07 Apr Natural Gas in an evolving US Energy Landscape

By JD Hayward

The United States has undergone several significant shifts in its energy landscape over the past two centuries. From wood in the early 19th century to the widespread adoption of coal as the dominant fuel source in the late 1800’s, powering industrialization and the expansion of railway networks. The early 20th century saw the rise of oil and natural gas, driven by the automobile revolution and advancements in electricity generation. By the mid-century, nuclear power began to gain traction as an alternative energy source.

During the latter half of the 20th century, the US energy landscape was characterized by a heavy reliance on oil imports, particularly after the oil crises of the 1970’s. This period prompted efforts toward energy independence, leading to policies that encouraged domestic production and exploration. Coal remained a major player in electricity generation until environmental concerns and regulatory changes in the early 21st century spurred a shift toward cleaner energy sources, including renewables and natural gas.

The Status Quo

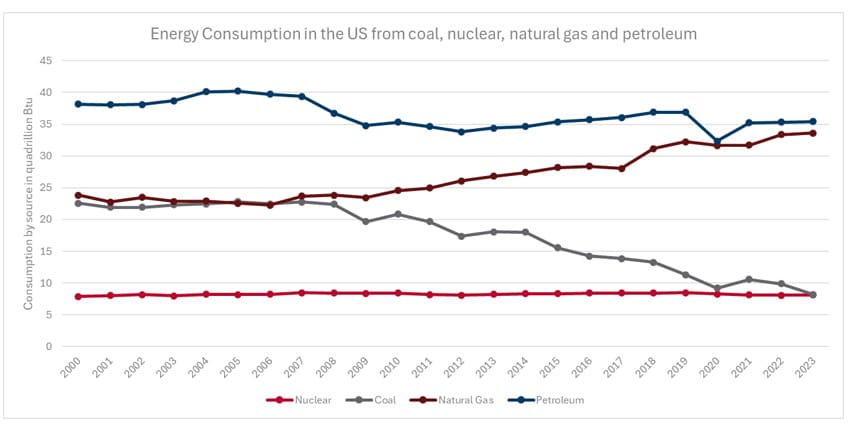

Today, the US energy sector is more diverse and dynamic than ever, shaped by a mixture of political dynamics, market forces and technological advancements. Petroleum products, (mainly for fueling the transportation sector and general industrial purposes) and natural gas, (mainly for electricity generation, heating, and liquified natural gas exports) are the primary fuel sources in the US, with gas consumption levels rising closer to that of petroleum over the last 2 decades.

When considering usage only for the purpose of electricity generation, natural gas has surpassed coal as the leading source in the US, accounting for nearly 45% of all US electricity. Its dominance can be ascribed to abundance of supply, cost efficiencies, and lower carbon emissions – gas emits about 50% less CO2 than coal to generate the same amount of electricity. The use of renewables, mainly wind and solar, is also rapidly expanding due to government incentives (at least under the previous administration), technological advancements, and decreasing costs.

Despite progress in renewable energy, fossil fuels still account for a significant portion of the nation’s energy mix. According to the US Energy Information Administration (EIA), petroleum remains the largest energy source, largely due to transportation needs, while natural gas continues to grow in importance. Meanwhile, coal’s share has declined drastically due to market competition and stringent environmental regulations.

Developments over the last decade have positioned the US as a leader in global energy production, having become the world’s top producer of both oil and natural gas. The introduction of hydraulic fracturing (fracking) has unlocked vast reserves of shale gas across swathes of the US, making the country a major energy exporter.

The Rise of Natural Gas

The prominence of natural gas in the US energy mix is a relatively recent phenomenon, largely driven by the shale revolution. A simplified timeline for context follows:

- 2000’s: Coal is the dominant energy source, providing more than 50% of US electricity.

- 2008 – 2010: Fracking and horizontal drilling led to a natural gas boom, making it much cheaper and readily available.

- 2016: Natural gas officially passes coal as the leading electricity source, enabling the US to become a net exporter of natural gas for the first time in nearly 60 years.

- 2020 onwards: Natural gas consistently used to generate over 40% of US electricity – with coal now in the mid-teens.

- 2023 – US surpassed Qatar and Australia to become the world’s largest liquified natural gas (LNG) exporter. Expansion continuing with more pipelines and more LNG terminals.

Technological advancements in horizontal drilling and hydraulic fracking have enabled the extraction of vast reserves of natural gas trapped in shale formations, particularly in states like Texas, Pennsylvania, and North Dakota. This surge in production has positioned the US as the world’s top producer of natural gas as well as LNG (liquified natural gas), a mantle it received in 2023 after it overtook Qatar and Australia in LNG exports. Between them, these 3 countries account for more than 50% of global LNG supply.

The global oil market catches all the airtime, with people often overlooking the size of the gas market, especially in SA where natural gas is not widely used as an energy source. The gas market is itself a behemoth at around 400 BCFD (billion cubic feet per day), roughly 2/3 the size of the global oil market. At around 120 BCFD, the US itself is one of the largest users of natural gas, with the other main centres of demand being China, Japan, Korea, and India. This Asia-pacific group of countries is particularly important to the industry’s future, as they are expected to account for more than 90% of demand growth through 2030, according to Bernstein research.

Natural gas has several advantages over other fossil fuels. It burns cleaner than coal and oil, producing fewer greenhouse gas emissions and pollutants. This makes it a preferred choice for power generation, industrial applications, and residential heating. Natural gas-fired power plants also offer flexibility, as they can quickly ramp up or down to complement intermittent renewable energy sources like wind and solar.

Naturally, the gain of one source of fuel often leads to the demise of another. The rise of gas was somewhat of a death knell for the US coal industry, where jobs fell from around 90 000 in 2012 to around 37 000 in 2023. Gas-related industry jobs grew, but net-net it was a large loss due to lower manpower requirements for natural gas. Luckily for the US coal industry, it did not lead to a complete collapse, with China and India, (both of which are still highly reliant on coal for electricity) becoming large export markets.

The Effect of Politics on Changing Energy Policy

Energy policy in the US is highly influenced by political dynamics, with shifts in administration often leading to changes in regulation. Republican administrations have generally favoured fossil fuel development, advocating for deregulation and increased production. In contrast, Democratic administrations have emphasized climate action, renewable energy incentives, and stricter environmental regulations.

The difference between the Trump administration and the Biden administration clearly illustrates these policy shifts. The 1st Trump administration prioritized energy independence through aggressive oil and gas production, rolling back environmental regulations, and withdrawing from the Paris Agreement. Conversely, the Biden administration set ambitious climate goals, aiming for net-zero emissions by 2050 and rejoining the Paris Agreement.

Natural gas acts as a middle ground whether you proceed with a fossil fuel, or renewable energy approach, and thus will remain a critical component of the energy transition. While policies are being implemented to curb methane emissions and promote cleaner alternatives, natural gas continues to be viewed as a “bridge fuel” in the shift from coal to renewables.

The current administration has made its goals clear, adopting a pro-fossil fuel stance, looking to bolster domestic energy production and ease regulatory burdens on the industry.

These include:

- Deregulation Efforts: Streamlining permit processes for energy infrastructure projects, thereby reducing delays and costs for natural gas developments.

- Expansion of Drilling and Mining on Public Lands: Policies have been enacted to open federal lands and offshore areas to oil and gas exploration.

- Support for LNG Export Facilities: expediting approvals for LNG export terminals, aiming to enhance the United States’ position in the global energy market.

These regulations all form part of the Trump administration’s 3-3-3- plan:

- Increasing energy output by 3 million oil-equivalent barrels per day. (Note that oil-equivalent includes increases in natural gas output).

- Boosting real GDP growth to 3%.

- Reducing the budget deficit to 3% of GDP, down from 6% currently.

In rolling out these plans, President Trump recently hosted top US oil executives at the White House, his first sit-down with energy sector leaders since his return to the presidency in January, with discussions mainly aimed at pushing American energy dominance. Some industry participants used this opportunity to convey a warning about the effects of certain other policies, such as steel tariffs and trade disputes with China, which could work against efforts aimed at increasing energy dominance:

- Tariffs on Steel Imports: Imposed tariffs have increased costs for pipeline construction and maintenance, affecting the economics of natural gas infrastructure projects.

- Trade Disputes with China: Escalating trade tensions have led to retaliatory tariffs, including China’s 15% tariff on US LNG, resulting in a significant decline in exports to this crucial market. This has raised concerns about the long-term viability of US LNG in the global marketplace.

Some participants, such as Ed Hirs, energy economist at the University of Houston, believe that Trump’s motto of “Drill baby drill” is not the way forward, arguing that prices need to be maintained at steady levels to maintain production, allowing the US to maintain its energy independence and capitalize on export opportunities.

Outlook, Expansion, and Opportunities for US Natural Gas

The US natural gas industry is poised for continued growth, both domestically and internationally. Domestically, natural gas is expected to play a key role in supporting grid reliability as renewable energy expands, especially given the expected surge in electricity demand caused by datacentres as part of the AI drive.

The international market presents significant opportunities for US LNG exports. With geopolitical tensions affecting global energy supplies, US LNG has become a crucial alternative for countries seeking to reduce dependence on Russian gas. European demand has surged, and Asian markets are also looking to secure long-term LNG contracts. Expanding LNG export infrastructure, including new terminals and pipeline networks, will be essential to meeting this demand.

Challenges remain, particularly in terms of environmental concerns (even though natural gas is preferable to coal and oil), regulatory hurdles, and infrastructure development. Limitations in terms of pipelines and LNG export facilities take years to be resolved, as does building out the required capacity. Maintaining relations with China, the most important export market for US LNG going forward, will also be crucial to the industry’s success.

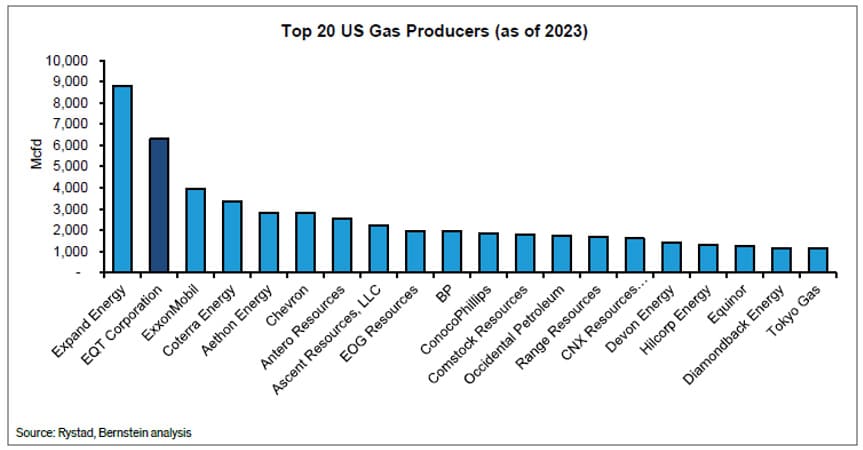

Our preferred exposure to the industry is via EQT corporation, one of the largest natural gas producers in the US. Up until recently, EQT was the largest producer by a substantial margin, however a merger in 2024 between Chesapeake Energy and Southwestern Energy to form Expand energy, took the crown as the largest producer.

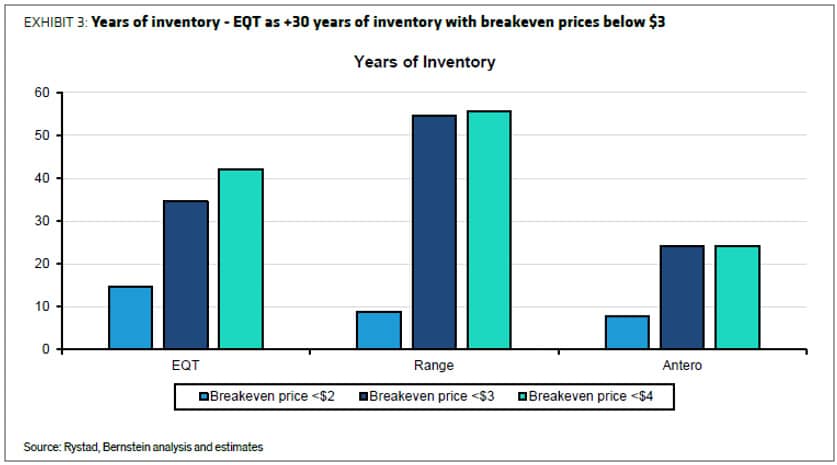

EQT is an Appalachian gas pure play. Their portfolio of midstream assets allows them to be the leading provider of low-cost gas, while sitting on decades worth of inventory and, notably, a very large portion of their inventory has a lower breakeven point than many of their competitors. Meaning, even if policy missteps lead to adverse gas price reactions, EQT are still better positioned than most peers.

The US energy sector continues to undergo transformation, with natural gas playing an increasingly dominant role. As the world navigates energy security, climate goals, and economic stability, US natural gas is well-positioned to serve as a reliable and flexible energy source for years to come.