After a brief respite in April, markets continued their impressive rally in May. In the US, the S&P 500 increased by 4.96%, while the Nasdaq gained nearly 7% during the month as all-things tech continued to shine. In the UK, the FTSE gained 2%, while in the East, the Hang Seng also continued its recovery. It increased by 2.5% during May and has now gained nearly 11% during the last 3 months as the Chinese market reacted positively to the news that Beijing will actively support the stumbling property market.

On the commodity front, oil continued its decline as fears of a wider regional war in the Middle East continued to decline. Brent Crude closed the month 7.1% lower. Silver, on the other hand, gained 15.6% during the month, with natural gas increasing nearly 30% over the same period.

May did not have a shortage of major news items. On the geopolitical front, Israel continued its planned offensive on Rafah, despite some warnings from its longtime allies. This led to deteriorating global sentiment for its war effort from the likes of Spain, Norway, and Ireland – all of whom moved to acknowledge a Palestinian State. In Ukraine, Russia made progress in a renewed press towards Kharkiv during the same period that Putin announced, in a shock move, the replacement of his defence minister that has overseen the Ukraine invasion thus far.

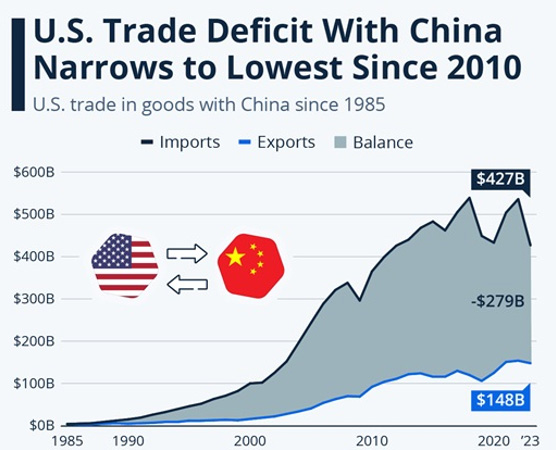

Lastly, the strained relations between Washington and Beijing were also on full display over the past month. Examples of this include the Biden administration hiking tariffs on Chinese-made electric vehicles from 25% to as much as 100%, Qualcomm and Intel having their export licenses to China revoked, Microsoft asking Chinese employees to consider relocating from mainland China, and the US government ruling that Chinese owned Tiktok had to be sold or face a complete ban in the US.