16 Apr Trouble brewing for South-African retailers as Temu and Shein snatch away market share

As published in Business Day on 16 April 2024 By Gerhard Janse van Vuuren

Just as they were girding their loins for Amazon’s SA launch later in 2024, local retailers have been blindsided by Chinese retail giants Temu and Shein, which are advertising aggressively and flooding the market with highly competitive offerings.

Aside from introducing stiff competition in the retail sector, these extremely efficient global retailers, which benefit from massive economies of scale, will likely have a broader economic effect. The authorities will need to consider whether the savings consumers are able to make by buying these goods outweigh the potential job losses that could ensue in an economy that already has one of the highest unemployment rates in the world.

Going big globally

If you saw an ad during a sports break telling you to “shop like a billionaire”, would you sit up and listen? That is precisely the approach taken by Chinese e-commerce retailer Temu during the recent US Super Bowl, where the company showcased six advertisements (at an estimated cost of more than R400 million) and immediately became the number one downloaded free app in the US.

Temu offers similar products to those of other online retailers targeting the US market, yet in some cases is able to do so at less than 50% of their listed prices. This is remarkable, given Amazon’s reputation for having some of the most competitive prices available.

The meteoric rise of discount e-commerce retailers like Shein and Temu has also created a general feeling of uneasiness among South African retailers, who are already concerned about having to compete with Amazon’s much-anticipated launch later in 2024.

What is Temu?

Temu is owned by Chinese e-commerce giant Pinduoduo (PDD) — meaning “together, more savings” — which started out selling groceries in China and has since expanded into numerous other categories and gone global. Founded in September 2015 and listed in the US, PDD attained a gross merchandise value (total value of all goods sold on the platform) of $65.7bn within three years of launching.

The company is able to negotiate better prices with suppliers by using ‘group buying’, which means inviting customers to recruit family and friends who all order the same product and receive a bulk discount.

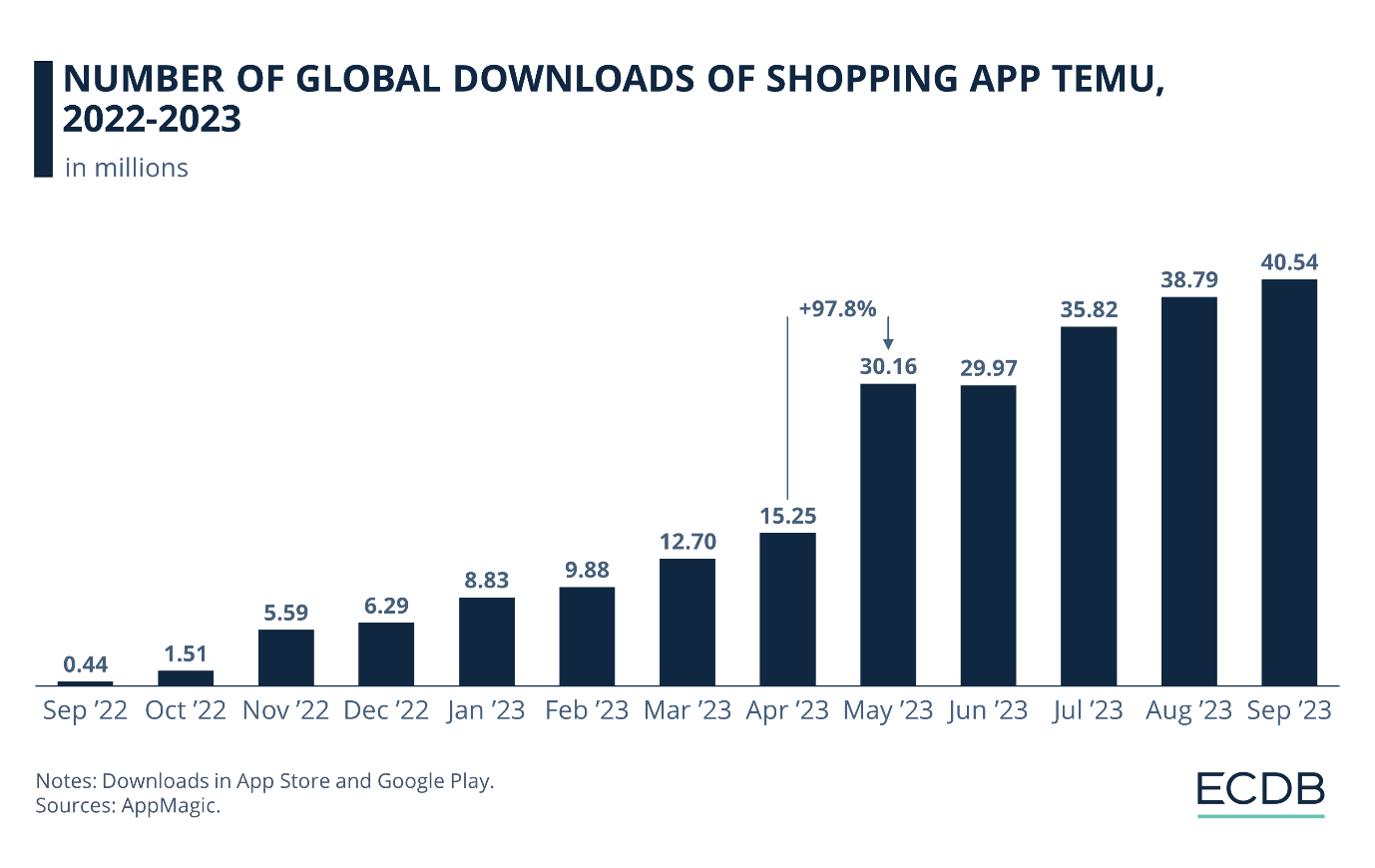

Source: https://ecommercedb.com/insights/temus-global-download-numbers-2023/4642

Temu’s marketplace platform launched in the US in 2022 and in key European markets in 2023, where it has already become a household name. Part of Temu’s meteoric growth can be attributed to its aggressive marketing spend — it has shelled out about R38bn on Meta (Facebook and Instagram) alone, making it their largest customer for advertisements on these platforms. In the last year alone, Temu has placed around 1.4 million global ads on Google[1].

In South Africa, the platform offers a wide range of products at bargain-basement prices. A soap holder for R13? Check. Polarised sunglasses for R100? Check. Consumers vote with their wallets, and droves of them are buying from Temu or Shein in SA, welcoming these new e-commerce entrants with open arms.

Effects on the South African retail sector

Though the low prices and range of goods may be attractive to South African consumers, there are valid concerns regarding these platforms. Do the savings to consumers outweigh the economic impact of potential job losses? In a country with a 32% unemployment rate, should South African regulators be alarmed or welcome new entrants that increase the sector’s competitiveness? At what cost? Offshore platforms operate under different regulations and guidelines, with no local ownership laws and potentially flouting labour rights.

There have been allegations from regulators and competitors that some overseas retailers might be side-stepping tariffs by exploiting certain loopholes. Yet, even if you had to adjust for increased tariffs, the prices offered by these discount e-commerce retailers will likely still be incredibly difficult for domestic retailers to compete with.

Just this week, Takealot announced the potential sale of Superbalist, as direct response to the competitive strain forced on local retailers by Temu and Shein. Interestingly, Takealot was once seen as a disruptor in the South African retail landscape, but now the tables have turned.

While competition is generally positive for consumers, as it ensures they are paying reasonable prices for products, the full scope of the impact needs to be evaluated. Among other things, one should consider the economic climate in our country, as well as the strained wallets of consumers.

Efficiency

To combat high inflation the SA Reserve Bank set out on its interest rate hiking cycle in 2022 with the aim of bringing inflation back to within the target range of 3%-6%. This has meant rate-related payments have gone up significantly for most South Africans, and there has been considerably more pressure on their finances. This inevitably causes consumers to trade down to cheaper alternatives.

Chinese e-commerce products are so affordable due to China’s remarkable efficiency as a manufacturing hub — the country accounts for 28% of global manufacturing output. Another reason for the low prices is how much of the value chain Temu bypasses, as it sources products directly from factories in China and retails them globally.

Valuations

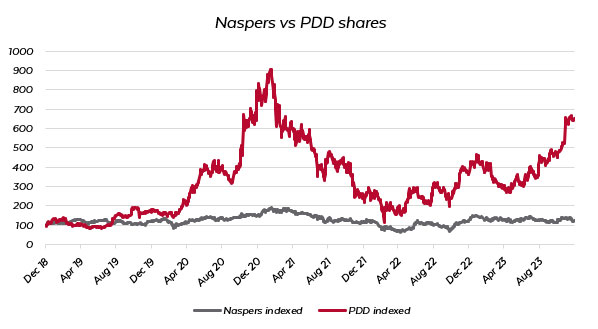

As an investor, the rational next step is to consider Temu’s parent company, Pinduoduo (PDD), as a possible investment opportunity. The company, founded in Shanghai in 2015 and listed in the US, trades on a forward price-to-earnings (PE) ratio of 13.9 times. While this might not scream bargain to some value investors, the shares are not particularly expensive if you consider the growth prospects. PDD has been growing revenue at an annual rate of 63% over the last three years, and is expected to double over the next two years.

China’s valuations are touching record lows when compared to the US market. It may only be a matter of time until we see a rebound in Chinese share prices. Companies like PDD, Alibaba and JD.com are sitting on an average net cash position equal to 41% of their market cap. This effectively means that should these companies choose to repurchase shares or pay dividends, with a portion of this cash, investors could realise substantial gains.

As reflected in the S&P 500, the US stock market is trading on a forward PE ratio of about 21 times, compared with China’s 10 times.[2] Investor worries stem from China’s struggling property sector, deflation concerns and irrational regulatory crackdowns by Chinese authorities. At these valuations, the market is more than discounting China specific risks and implying that Chinese companies are substantially less efficient than US companies, which is clearly not the case. There is ample scope for China to stimulate their economy, which would be further boosted by a pick-up in global demand.

As an investor looking to obtain exposure to the e-commerce industry, the JSE offers a limited selection. Naspers is the only option available to South Africans, and most domestic funds are already overweight the share. Temu and Shein’s expansion in the global retail market highlights that if investors cast their net wider, there are excellent diversification opportunities to be found in other geographies.

About the author

Gerhard Janse van Vuuren BCom (Hons)

Equity Analyst

Gerhard completed several investment internships while concluding his degree in Investment Management at Stellenbosch University. Gerhard is a CFA Level II candidate and has completed his Honours degree in Finance at the University of Cape Town.