26 Jun Cruising no longer only for retirees

As published in Business Day on 24 June 2024

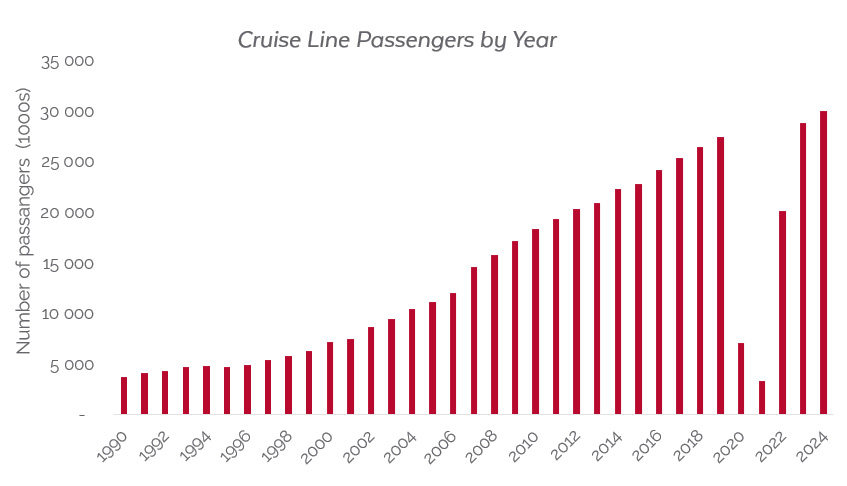

The popularity of seagoing holidays has risen over the past three decades.

Depending on personal preference, one’s idea of an ideal holiday might not involve being confined to a ship at sea. Yet, for every person that dislikes the idea of a cruise ship holiday, at least one other loves it.

Cruise ship business is booming. One thing is certain, cruises are serious business. In 2023, more than 30 million people embarked on a cruise holiday. They had a choice of more than 300 cruise ships around the globe, managed by more than 50 cruise operators. To keep these passengers entertained and fed, the industry employs some 1.2 million full time staff, earning salaries in the region of $50 billion annually. The ships required for these cruises come in all shapes and sizes, but some of them are truly gargantuan, such as Royal Caribbean’s new Icon of the Seas, which cost a staggering $2 billion to build and can accommodate 6700 guests alongside more than 2000 crew members.

Today the cruise industry is once again flourishing, but 3 years ago it was on its knees as the Covid-pandemic wreaked havoc. A floating city – where close contact is unavoidable – is not the best place to isolate. Passenger volumes declined by some 75%, and most cruise operators had to significantly increase their debt load to stay afloat. Quite literally. However, the industry has shown its resilience, with demand bouncing back to pre-Covid levels by 2023.

Sticky Demand

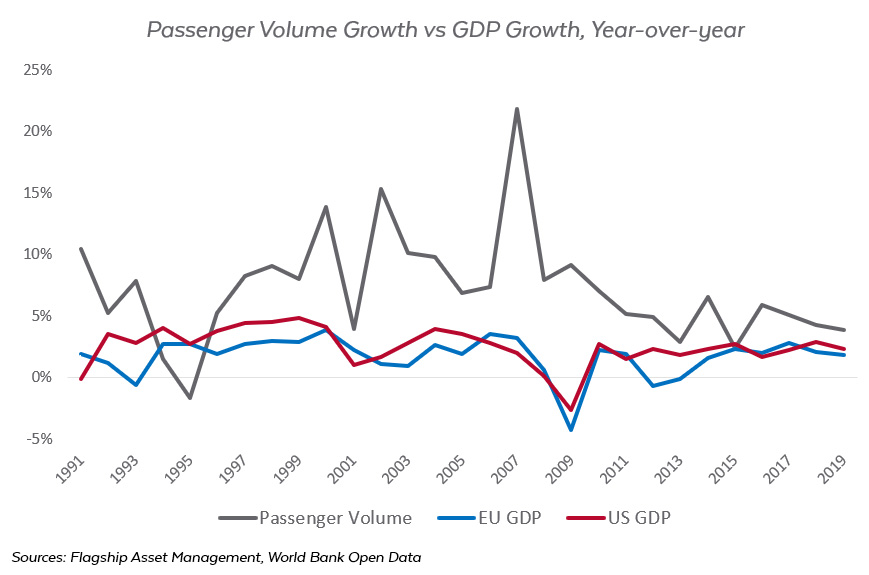

Over the past three decades, the demand for cruise vacations has not only endured, but these holidays have in fact increased in popularity. One would assume that the industry’s growth would be linked to the GDP growth of its main passenger hubs, the US and EU (combined, they account for 75% of passenger volume). However, a quick comparison between the annual growth rate of passenger volume and annual GDP growth in the US and EU indicates passenger volumes are growing much faster than GDP in the two primary markets.

In fact, over the last 33 years, passenger volumes have increased at a compound annual growth rate of 6.4%, vs GDP growth in the region of 2.5%, and on only 2 occasions has the growth in passenger volumes lagged GDP growth.

One of the contributors to this strong growth is repeat customers. A 2022 Cruise Traveller Sentiment Study found that 85% of past passengers would like to go on another cruise. Another industry study pointed out that 58% of participants that had not been on a cruise before were considering one.

Notably, not only are former customers returning and new customers considering cruises, but operators are also actively adapting their offering, catering to new markets and expanding their opportunity set in the process.

Shifting Trends

One of the interesting trends among cruise line passengers is their age demographic, passengers are getting younger. Today, almost 70% of passengers are younger than 60, with the average age being just 46, the lowest it’s been in 20 years. In the Asian market, the average age is only 39, practically juvenile in cruise ship years.

This bodes well for future demand. In industry surveys, 88% of millennials (aged between 28 and 43) and 86% of GenX (aged between 43 and 59) cruisers indicated that they would be cruising again. If these numbers are remotely accurate, it represents a long runway of returning clientele for cruise ship operators.

This shift has not happened by chance, though. Cruise lines have, for years, been focusing on expanding their addressable market, targeting younger families by offering a range of themed cruises and kid-friendly activities. This is clearly working, as today, 73% of passengers are travelling with family representing at least two generations. Solo travellers are also being targeted, with more economical single berths and events aimed at potential solo travellers.

Investment Implications

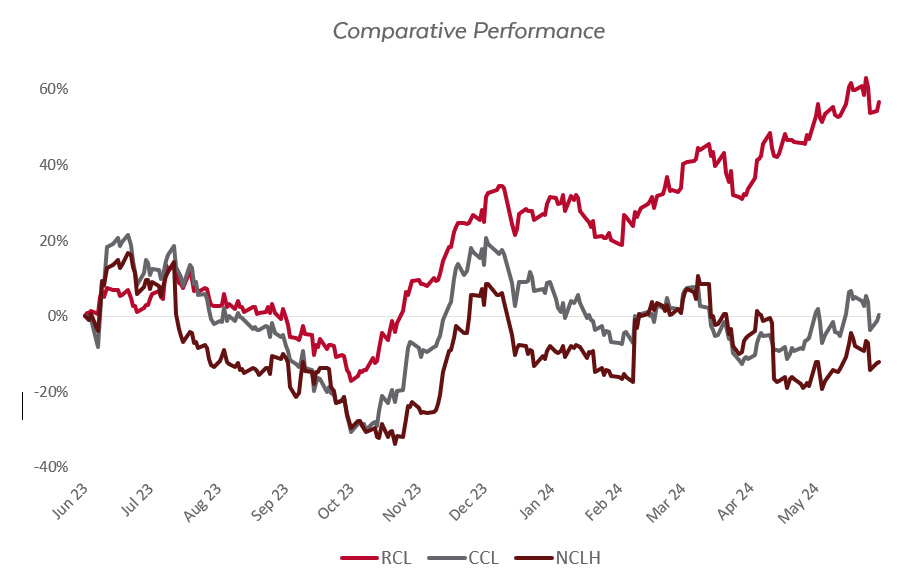

Given the positive outlook and enduring demand for cruise lines, what are the opportunities available to investors? The industry is dominated by three large players: Carnival Corporation, Royal Caribbean, and Norwegian Cruise Lines. Between them, they control more than 75% of passenger volume and revenues.

Royal Caribbean, however, has been the standout performer, outperforming its peers by more than 50% over the past year, as shown in the chart below.

They have been able to do this by focusing on operational efficiency, successfully expanding their target market and investing in innovative vessels. The success of their approach is clearly leading to happy, loyal customers. Royal Caribbean has been voted as the best overall Cruise Line for 21 years running.

After their impressive recovery from Covid, they set themselves a number of targets, all of which are on track to being achieved earlier than expected. This, along with the company citing record-breaking demand has clearly been appreciated, and rewarded, by the market.

Royal Caribbean is another example of an investment opportunity that is available outside of the well-trodden, AI- and tech dominated sectors. Finding such companies is achievable when you consider investment opportunities all over the world.

About the author

James Hayward BEng (Civil) CFA

Fund Manager

James, JD, is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.