18 Mar The Land of the Rising Sun

As published by Sanlam Glacier on 14 March 2025

By Philip Short

In a historic 7th century correspondence addressed to the Chinese Emperor, Prince Shôtoku of Japan notably described Japan as the “Land of the Rising Sun” and China as the “Land of the Setting Sun,” symbolically framing Japan as the origin of a new era while subtly challenging China’s perceived dominance. This deliberate choice of imagery, equating Japan with the birth of light and China with its decline, was a daring diplomatic gesture that carried significant undertones of defiance and self-assertion.

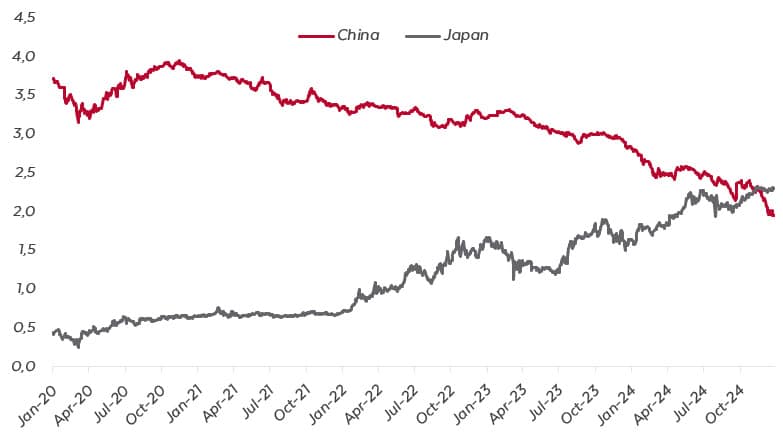

While China has undoubtedly grown its economy far beyond Japan’s since they crossed in 2010, the latter still enjoys a stronger GDP per capita by a factor of 2.5x. Another interesting, and recent, economic intersection between the two nations has been their 30-year bond yields.

Chart 1: 30-year bond yields of China and Japan (from Jan 2020 to Dec 2024)

Japan has experienced deflation since the mid-1990’s until the early 2020’s. Deflation is a major drag on an economy and something that a central bank will want to avoid at all costs. Why? Two notable reasons:

- It leads to a negative economic output gap. For example, as consumers expect a decline in prices (deflation), they delay consumption, leading to lower economic activity.

- The one thing that doesn’t deflate in a deflationary environment is debt. Hence, debt relative to real income will increase.

Looking at their 30-year bond yields, the lower yield for China is a cause for concern. It suggests to us that there is very little economic growth in the country as investors are willing to accept a lower yield in bonds (versus equities) and raise concerns around deflation. Indeed, China entered deflationary territory 18 months ago and is currently sitting at a CPI of 0.1% year-on-year.

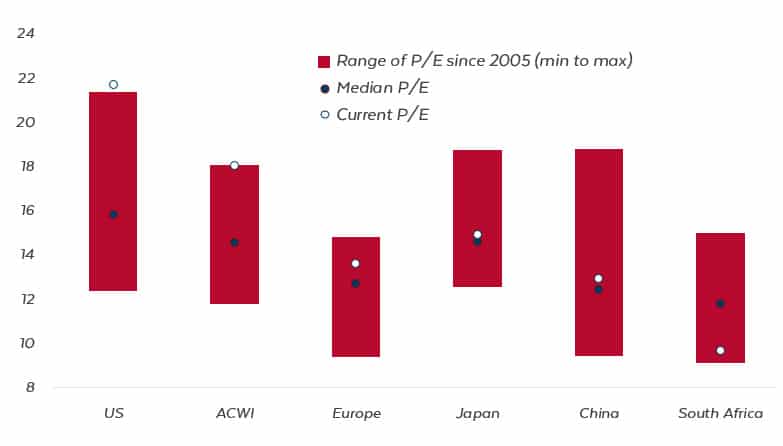

From a top-down perspective, looking globally for attractive investment opportunities, an acceptable starting point is looking at an index’s forward PE, in absolute and relative terms. In the chart below, we see that relative to its own history, Japan and China’s current PE’s are both in line with their 20-year median. The US, ACWI (All Country World Index), and Europe are higher while South Africa is below its median.

Chart 2: 12-month Forward PE for select regions (range from Dec 2005 to Dec 2024)

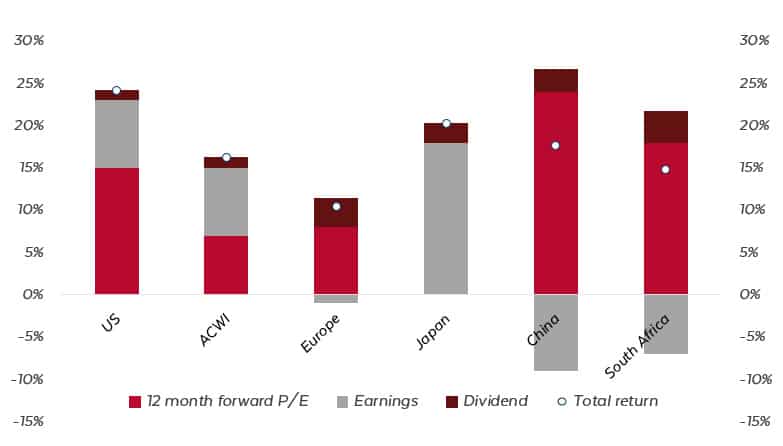

If we add another lens, in the following chart we look at the return attribution over 2024 with regards to multiple re-rating, earnings growth, and dividends. What stands out is that Japan’s returns during 2024 were driven almost entirely from earnings growth, while China and South Africa had negative earnings growth and a positive re-rating. Returns driven by earnings growth are healthier than returns driven by a re-rating, especially if earnings are declining.

Chart 3: Select indices return contribution in local currency (YTD 2024)

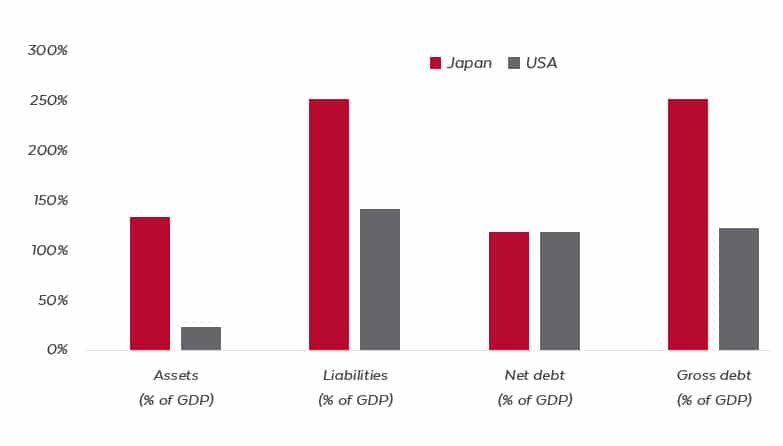

One cannot examine Japan without considering its debt. Japan has a debt to GDP position of 250%, which is eye-watering. However, one should also consider the asset side of Japan’s balance sheet. In the chart below, when we compare Japan to the US, we see that although Japan has a significantly larger gross debt to GDP, so too, assets to GDP. This results in a net debt to GDP for both countries leveling out at approximately 120%. While this is still on the high side, it is manageable. Japan is a country of savers, and as citizens and corporates, they provide a cheap source of funding to the Bank of Japan – 50% of Japanese government debt is held by the Bank of Japan. Going one step further, Japan is the only major economy whose central bank is currently raising rates. As net savers, this is positive for Japanese citizens and corporates who will experience an increase in net income.

Chart 4: Asset, liabilities and debt to GDP for Japan and the US (June 2024)

An interesting sector within Japan is semiconductors. Everyone has heard of Nvidia, Taiwan Semiconductor, Intel, Broadcom, etc., but have you heard of Advantest, Tokyo Electron, and Disco? These companies are integral players in the semiconductor value chain but are relatively overlooked versus their more popular Western peers.

Advantest specializes in the design, development, and manufacture of semiconductor testing equipment and systems. Founded in 1954, the company plays a critical role in the global semiconductor industry by providing advanced testing solutions that ensure the quality, performance, and reliability of integrated circuits (IC’s) and other electronic components.

Tokyo Electron is a global leader in the semiconductor and flat panel display manufacturing industries. Founded in 1963, Tokyo Electron specializes in designing, producing, and selling advanced equipment and systems used in the fabrication of semiconductors and display panels. The company plays a vital role in the production of IC’s, which are essential components in a wide range of electronic devices, from smartphones and computers to automotive systems and IoT devices.

DISCO Corporation, founded in 1937, specializes in manufacturing precision cutting, grinding, and polishing equipment, primarily for the semiconductor and electronic components industry. They are particularly known for:

- Manufacturing dicing saws and blades used to cut semiconductor wafers into individual chips,

- producing grinding and polishing equipment for semiconductor wafers and electronic components,

- making precision tools for processing advanced materials used in electronics manufacturing.

Japan screens well from a top-down point of view and offers quality names in an industry where they have history, pedigree, and are known for their quality manufacturing. The Semiconductor sector is a hot topic right now and this has led to some punchy valuations, especially for the popular names. It might be worth looking East to the ‘Land of the Rising Sun’.