05 Jun Novo Nordisk and Eli Lilly’s GLP-1’s investment case just became even more compelling

As published in FA News on 30 May 2024

By Philip Short Flagship Asset Management fund manager

The investment case for Novo Nordisk and Eli Lilly became even more compelling last week after a study found that the fast-selling weight loss GLP-1 drug semaglutide, sold as Ozempic and Wegovy, helps protect the kidney function of overweight or heart disease patients.

Weight loss drugs containing GLP1 have become a new pharmaceutical craze catching the world’s attention. What was initially prescribed as a diabetic drug has morphed into a weight loss drug—and promises to address other chronic health conditions. Glucagon-like peptide-1s (GLP-1s) are a class of drugs that was, and is still, used for treating diabetes and is now being used for weight loss.

GLP-1s are hormones naturally produced in the intestine when eating and signal the release of insulin in the body. Two important things happen with the intake of GLP-1: 1) appetite satiety; you feel full sooner and for longer, and 2) a disruption of the dopamine receptor, meaning the good feeling of eating something that you enjoy is not as rewarding.

Novo Nordisk and Eli Lilly are the two leading pharmaceutical companies in this space. Novo Nordisk produces the GLP-1 semaglutide, branded as Ozempic for diabetes and Wegovy for weight loss, which has been available since 2021. Eli Lilly’s GLP-1 terzepatide, branded as Zepbound, has been available since 2023. Trials showed that using these GLP-1s resulted in a range of 6% to 21% total body weight loss in patients, depending on which branded drug they used.

Since the public release of these drugs, some other positive implications have to come light. For one, some obese GLP-1 users who were also habitual smokers no longer felt the need to smoke and quit. Other observations have been improved cardiovascular health, decreased sleep apnea, reduced diabetic kidney disease, reduced risk of Alzheimer’s, and the list goes on.

Novo Nordisk, Eli Lilly, and others are now in full swing, taking all these initial observations and putting them through the various trial phases. It’s worth noting that all these additional benefits were observed before the actual weight loss, so they seem to be a result of the GLP-1 and not the weight loss.

GLP-1 penetration of the US adult population went from 0.1% in 2021 to 1.5% in 2023. And this is just for weight loss in the US. Imagine the global target market for weight loss, smokers wanting to quit, Alzheimer’s, and all the other uses for GLP-1. According to the Organisation for Economic Co-operation and Development, nearly 40% of the US population is obese. According to the World Health Organisation, 1 in 8 people in the world are living with obesity. Worldwide, adult obesity has more than doubled since 1990, and adolescent obesity has quadrupled. It is, therefore, not difficult to believe that there was a worldwide shortage of many of the GLP-1 drugs earlier this year.

Pricing for the medication is high. For example, Saxenda, a Novo Nordisk GLP-1 obesity medication, costs approximately R5,000 per month in South Africa. For certain serious cases of obesity in the US, medical insurance covers most of the cost. Whether medical insurance will in the future cover costs when GLP-1s can be prescribed for smoking cessation or cardiovascular health remains to be seen. Patents for Wegovy and Zepbound should expire in 2031-2032, which could see cheaper generics being launched.

Currently, GLP-1s are delivered via injection once a day or once a week. Novo Nordisk is currently in phase two of trialling a GLP-1 pill, Amycretin, to be taken daily. In phase one tests, it has shown a higher efficacy than the injectables Wegovy and Saxenda.

This all sounds promising, so what’s the catch? There are indeed a number to consider:

- Taking any medication is a change to one’s organic make-up and has the potential to change the inner workings of the human body. Even more so when this medication involves altering or mimicking hormones.

- The most common listed side effects include nausea, vomiting, and diarrhea.

- With the current line-up of GLP-1s, you have to keep taking the medication into perpetuity for it to have the desired effect. However, this may change with the next generation of GLP-1s.

- Injectables need to be cold-chain stored.

From a medical point of view, it’s early days in the application of GLP-1s other than to treat diabetes, which was first applied in 2005. From an investment point of view, we believe it’s also in the early days when looking at Novo Nordisk, Eli Lilly, and others in the space. We look forward to seeing the total addressable market expand as new uses are approved for this interesting class of drugs, GLP-1.

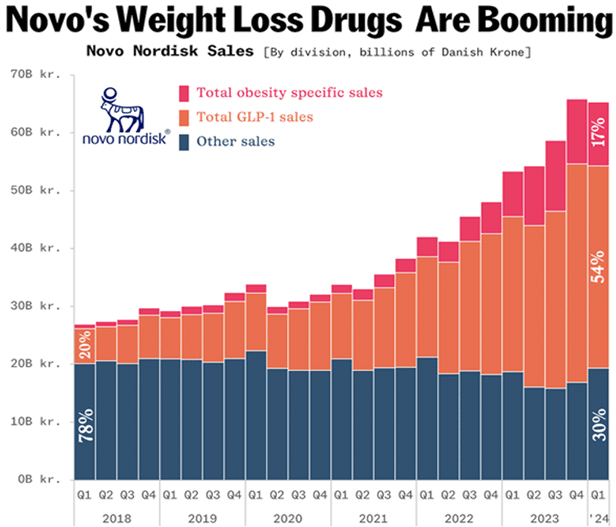

We own both Novo Nordisk and Eli Lilly in the Flagship global funds. If we look at Novo Nordisk, the short-term forward price-to-earnings multiple is rich at 37x. Can it grow earnings into that multiple in the medium term? We think so. Even on the current addressable market for obesity only, we see scope for better-than-expected growth in the US alone, as the penetration rate in US adults is still small at 1.5%.

Then, if one adds the additional use cases, which will admittedly come only in a few years, and additional geographies, we see potential for medium-term expectations to continue moving upwards. In addition, Novo Nordisk pays a dividend, is busy with a share buyback program, has zero net debt, and has a return on equity (ROE) of 88%. Thus, the investment case for the two leading manufacturers of GLP-1s does look compelling.

About the author

Philip Short BSc (Maths) CFA

Fund Manager

Philip is a Fund Manager of Flagship’s global funds and brings specialist macroeconomic expertise. Philip has gained 20 years’ experience in the industry at JP Morgan, Fairtree Capital and Old Mutual as an analyst and portfolio manager. He completed his Bachelor of Science in Mathematics at the University of Pretoria and is a CFA charter holder.