02 Aug Will gold continue to edge out treasuries as a safe-haven investment asset?

As published in Business Day on 2 August 2024

By Flagship Asset Management fund manager Philip Short

The gold price remains on a record-breaking run as we head towards the unpredictable US elections, buoyed by its historical and increasingly attractive 21st-century geopolitical and macroeconomic attributes.

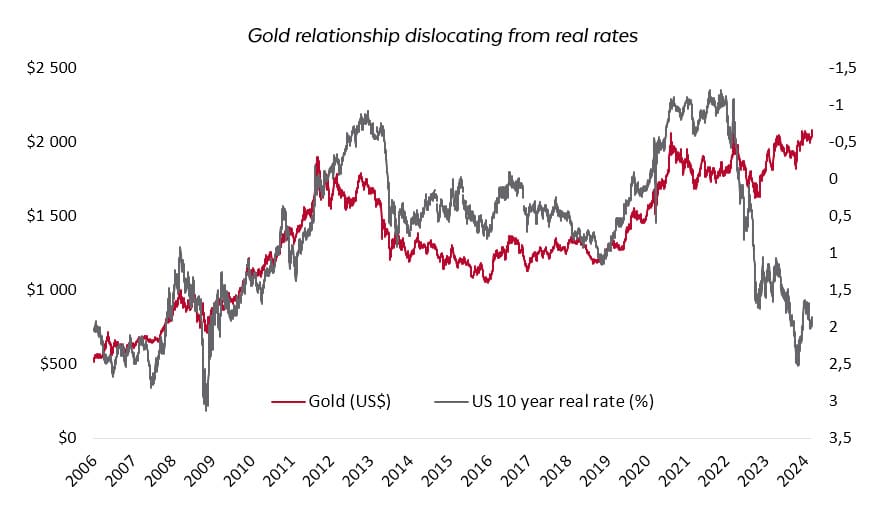

But will it continue to rally even though it falls short in some investment respects, including not generating an income and thus imposing an investment opportunity cost when real rates are positive? The breakdown of a historical relationship between gold and the US 10-year real rate since the Russia-Ukraine war started suggests so.

Gold is fit for purpose as a safe-haven asset

Gold has always been seen as a safe haven asset, a store of value, and something appreciated universally. Out of the 118 elements on the periodic table, its unique atomic qualities make it fit for this purpose. It’s solid (not a gas or liquid), non-corrosive, non-radioactive, non-combustible, malleable, rare and shiny. This is why, almost by process of elimination when working through the periodic table, it has been desirable as a means of international exchange for the last 5,000 years.

Not everyone finds it desirable, though. Many investors have raised an important concern: how do you value it? And if you can’t value it, how do you know what price to pay for it? Perhaps if one looks at it from a relative point of view, understanding its value becomes more agreeable. So, from a relative point of view, what would you own instead? Looking towards the lower end of the risk spectrum of assets, how about money in an interest-bearing bank account or owning US Treasuries? The latter is based on a strong, global reserve currency and backed by the strongest, biggest economy in the world, so these assets arguably have equally desirable qualities.

Historically, gold has been strongly correlated with negative real rates, i.e. when interest rates, adjusted for inflation, go down, gold increases in value. The reason is that gold does not earn an income or pay a dividend, and thus, there is an opportunity cost to owning it when real rates are positive. Instead of owning gold, you could earn interest in an almost risk-free money market account. That relationship changed, however, when the Russian-Ukraine war started in early 2022, as can be seen in the graph. Note the right axis is inverted.

Source: Flagship Asset Management, Bloomberg

Debt default

As a consequence of the war, and as “punishment”, the US and its allies froze all of Russia’s foreign reserves, including US debt held by Russia (debt and interest payments owed to Russia by the US). The US is even currently questioning whether it should give this Russian money to Ukraine to assist it in its war efforts. Moral issues aside, you cannot disavow a debt.

Given the massive debt the US government has built up, currently sitting at $35 trillion, some have questioned whether the US will default on its debt. Given that all of the US’s debt is based in US dollars, it can simply print any dollars it owes, so it shouldn’t default. (The effects on the worth of the dollar as that happens is a story for another day). So, the US is able to pay its debts. But is it willing? In the case of the US freezing Russia’s holdings of US debt, it is unwilling to do so. And if you’re unwilling, it’s as good as being unable.

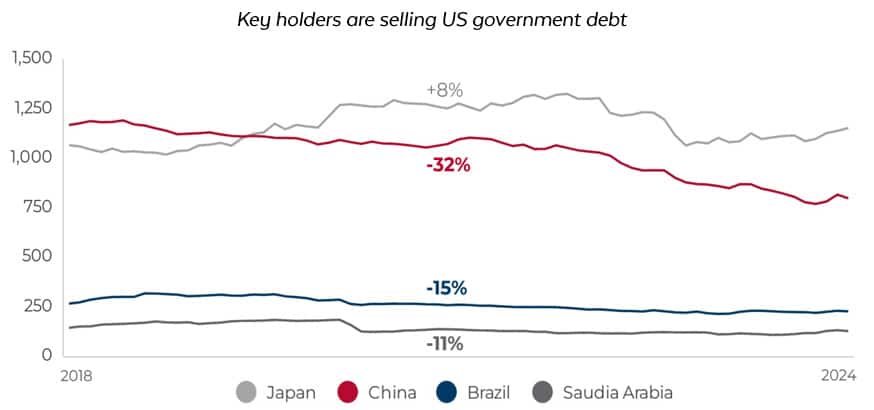

Now imagine being China on the sidelines, watching the US not honour its debt to Russia. As China, would you be buying more US debt, or would you be selling your current US debt holdings? especially if you, China, already have a tense relationship with the US and have your own regional intentions regarding Taiwan.

Source: Flagship Asset Management, Bloomberg

China, once the largest holder of US debt after the Federal Reserve, has been reducing its holdings since at least 2018 and even more aggressively since 2022, at the beginning of the Russian-Ukraine war. And so have some of its BRICS allies. Given that some countries are selling what they once considered a safe-haven asset, what other safe-haven asset is there to buy? Gold – and lots of it.

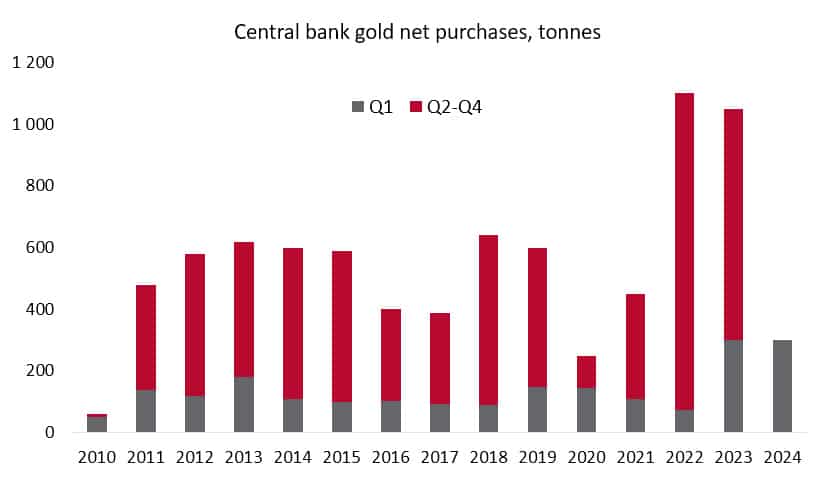

Source: Flagship Asset Management, Metal Focus, Refinitiv GFMS, World Gold Council

Driving forces

Since the Russian-Ukraine war, central banks worldwide have been buying far more gold. Beginning in the first quarter of 2022, this buying spree coincided with the dislocation of the relationship between gold and real rates. In the chart above, you can see the strong demand that followed in the second through fourth quarters of 2022 and continues today. This is the main reason for gold’s strong performance.

Where to from here? The two scenarios discussed above – real rates and the US decision to weaponise its debt – are expected to be the main driving forces behind the movement in gold.

Real rates are determined by nominal interest rates minus inflation. The combination of lower US interest rates and higher inflation results in lower real rates, which should continue to affect gold. If real rates come down faster than the market expects, then gold will go up, all else equal. And vice versa. The market is currently expecting the Federal Reserve to begin cutting US interest rates in September, so watch that space if you own gold. Also, keep an eye on US inflation.

Has the US crossed the Rubicon by freezing Russia’s US debt assets? If, say, a newly elected US president walks back on freezing Russia’s foreign reserves, will the market take it to mean it will never do so again? Maybe initially, but my guess is that the proverbial river has been crossed.

Gold’s current upward trajectory highlights that, for some, gold has replaced US Treasuries as a core, safe, and internationally recognised asset to hold. At times when inflation is greater than interest rates – meaning your money is losing value in real terms if sitting in a bank account – gold’s appeal will become even shinier. Geopolitical instability adds to its global appeal.