08 Oct Supply and demand of US Government bonds

As published by Sanlam Glacier on 13 September 2024

By Philip Short

The US has a mountain of debt. What’s more, every year it adds to that debt. In fact, the US owes so much money that it cannot cover the interest payments on its existing debt, via tax receipts only. It must borrow more money, by issuing more debt, to cover the interest on its existing debt, but in doing so racks up new interest payments on the newly issued debt. Just like using a second credit card to help you pay off the interest on your first credit card. Then using a third credit card to pay off the interest on the second card. And so on.

The US is on an unsustainable fiscal path as it continues to run large budget deficits, even when the US economy is strong. Currently, US Gross domestic product (GDP) is growing at 3% in real terms and unemployment is at a very acceptable 4%. Yet, the government is on target to run a significant budget deficit of $2.3tn in 2024, which is 8% of US GDP.

One can be forgiven for raising only half an eyebrow to these gargantuan numbers as they’ve been around for years, although increasing at a faster clip. Albeit some respected market participants have been begging politicians to rein in spending, it has fallen on deaf ears.

Is the US debt a problem or not? Let’s go over the facts as they stand today:

- US government debt currently sits at $35tn, which reflects a debt-to-GDP ratio of 120%, a level not seen since World War 2.

- The US’ Congressional Budget Office (CBO) sees US debt-to-GDP reaching 200% by 2053.

- If the US could be more productive with the use of their debt, it would not be such an issue, i.e. if GDP were to outgrow debt issuance. Currently, this is neither the case, nor the projected outlook.

- For the year 2023, the US spent $6.1tn but collected only $4.4tn via tax receipts. Thus, it spent 39% more than what it collected, and this $1.7tn deficit was financed by issuing debt.

- Every annual deficit is funded by new debt and adds to today’s debt bill of $35tn.

- The CBO estimates that the US will continue to run an annual deficit every year until the year 2053, at which point it stops forecasting.

- The last time the US ran a budget surplus was in 2001.

- The US’ current annual interest bill is $1tn which it can’t fund without further borrowing.

So, even though the US is already heavily indebted, it’s adding to its debt every year via deficits – even in good economic times – meaning the country will become more and more indebted. Which leads us to ponder; are people in general not taking the debt issue as seriously as they should because, hey, the economy is doing all right? Or is the economy seemingly doing all right because so much debt it being issued? If the latter, the US is ultimately heading towards an economic hangover.

Supply of US debt

Whenever the US Treasury needs more money than what can be collect from tax revenue, it issues new debt on the open market. Buyers of this newly issued debt include countries, pension funds, asset managers and others. When the US, or any other country, issues debt, this debt is priced by the market. This price can be viewed as the yield on that debt.

When countries issue debt, they will issue different tenors. They usually offer tenors, or maturities, ranging from 1 month to 30 years. Ideally, one would like an evenly maturing profile of debt so that you are not faced with having to refinance a very large amount of debt in any single year.

Unfortunately for the US, they have nearly half of all their current outstanding debt maturing in 2024 and 2025. This is a function of issuing a significant amount of debt during Covid in 2020, as well as taking advantage of ultra-low rates around the same time. As this debt matures, the US will have to refinance it by issuing new debt, at significantly higher rates. This refinanced debt, together with the new debt needed to cover the ongoing deficits, is termed the supply of US debt.

Source: Bloomberg, Flagship Asset Management

Demand of US debt

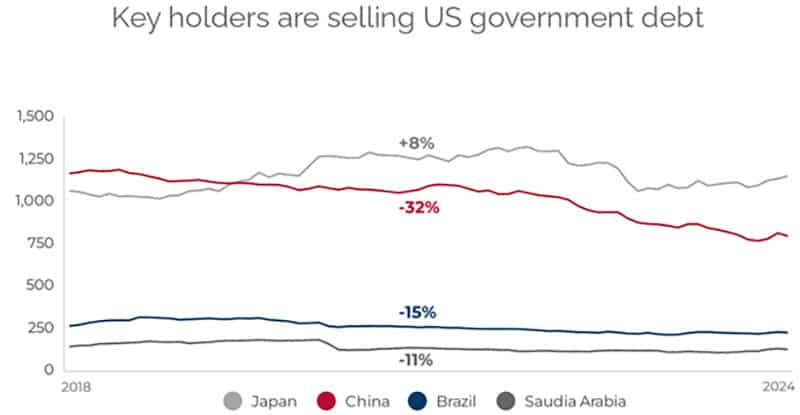

In early 2022, Russia invaded Ukraine. In retaliation, the US and its western allies froze $US300bn of Russian foreign holdings, including Russia’s US debt holdings, meaning Russia couldn’t access those assets or receive its interest payments due on its US debt. The US has gone so far as to suggest that the frozen US reserves and debt be confiscated and distributed to Ukraine. Unsurprisingly, upon seeing this, countries not so friendly with the US are continuing to reduce their US debt holdings. Why risk having your foreign holdings being frozen by the US? Conversely, those friendly with the US, such as Japan, UK and Canada have stepped up their purchases of US debt.

Source: Bloomberg, Flagship Asset Management

Conclusion

While there is an ever-increasing supply of US debt, the demand profile is also changing. China, once the largest sovereign holder of US debt, now sits in 3rd place behind Japan and the UK. Japan is increasing its holdings of US debt, but this might be at an inflection point. Let me elaborate. Recently, we’ve seen the Japanese Yen carry-trade unwinding. With global inflation trends coming down, interest rates should follow. However, Japan’s inflation rate is one of the few trending upwards, thus is as one of the few countries experiencing upward pressure on interest rates, and a stronger currency. If the US cuts interest rates in September, and Japan continues to increase its interest rates later this year (or in 2025), the result could see forced US debt selling by Japanese institutions, as it becomes more attractive to hold Japanese bonds instead of US bonds. Hence, we could witness a current large buyer of US bonds turning into a seller.

Economic theory says that when supply and demand are not balanced, something must give. In the case where you have the US debt supply growing and the demand profile changing, what gives? It’s either:

- Price: higher yields on US debt make it more attractive to buyers of US debt. Higher yields, though, also mean the cost for the US to service their debt becomes more expensive.

- Higher US inflation: the issuing of more and more debt, all else equal, is inflationary. If inflation starts picking up again, the Federal Reserve will have to hike rates again, and this would be a problem for global markets.

- Potentially, a weaker US Dollar: Potentially, as it depends on what currency you take on the other side to the US Dollar. Looking at the US Dollar basket (DXY), that basket consists of the following and their weights: Euro (58%), Yen (14%), British Pound (12%), Canadian Dollar (9%), Swedish Krona (4%), Swiss Franc (3%). As many of the countries listed above have their own issues, a slam dunk weaker US Dollar is not a given.

Maybe it’s a combination of more than one of the above. If the US doesn’t rein in spending and/or cut debt, supply will outstrip demand, leading, inevitably, to a negative outcome.