not a result that many people would have expected. The reason for this is twofold: firstly, equities underperformed because very high rates of inflation are often accompanied by low economic growth rates (hence the term “stagflation”) and, secondly, they are long-duration assets so equity valuations suffer as the result of a higher discount rate being applied to the stream of future cashflows that equity holders are entitled to.

To what extent would we expect asset class returns to mirror the past if we experienced a period of outlier high inflation today? I believe that there is compelling argument to be made that instead of commodities and gold, certain types of REITs, specifically those with short duration leases, might be the asset class that performs the best. The reason for this is that both commodities as well as gold have very significant shortcomings which may be hard to overcome.

Let’s begin with the shortcomings of commodities. The cleanest way for portfolio investors to gain broad commodity exposure is through a collateralized futures ETF rather than an ETF which holds the various underlying commodities directly. Collateralized futures ETFs, like physically backed futures ETFs, carry an implicit charge for cost of storing the physical commodity (which can be high for certain high volume, low value commodities). They also carry a second charge, an implicit interest charge. This charge is to prevent cash-and-carry arbitrage between the futures and physical markets and could provide a very large offset as interest rates typically rise in tandem with inflation rates.

Gold also has its shortcomings. Unlike other commodities, the largest gold ETFs are physically backed. As I stated above, there is no implicit interest rate charges built into pricing of physical gold ETFs but there is a “negative carry” from holding gold which is the opportunity cost of holding an asset which doesn’t provide an income. This may impair its desirability as an inflation hedge. Secondly, while the role of gold as a store of value has been entrenched for centuries, there are a number of asset classes that are vying with it for this role today, amongst them Bitcoin. These asset classes may further impair its desirability as an inflation hedge.

REITs surmount all of these problems. Firstly, there is no implicit interest rate charge or negative carry that need to be recouped, only an opening yield which is typically set to grow in line with contractual, often CPI-linked, escalations. Property valuations also tend to rise with inflation. Secondly there are no storage costs.

Not all REITs are created equal, however, and it is those with short duration leases that will be better at passing on rising inflation.

While I expect inflation to be transient, the risks of the situation today evolving into scenario of persistent high inflation is far from zero. The 1970’s has concerning parallels with the situation today and once inflation takes hold, it is very hard to stop it in its tracks. The cycle of negative (high) inflation expectations becomes self-reinforcing.

I believe investors with multi-asset mandates should hold small positions in all asset classes that have proven themselves as inflation hedges, and specifically re-evaluate the role that REITs might play, as this might prove very valuable in a portfolio context.