28 Jul Blue Label Telecoms: A Contrarian Turnaround Story

By Philip Short

As published in FA News on 21 July 2025

Blue Label Telecoms, the JSE’s top-performing stock since September 2023 with gains exceeding 400%, is poised for another potential doubling as the company prepares for a major restructuring of its Cell C subsidiary within the next six months, including a debt-for-equity swap and planned IPO that could unlock R27 billion in value from its current R13 billion market capitalisation.

Blue Label Telecoms (BLT) is a South African company that predominantly distributes digital tokens, such as prepaid airtime and electricity. In 2017, BLT acquired Cell C, a struggling mobile operator, which dragged the share price to a low of R2.60 in September 2023. This presented a contrarian investment opportunity when institutional ownership was very low and sentiment was negative.

Chart 1: Top 10 performers on the FTSE/JSE since September 2023

* BLT is selling Communication Equipment Company (CEC) to Cell C as part of the latest restructuring

Despite significant challenges including poor capital allocations, high debt, and complex accounting structures, BLT was trading at compelling valuations for those willing to look past the complications.

Theme: The Bank-Telco Battle

A cold war has been brewing between financial institutions and telecom companies for more than a decade. The smartphone made this inevitable, as consumers increasingly used their devices for banking, shopping, reading, working, talking, texting, and more.

African telecom companies made serious inroads into financial services. Safaricom’s pioneering M-PESA in Kenya highlights this trend, with nearly 50% of the company’s revenue now coming from financial services. MTN and Vodacom attempted to replicate this model across their African operations.

Capitec, being the innovative enterprise that it is, responded by leveraging its existing position. By 2022, it was processing 30% of all prepaid airtime in South Africa through its own channels, with BLT facilitating the prepaid engine in the background. This platform enabled Capitec to launch Capitec Connect, a Mobile Virtual Network Operator ( MVNO) roaming off Cell C’s network, in September 2022.

Capitec Connect’s growth has been remarkable. By December 2024, it gained 1.5 million subscribers, with a current run rate of 180 000 subscribers per month. For context, FNB launched its MVNO in 2015 and, by 2024, had only 958,000 subscribers – 30% less than Capitec achieved in just over two years.

This growth directly benefits Cell C, as every Capitec Connect subscriber becomes a Cell C subscriber. With Capitec’s 22 million banking customers as a potential subscriber base, the growth runway is substantial.

Capitec’s strategy goes beyond becoming a mobile operator. By studying mobile subscriber behaviour from banking customers, they can make better lending decisions, ultimately making Capitec a more profitable bank. This data-driven approach provides significant strategic value beyond simple MVNO revenue.

Strategic Advantages

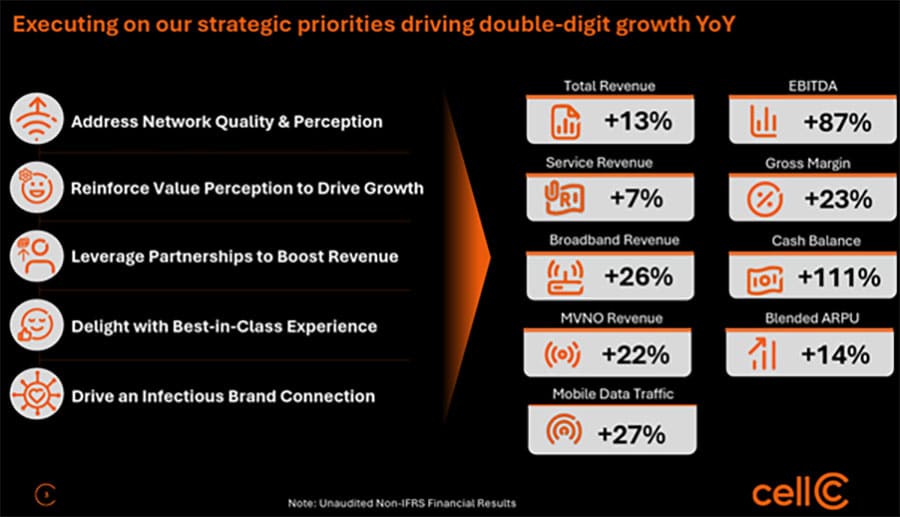

Cell C benefits from unique network sharing agreements, roaming on both MTN and Vodacom networks while maintaining its own spectrum. This provides excellent network quality without the capital-intensive infrastructure investments typically required in telecoms.

Management quality has improved significantly, with 6 out of 11 C-suite executives, including the CEO, joining from highly regarded Vodacom in the last 20 months. This represents a substantial upgrade in operational expertise.

Cell C now supports 13+ MVNOs including major brands like Shoprite, FNB, and Standard Bank. MVNOs are attractive for mobile network operators because they handle their own marketing and customer acquisition, resulting in higher operating margins due to lower customer acquisition costs.

The asset-light model means Cell C can grow market share without the capital expenditure burden that typically drags on telecom cash flows. This positions the company well in a traditionally challenging sector.

Value Proposition

BLT’s core digital token business generates R800 million profit annually and remains cash generative. After a poorly structured initial acquisition in 2017 and subsequent recapitalisation in 2022, BLT now owns approximately 80% of Cell C, up from the original 49%.

The complex accounting structure that emerged from the 2022 recapitalisation has deterred many investors, but this complexity creates the opportunity. Cell C currently has negative equity, preventing its profits from being recognised in BLT’s financials. As the turnaround continues, this will change.

The upcoming restructuring presents significant value-unlocking potential. In May 2025, BLT announced plans for a debt-for-equity swap that would eliminate Cell C’s debt and increase BLT’s ownership to nearly 90%. This would be followed by a Cell C IPO.

Through smart corporate finance activity, BLT now owns approximately 90% of the debt on Cell C’s balance sheet and 80% of the equity. Essentially, BLT owes the money to itself, setting up the debt-for-equity conversion.

Financial Projections

Post-restructuring projections are compelling. Cell C is estimated to generate R2.5 billion EBITDA with approximately R2 billion net profit, benefiting from R28 billion in tax losses over the next 5-10 years and no long-term debt.

For a debt-free company with double-digit earnings growth, an asset-light business model, and likely dividend payments being initiated, applying a conservative 10x P/E multiple suggests Cell C could be valued at R20 billion. Core BLT (excluding Cell C and CEC) generates R700 million net profit, worth approximately R7 billion at similar multiples.

The combined sum-of-parts valuation reaches R27 billion versus BLT’s current R13 billion market cap at R14.90 per share.

Investment Outlook

Despite BLT’s 400%-plus appreciation since September 2023, making it the top JSE performer over this period, the analysis suggests shares could double again following successful restructuring and Cell C’s IPO.

The investment thesis combines several attractive elements: a contrarian opportunity with improving fundamentals, exposure to the structural shift in bank-telco competition, and a clear catalyst for value unlock through corporate restructuring.

Bottom line: BLT represents a rare combination of contrarian opportunity and structural growth. It is positioned to benefit from the convergence of banking and telecommunications while unlocking substantial value through Cell C’s transformation from struggling operator to asset-light growth story.