25 May Dollar-cost averaging maximises your offshore exposure at lower cost and risk – even as stock markets tumble

As published by FA News on 23 May, 2022 by Kyle Wales

Equity markets are close to dipping into bear market territory year to date, so it may seem counterintuitive to look at maximising your retirement fund offshore investment exposure to the new maximum – 45% of your retirement funds. But there are several good reasons to do so.

In fact, while stock markets may wax and wane in response to the latest news, in the long-term there are strong reasons to justify putting an even greater proportion of your wealth in offshore assets.

However, for the risk-averse, taking the plunge as markets sell off may be a bridge too far. Instead of investing at a single point of time, like now, however, you should consider the benefits offered by dollar-cost averaging by raising your offshore investment exposure in smaller amounts at regular intervals without considering the price at which you are investing. It’s a strategy that helps you lower what you pay over time and minimises the risks associated with trying to time the market.

In his latest budget speech, finance minister Enoch Gondwana gave investors more room to manoeuvre, announcing that the offshore limit for pension funds would be raised from an effective 40% (30% in the rest of the world (ROW) + 10% Africa) to 45% (no distinction was made between ROW and Africa).

While the stated intention of Regulation 28 is laudable, that is to protect those saving towards retirement against poorly diversified investment portfolios, it is disingenuous. Even with the new amendments to Regulation 28, savers are still forced to have 55% exposure to domestic assets within their retirement portfolios when South Africa’s contribution to global GDP is a mere 0.6%. More likely, the intention is to keep South Africa’s long-entrenched exchange controls in place, even if this comes at the expense of domestic savers.

This 55% exposure also needs to be considered within the context of the typical saver’s entire exposure to South Africa, which may be north of 90% when one considers that their jobs are based here as well as their primary residences. They also face a dwindling number of investment opportunities as a result of companies delisting from JSE.

Savers in the private sector find themselves in a very different position to government employees. Government employees are typically members of the Government Employees Pension Fund (GEPF), which is a defined benefit scheme. As such, their retirement benefits (plus an adjustment which is at least equal to 75% of the inflation rate per annum) are underwritten by the fiscus.

In contrast, private savers are typically members of defined contribution schemes where they bear the full investment risk associated with their retirement savings. They thus bear the costs of being over or under-exposed to South African assets.

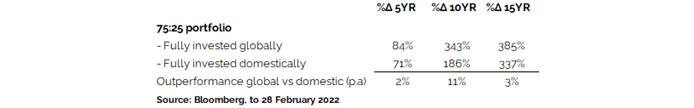

As is evident in the table below, a 75:25 portfolio that was fully invested globally would have outperformed one fully invested domestically over five, 10, 15 years. Less aggressive global portfolios would have performed less well relative to their domestic counterparts because we have seen the lowest interest rates for a generation post the Global Financial Crisis. This looks set to change.

An argument put forward by one of South Africa’s large investment managers that the optimal offshore asset allocation (from a risk and return perspective) would be below 45% for local high equity mandates simply does not hold water. Their argument is that higher offshore allocations lead to higher rand volatility, which impedes the investment goal of preserving capital in rands (as opposed to dollars).

Firstly, academic measures of risk and return focus unduly on market volatility and this would compromise the investment outcomes for most of those invested in high equity mandates, many who would be in their wealth accumulation phase and therefore have longer-term time horizons. In this respect, Warren Buffet’s quote that he would prefer a “lumpy 15% return to a smooth 12%” comes to mind.

Secondly, it is irresponsible to focus on the preservation of capital in rands. Who would want to measure their returns in a soft currency (like the rand) rather than a hard currency (like the dollar)? In the short-term, the impact of rand movements on local inflation may be minimal but in the longer-term, they feed through to local CPI. This has led to a steady erosion in the purchasing power of domestic savers (and non-savers for that matter) because the unmistakeable trend in the rand has been downwards.

For each of these periods above (with the exception of the five-year period), the rand depreciated by more than the inflation differential between South Africa and the United States due to declining South African competitiveness. This looks set to continue. If you look back over the last 30 years, unemployment has spiralled due to the failings of our education system. We have gone from a net exporter of electricity to having insufficient electricity to meet the needs of our domestic market. Transnet has gone from having surplus rail capacity to calling force majeure on many of its longer- term contracts. Policy changes to reverse this trend have been slow to materialise.

South Africa is behind the curve in relaxing the requirements to Regulation 28 to allow domestic savers to have greater discretion in investing their retirement funds. “Self Invested Pension Pots” in the UK, for example, give UK savers almost full discretion to choose where they invest their retirement savings. Despite the fact that many people are calling for domestic assets to perform well in the short-term as a result of high commodity prices, over the long-term the primary goal of domestic savers with respect to increasing their global exposure should be to achieve diversification.

This will not only provide them with protection against a weaker domestic economy and declines in the rand should these scenarios unfold. It will also protect them against South African tail risks, which may be greater than one would like to think if the ANC tries to arrest the decline in their electoral support by passing more popularist policies.