17 Jul For many, the jury is still out on the case for investing in China

As featured in Business Day on 16 July 2024

By Flagship Asset Management global equity analyst Gerhard Janse van Vuuren

China was one of the hot topics on Wall Street until investors turned their backs on it.

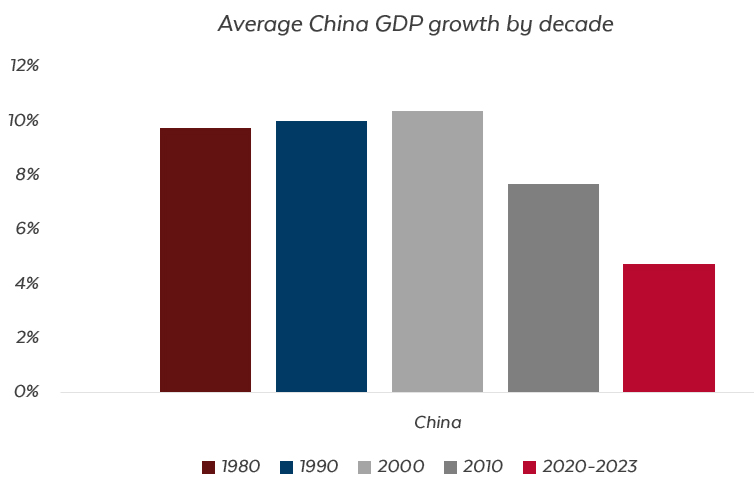

China’s spectacular four-decade rise to global superpower made it the darling of the investment world. Its growth topped 14% a year at its peak, and China was considered the world’s leading investment destination. As such, China’s domestic equity market capitalisation doubled between 2014 and 2020.

Economic growth has more than halved since then, and the Chinese stock market has lost roughly $6 trillion since 2021. The $6 trillion question now is whether China, the factory of the world, will regain its status as a favoured destination for investors.

Source: World Bank, Flagship Asset Management

While GDP reached a stable 7.7% on average over the previous decade, the onset of the global pandemic in early 2020 marked the beginning of the slowdown for China. To contain the spread of the pandemic, China implemented one of the strictest and longest lockdowns worldwide, called “Covid-Zero”.

This policy, which had severe consequences for the Chinese economy, was only abandoned at the end of 2022, much later than the rest of the world. As a result, the economy remains severely hungover, still struggling to shake off the negative impact of post-Covid events on investor sentiment.

Source: World Bank, Flagship Asset Management

China’s accompanying regulatory crackdowns on the economy’s significant growth drivers exacerbated the impact of Covid. In an effective double blow, the Chinese government simultaneously clamped down on the property and internet sectors. The most famous example of restrictions implemented on major tech firms out of concerns that they were becoming too powerful was that of Alibaba and its fintech affiliate, Ant. The founder of Alibaba, Jack Ma, criticised the Chinese government’s actions, which resulted in authorities suspending the Ant Initial Public Offering. The government also focused its regulatory crackdown on gamers in 2021, banning children from playing for over an hour on certain days.

Investors are generally reluctant to invest in countries with unpredictable policy changes and thus these measures severely damaged investor sentiment.

However, policy uncertainty is not the only reason the Chinese stock market has lost roughly $6 trillion in value since 2021. The property sector debacle added to China’s issues. Around 70% of Chinese household assets are tied up in property, versus about 45% in the US. Chinese property giant Evergrande’s implosion, brought down by its massive debts and inability to complete existing projects, made it clear to all that this sector was seriously struggling. According to Bloomberg, a 5% decline in Chinese home prices would wipe out $2.7 trillion in wealth.

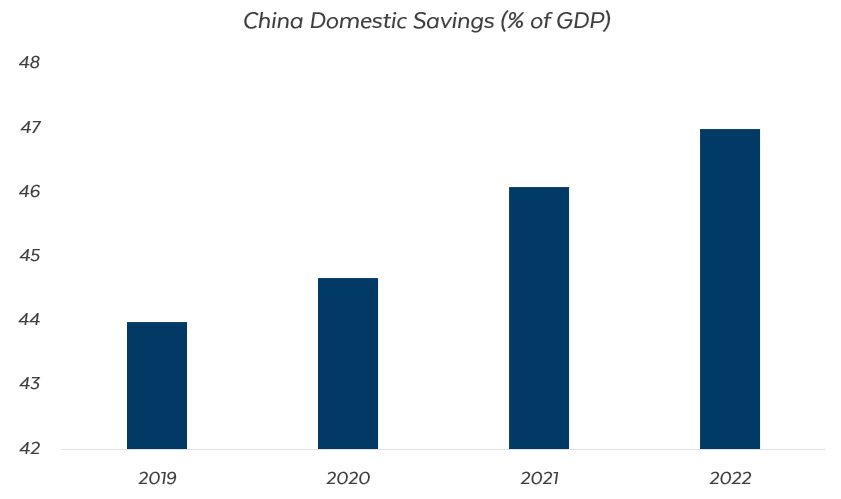

While Chinese consumers worry about what the future may hold, domestic savings have increased significantly. This, ironically, is hurting economic growth. With a growing economy, one would like to see stable savings as a proportion of GDP, as this means consumers are still spending the same portion of their wealth, which continues to drive the economy forward. Since 2019, Chinese domestic savings have ticked up, with citizens citing concerns about possible unemployment, declining personal wealth and property woes. This would not usually pose a problem, but given the recent challenges, it is an ominous sign.

Source: World Bank, Flagship Asset Management

Additionally, tensions between two of the world’s superpowers, the US and China, are currently boiling below the surface. With both Biden and Trump signalling more tariffs on Chinese goods and protectionist measures to come, it seems as though this tension will continue to simmer, regardless of who becomes the next US president in November. Increased tariffs imposed on Chinese goods will likely make them less attractive to other alternative producers or lower demand for them altogether. This is at a time when the Western world is focused on reducing reliance on Chinese goods, with India currently grabbing investors’ attention instead. Together, these forces may significantly impact the Chinese economy.

Given the challenges faced over the past few years, Chinese valuations are, understandably, under pressure. This sharply contrasts with the US, which appears to be going from strength to strength despite tight monetary policy. US valuations are above their long-term average, while the Chinese market is at all-time lows.

Slightly more optimistic investors are asking, “At what point does China just become too cheap?” while the more pessimistic pose the question, “Is China uninvestable?” According to a survey quoted in the Financial Times, more than 40% of the respondents surveyed believed the latter to be true.

While it is easy to be sucked into the prevailing narrative in mainstream media, it is essential to remember that every asset has its inherent value. Even when there are challenges, the asset becomes too undervalued to ignore at some point, and investors will step in and take advantage of the opportunities. Most investors, however, would like to see a few critical areas addressed before committing capital to China, such as resolving deflationary concerns, policy stability, and the protection of household wealth.

Investors have gone into risk-off mode ahead of the Communist Party’s annual policy meeting, the Third Plenum, in mid-July. This has ended a solid stock market rally from February to May 20th, which saw the CSI 300 Index climb 15%, before retracing 7% by early July.

However, given the level of pessimism building up before the meeting has started, any positive surprises that come out of it could well see the investment case favouring rebuilding exposure to Chinese equities, namely cheap valuations and record levels of underexposure to the world’s second-largest country, come into play again.

China’s recent false starts have understandably made many investors weary of wondering if a “turnaround” is still on the cards. Nonetheless, China remains the world’s factory because it has ensured that entire manufacturing supply chains are located in the country. This gives it a strategic advantage over most of its competitors on the world stage and one that is difficult to replicate elsewhere, cost-effectively and in good time.

Thus, despite domestic concerns and politicians’ desire to display their power, investors cannot afford to ignore this global powerhouse from an economic or potential investment perspective.

About the author

Gerhard Janse van Vuuren BCom (Hons)

Equity Analyst

Gerhard is an equity analyst for the global team, having joined Flagship in 2022 via the internship program.

Gerhard completed several investment internships while concluding his degree in Investment Management at Stellenbosch University. Gerhard is a CFA Level II candidate and has completed his Honours degree in Finance at the University of Cape Town.