14 Jun The evolution of a top-performing flexible fund of funds

As published in Citywire on 31 May 2024 By Patrick Cairns

The Flagship IP Worldwide Flexible fund of funds takes ‘an active top-down approach’ to asset allocation decisions.

The Flagship IP Worldwide Flexible fund of funds has gone through a number of iterations since it was launched in 2003. At times, it has only held exposure to underlying active managers, and at others, it has exclusively used exchange-traded funds (ETFs).

Under the management of Philip Short and James Hayward, it now uses a combination of the two. The co-managers also continue to have the guidance of the original manager and Flagship chairman, Winston Floquet, who sits in on the monthly asset allocation meetings.

‘We take quite an active top-down approach,’ Short told Citywire South Africa in an interview. ‘We research managers, and monitor the managers we use to ensure that they stick to their philosophy and process, but then we also add equities or lower equities when we feel that markets are too rich or too cheap.’

This has always been a feature of the strategy. When Floquet was running the fund in 2008, for example, he switched 100% into cash ahead of the global financial crisis. In February 2020, just before the Covid-19 crash, the fund had a lower-than-usual 60% equity exposure and then upped equity exposure to 80% post the sharp sell-off.

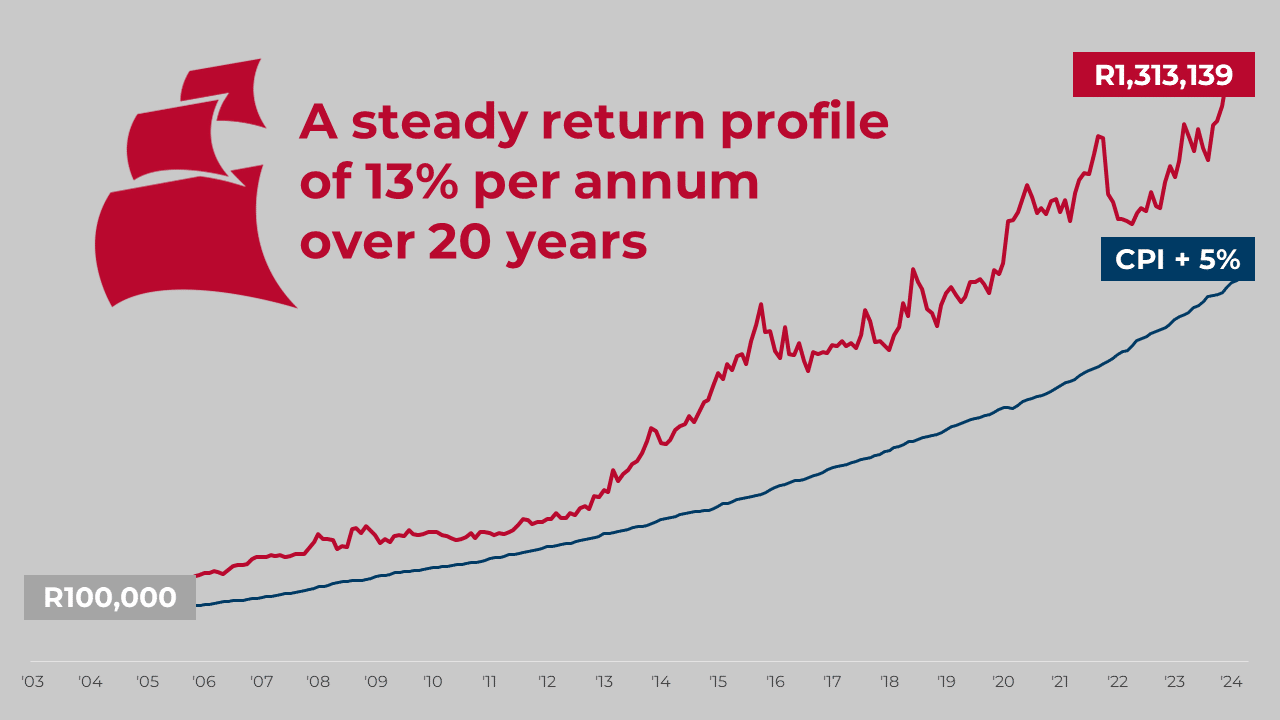

The fund’s benchmark is [consumer prices index] CPI-plus-5%, and it has outperformed that since its inception in 2003. Over that period the fund has returned an annualised 12.9%, against the benchmark of 10.5%.

‘The reason we have that as a benchmark is the fund is designed for people who live in South Africa but want to hedge against a weaker local currency and a relatively weak economy,’ Short (pictured above) said. ‘By investing globally, we have access to thousands of companies and some sectors that are not available on the JSE, like aerospace and defence.’

He added that given the long-term growth potential in equities, this is where most of their focus lies.

‘This and our other flexible fund are equity-centric,’ Short said. ‘On a look-through basis, we probably hold around 75% in equities through the cycle.’

For the most part, that will be entirely offshore. But the fund has recently taken a 9% exposure to local equities.

‘We were holding that 9% in local bonds that were offering a good return, and moved that into local equities,’ Short said. ‘The reason is that we think there is a tactical opportunity here as the market is very cheap.

‘With elections coming, there is a lot of bad news that has been priced in, on top of the Eskom and Transnet issues. In combination with that, we’ve seen commodities rallying, and that improves South Africa’s terms of trade, which in turn increases the value of the rand.’

Tactical Shifts

The fund has expressed this view by buying two local ETFs – one tracking the mid-cap index and the second the financials index.

‘The reason we chose those is to get true SA Inc. exposure,’ Short said. ‘We wanted to avoid the likes of Naspers, Richemont or the bigger miners which we could be getting elsewhere through our global exposure. We wanted to get SA Inc. stocks like the local banks that are trading on low price-earnings ratios (PE) and high dividend yields.’

The fund also uses this approach globally to take tactical positions through sector, region, or country-specific ETFs. Currently, these international building blocks make up just over 20% of the portfolio.

‘Recently, in the last year or so, we have moved into a Japan ETF, for example,’ Short said. ‘And in the last three or four months into an ETF tracking Chinese internet stocks. This is how we express our macro view while letting the underlying active managers we use express their view.’

Those active managers make up the bulk of the portfolio at just over 50% in total. The four largest are the Artisan Value fund, GQG Partners Global Equity fund, GQG Emerging Markets Equity fund and Lindsell Train Global Equity fund.

‘We’ve had those specific managers for at least the last four years,’ Short said. ‘Theyare very, very good at what they do and sticking to their specific styles.

‘We are style agnostic, but prefer to have a blend.’

Emerging Markets

He added that while the fund does like to hold some emerging markets exposure through the cycle, the current emerging market allocation is higher than it might usually be.

‘That has crept up as we have brought our exposure to America down,’ Short said. ‘We are underweight the US at the moment because we feel it’s expensive.

‘We like GQG’s emerging market fund because they are very up to speed on the Indian market, and India has been doing well. They have about a 30% exposure in that portfolio.’

The Flagship portfolio also currently holds a 6.6% position in physical gold.

‘Traditionally, gold has a really strong inverse correlation with real rates, but that broke down in early 2022 with the Russian invasion of Ukraine,’ Short said. ‘What happened was that the US froze Russian dollar-denominated assets, such as US debt holdings.

‘Countries like China, Brazil and Saudi Arabia have been selling US treasuries since then and their central banks have doubled up their purchasing of gold. That has supported the price, even with high interest rates.

‘And we think that when US rates do start coming down, you are going to potentially get an even bigger kicker in that gold price, so we’re comfortable holding it.’