05 Feb Finding Pockets of Value in Frothy Markets

As published in Business Day on 3 February 2025

By JD Hayward

Engaging in the activity of predicting market returns is tricky, especially when economic indicators start pointing in different directions. Take the predictions of Wall Street banks for the S&P 500 returns in 2024 – the consensus was no more than 2%, but the result was a 24% return. While some got closer to the target than others, storied banks like JPMorgan missed by as much as 42%. In defence of these analysts, the U.S. was facing the uncertainty of a presidential election, a possible recession, and sky-high inflation at the time.

Fast forward a year, and analysts are again making predictions, this time more bullish, expecting a 10% return on average (after two years of 20%+ returns!). So, is the outlook better? On the positive side, markets are responding to pro-business sentiment under Donald Trump. On the negative side, there’s uncertainty over the effects of his policies, tariffs, and inflation, which could influence monetary policy. Markets aren’t sure if interest rates will be higher or lower by year-end. Other concerns persist. The U.S. is running a large budget deficit (around 7% of GDP) with low unemployment, which is generally inflationary. Market concentration is at all-time highs, with the top 10% of U.S. stocks now making up 75% of the market’s total capitalisation.

The market’s valuation is also at an all-time high. The S&P 500 trades at 22x forward PE. If it derates to its 10-year average of 18.3x, it could mean a 17% decline. It’s priced for perfection, and any hiccups could cause trouble. Barely a month into the year, Chinese AI model DeepSeek caused a brief market meltdown. Investors are already questioning the high multiples at which technology stocks are trading.

The saying, “be fearful when others are greedy”, does come to mind…

So, where does this leave investors looking for less-risky sectors for 2025? Fortunately, some pockets of relative undervaluation remain for those worried that the market is getting ahead of itself. Luckily, some pockets of relative undervaluation remain for investors who might be worried that the market is getting ahead of itself.

We consider three potentially undervalued investment options: style, sector and region.

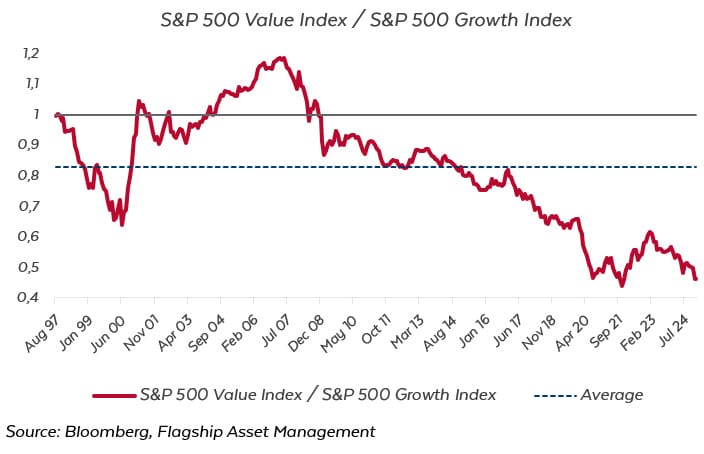

Opportunity 1: Investment Style – Value vs growth

Value has consistently underperformed growth over the past few years and is currently trading at near 20-year lows relative to its growth peers. (See line chart – any value less than 1 means value is underperforming growth) If you believe in mean reversion, this suggests there could be an opportunity soon. Shifting market conditions could lead to a correction, with value stocks potentially outperforming growth stocks. A return of inflation (due to tariffs) might prompt central banks to raise interest rates again. Growth stocks, which often rely on cheap capital for expansion, could face pressure from higher borrowing costs.

Higher rates reduce the present value of future earnings, which disproportionately affects high-growth companies. Value stocks, being more established with stronger cash flows, are better positioned to weather inflation and rate hikes. As investors seek safer, more stable returns, demand for value stocks could increase, potentially allowing them to outperform growth stocks in the coming year.

Opportunity 2: Undervalued Sectors

Most S&P 500 sectors are trading on earnings multiples well above their long-term averages. The IT sector, currently trading at 29.5x forward PE, is the most expensive relative to its own 10-year history of 21.4x. A correction back to average would mean a 27% decline. On a relative basis, consumer staples, utilities, and healthcare are trading in-line with their historical averages, potentially providing investors with some protection.

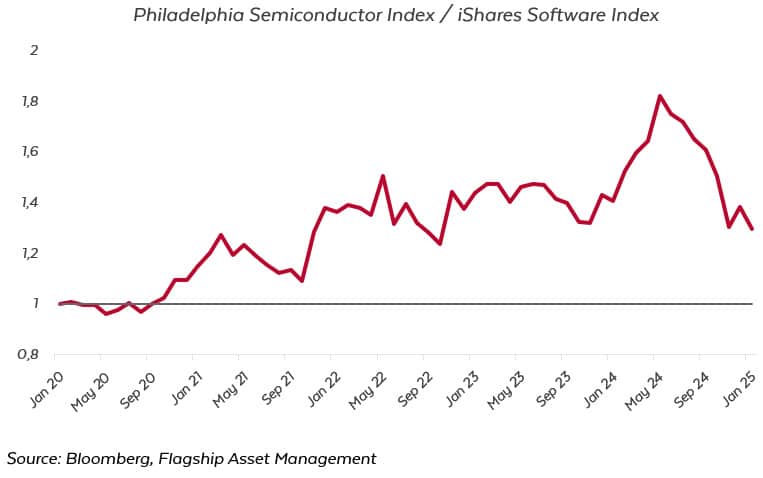

However, certain disconnects within sectors are more interesting. In the IT sector, semiconductor stocks have outperformed software stocks in recent years due to expectations of massive capital expenditures from big tech, which benefit semiconductor companies. Software companies, however, have more predictable, recurring revenue streams through subscriptions and licensing, offering stability in uncertain times. As businesses continue digital transformation, demand for software solutions (especially cloud-based, AI, and cybersecurity) should remain strong.

In contrast, semiconductor stocks are more sensitive to supply chain issues and cyclical demand fluctuations. A slowdown in AI-related capital expenditures or consumer demand could slow semiconductor growth, making software stocks potentially more resilient investments.

Opportunity 3: Undervalued Regions

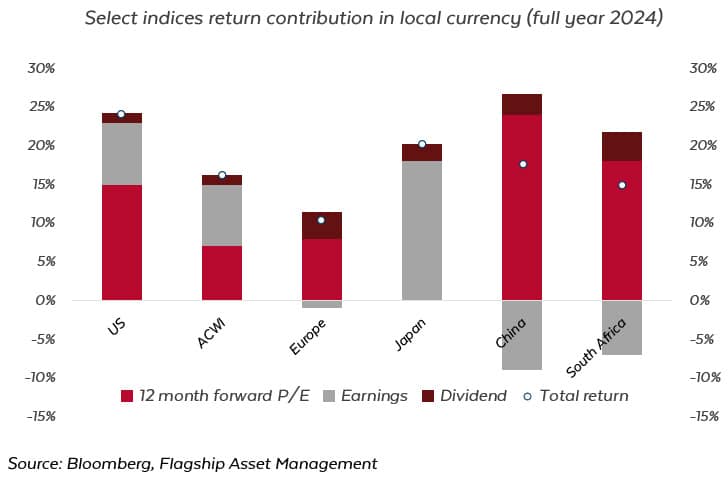

In 2024, roughly 50% of the S&P 500’s returns came from increasing earnings, while the other 50% was driven by multiple expansion. This wasn’t the case in Japan, where nearly all of 2024’s return came from increasing earnings, with little multiple expansion.

Sentiment toward Japan is shifting as it benefits from improved corporate governance, with companies focusing more on shareholder returns through higher dividends and buybacks. Historically, shareholders were ranked low in importance, behind employees, customers, and suppliers. Though not yet on par with the West, shareholders are moving up the ladder, securing a larger share of earnings.

Japan’s undervaluation relative to global markets also presents an attractive opportunity. The Japanese market trades at lower price-to-earnings ratios compared to the U.S. From a currency perspective, Japan’s export-driven economy could benefit from a weaker Yen, which might occur if the U.S. raises rates to combat inflation, making Japanese goods more competitive globally.

Predicting market returns is notoriously challenging, especially amid economic uncertainty. Despite concerns, opportunities for investors still exist. Value stocks may outperform growth as interest rates rise, certain sectors, like software, may offer stability over semiconductors, and Japan’s undervalued market presents attractive potential. Patience and diversification remain key.