28 May Stagflation to spoil soft landing and markets rally

As published in Business Day on 23 May 2025

By JD Hayward

Extreme fluctuations in market sentiment and economic policy have rendered many bold economic forecasts obsolete. Over the last 2 months, the number of economists either calling for, or against a recession has swung dramatically, sending the S&P 500 index into bear market territory, only to rally back to all-time highs at the first sign of good news.

The man tasked with trying to provide some sort of guidance in this environment is Jerome Powell, Chairman of the US Federal Reserve (Fed). Tasked with the dual mandate of full employment and price stability, the Fed’s every move is scrutinized for signals on future policy. After navigating pandemic stimulus and supply chain disruptions, Powell appeared to have achieved a soft landing, taming 40-year-high inflation without triggering a recession. With a year left in his term, Powell seemed poised for a soft-landing swansong.

Enter Trump’s tariffs. This introduces a potential worst-case scenario of stagflation (stagnant growth coupled with persistent inflation). Jamie Dimon, JPMorgan CEO, recently warned of extraordinary complacency, and he believes market may be underestimating the stagflation threat.

But, at 2.3% year-over-year, did US inflation not drop to its lowest level since 2021? Yes, it did, but this does not capture the risks ahead.

The Fed’s ability to cut rates is constrained. They now face an interlinked conundrum of inflationary tariffs, rising bond yields and weakening consumer and business sentiment.

Let’s assess inflation first.

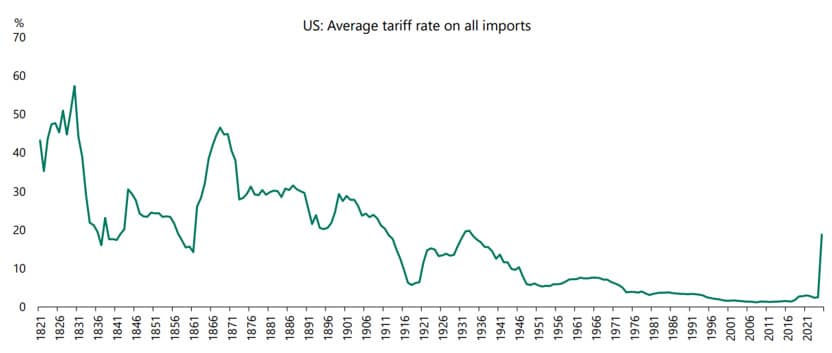

While currently low, the introduction of blanket tariffs will have an inflationary effect in the months to come. The 90-day reprieve from 145% tariffs on Chinese goods provides room for negotiations, but the average US tariff rate now sits at close to 20%, a level unseen since the 1930’s. Even during the trade standoff with China during Trump’s first term, the average tariff went from 2% to 3%, nothing like what we are seeing today.

These tariffs will no doubt find their way to the consumer. Large retailers may have the ability to absorb these costs, but small businesses, which account for nearly 50% of U.S. employment—lack the scale, margins and balance sheet strength to do the same. If they struggle, labour market stability could unravel quickly.

Energy prices might also turn inflationary. In April, gasoline prices in the US were 13% lower than in 2024. However, from around this point last year, gasoline prices started a prolonged decline. The net result is that if gasoline prices were to stay where they are now, in about 4/5 months this will be a source of inflation, rather than deflation.

The combination of these factors means the fed can’t lower rates too soon, as this could reignite inflation. However, should inflation increase, the fed would not want to raise rates and choke an economy where business and consumer confidence is already at relatively low levels.

The bigger headache – US debt, rising yields and fiscal fragility.

Meanwhile, the US faces a debt problem. $36 trillion and counting. The US is running a debt-to-GDP ratio last seen during the height of World War 2, while still increasing deficits. The interest payment on this debt load has become so significant that even more debt must be raised just to cover the interest bill on previously outstanding debt. This is obviously not sustainable, making US debt riskier for future providers of credit. While this is not explicitly the Fed’s problem, their policy does influence the rate of interest that Treasury must pay on its debt – hence the not-so-subtle requests from Trump to Powell to lower borrowing rates.

The kicker? A large portion of Federal debt, nearly a third (± $10 trillion) must be refinanced in the next 12 months. With elevated long-term rates, this will further increase debt servicing costs. These fiscal concerns have led investors to dump US bonds, sending the 10-year treasury yield North of 4.5%, a level where the stock market often starts to struggle.

It’s important to understand that this rise in yields is what forced the Trump administration to blink in the current tariff war. Around so called “Liberation Day”, yields on the US 10 year increased by 0.5%, their largest move in decades. Now this may seem counterintuitive. Uncertainty usually leads investors flocking to safety in the form of bonds, sending prices up and yields down. In this case, however, US debt had become the actual source of risk. As economist Ed Yardeni stated in 1980’s: “…if the fiscal and monetary authorities won’t regulate the economy, the bond investors will. The economy will be run by vigilantes in the credit market,”

Ultimately, whether the Fed is engineering a soft landing or steering into stagflation will depend on a several factors, some beyond their direct control. In a period where inflationary pressure is on the rise, the fiscus is looking weaker, consumer and business sentiment is waning – the Fed finds itself in an increasingly narrow corridor, forced to choose between fighting inflation and supporting growth. The coming months will test not only the Fed’s models and tools but also its resolve to hold steady amid mounting political and economic pressure.