12 Feb DeepSeek’s energy efficiency counter-intuitively bolsters AI energy companies’ outlook

By Philip Short

As published in FA News and Moneyweb on 12 February 2025

We’ve all read about DeepSeek and the remarkable competitive edge it presents to existing mega-cap AI companies. It’s more efficient, costs less to operate, and has decent output. However, the energy efficiency that DeepSeek achieves proves that AI can operate on less energy than the dominant AI players are running on. Thus, the market is taking an axe to AI energy providers.

However, this energy efficiency may have unintended consequences encapsulated in a 160-year-old economics paradox known as ‘Jevons Paradox’, which has come to light again in AI circles. It theorises that efforts to reduce the demand of a commodity, say energy, through energy efficiency initiatives may actually increase its use, because the resultant lower prices for the commodity spur significantly higher demand.

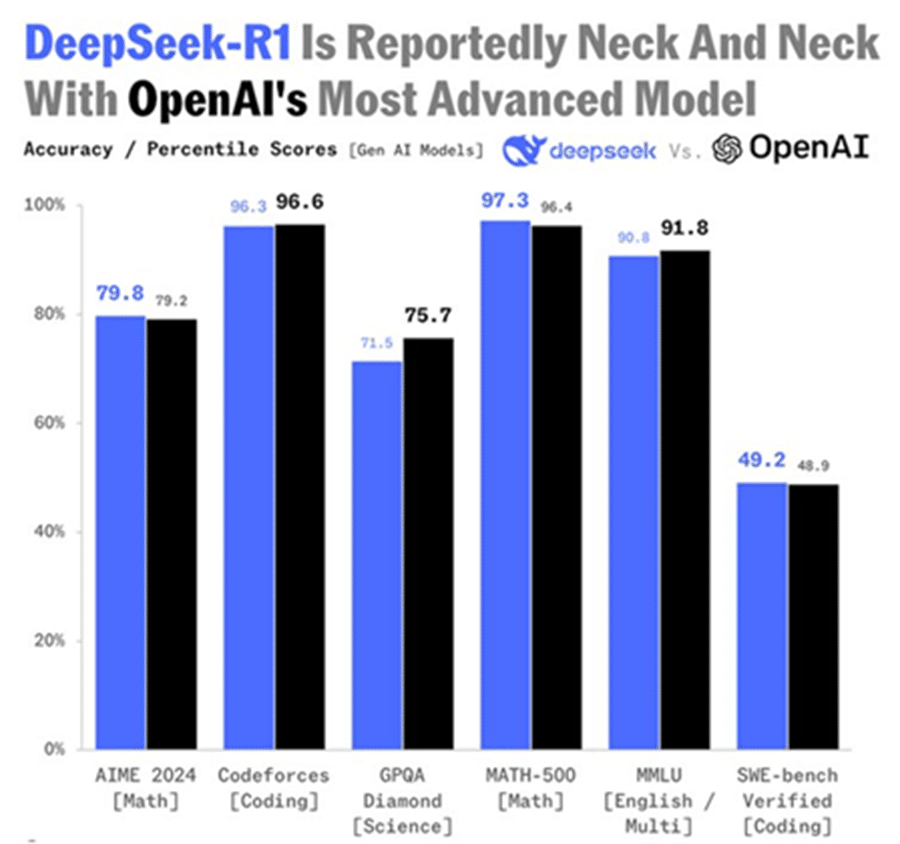

DeepSeek’s performance is in line with the latest OpenAI results (as per Chartr graph below), but it is less energy intensive at a significantly lower cost. Therefore, it’s cheaper, opening the door to more applications being taken up in the everyday world. This increase in penetration will create a net positive demand and actually increase AI’s total energy consumption.

When computers and mobile phones were first invented and trialled, people thought they would be used by a fraction of the actual Total Addressable Market (TAM), which is why their unit prices in the beginning were so high. Then, because pricing came down, the TAM opened dramatically. You had prices come down X and then another X, but volumes go up 10X, taking up the total net demand of the market.

I’m not too sure how this plays out in the semiconductor chips space (e.g. Nvidia) in terms of their pricing and margins; they will sell a lot more chips/units, but their margins are likely to come down with an unknown result on profit growth vs current estimates, in my opinion. But with energy, and probably the volume in computing (e.g. data centres), I believe the effect of DeepSeek on AI energy and infrastructure companies will be a net positive. I feel more comfortable holding the AI energy and AI infrastructure plays, the roll out of which I believe DeepSeek has likely reaccelerated, more than say the chip makers and the designers of these.