Global equity markets delivered vastly different results to close out the first half of the year. In the US, all rooms were sea-facing as the S&P 500 returned 3.6% for the month, largely driven by constituents that also form part of the tech-heavy Nasdaq composite, which returned 6% for the month. Year-to-date (YTD), the S&P 500 has now returned 15.3%, while the Nasdaq composite returned 18.6%. In the shadow of this tech-driven performance, we find the small cap Russell 2000 index, which was down 0.9% for the month, and is barely in the green YTD. In the UK, the FTSE 100 dropped 1.7% for the month, while the Euro Stoxx 50 declined by almost 3%. YTD, both indices have returned in the region of 7%. In the East, the Hang Seng Index continues to be volatile. After a strong recovery the previous month, June saw it giving back 1.1%, which now puts the YTD performance at 6.2%.

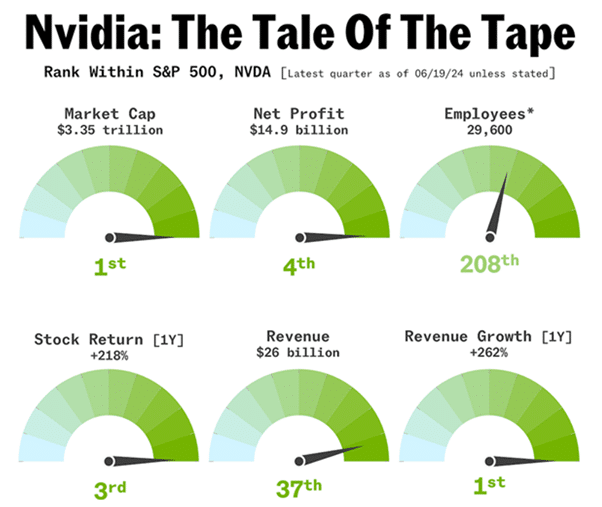

Despite the robust stock market performance in the US, there are certainly some warning lights flickering. One of these is the weak breadth of the market rally. YTD, Nvidia (+166%) accounted for 6% of the S&P 500’s 15% return, with the S&P 499 returning only 9%. Remove the rest of the Magnificent 7 and the return of the S&P 493 drops to 6% YTD. The second concern is consumer weakness – retail sales came in softer than expected in May, confirmed by profit warnings from several consumer driven sectors. Footwear and apparel giant, Nike, a clear example of this, falling 20% after providing weak guidance.

Headlines in June were dominated by politics. A major political swing was confirmed in the UK, as the Conservative Party lost to Labour, after 14 years in power. In France, after a dominant showing by Marine le Pen’s “Far right” National Rally in the first round of elections, circumstances changed dramatically in the second round, with a swing back to the centre and far left, leaving no party with an overall majority. In the US, a Republican (i.e., Donald Trump) victory is now looking likely after Joe Biden performed terribly in the first presidential debate. This raised the alarm in Democratic circles as voters now believe his cognitive state is clearly not fit for someone occupying the most powerful office in the world.

Locally, news flow was dominated by the bickering and bumping of heads between the DA and the ANC, as President Ramaphosa tried to get his cabinet for the Government of National Unity up and running. After some back and forth, and the DA threatening to pull out of the agreement, a deal was finally struck which led to optimism in local markets, evident in the double-upgrade South Africa received from JP Morgan. Responding to improved sentiment, the JSE Allshare Index staged an impressive rally, returning 4.1% over the month, while the JSE Financials index surged an eye-popping 17.5%. This strong performance, if not given back, should lead to increased weighting in emerging market indices, which should lead to increased flows from international investors.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.