04 Sep Why South African investors should care about the state of the US consumer

As published by Sanlam Glacier on 6 September 2024

By Flagship Asset Management portfolio manager JD Hayward

Most South Africans would question why they should care about the state of the US consumer when they have so many other things to worry about at home, including sky-high unemployment, widespread corruption, and the odd patch of tar in between our potholes (if you live outside of the Western Cape). However, US consumers do matter because the spending of US consumers drives 67% of the US economy, which is still the biggest economy in the world, and thus, when the US consumer stops spending, the rest of the world feels it.

Why does the US consumer matter?

The Butterfly Effect is the idea that something very small, such as the flapping of a butterfly’s wings, could, theoretically at least, lead to something very big, such as a ripple in the air leading to a storm halfway across the globe. In this case, the US consumer is the butterfly, but instead of normal butterfly wings, this butterfly has big ol’ American-made eagle wings.

To better explain this point, it’s worth spending a minute contextualising the size of the US economy and, thus, the impact US consumers can have on the rest of the world. If individual US States were classified as countries, California, with a GDP of almost $4 trillion, would have the world’s fifth-largest economy, just beaten out of the top three by Germany and Japan. Texas would be eighth, and New York State would rank 10th. South Africa, with a GDP of roughly $380 billion, would struggle to make it onto the list of the top 20 US states.

There’s a well-worn saying that when the US economy sneezes, the rest of the world catches a cold. What is not as well-known is the size of US consumers’ role in the overall US economy: 40%? 50%? No, closer to two-thirds: 67% of the US economy is driven by the spending of US consumers. The equation now becomes a bit clearer. If the US consumer stops spending due to higher interest rates, higher inflation, lower confidence, or any other factor, the US sneezes, and the rest of the world catches a cold. So, the short answer to how important the US consumer is in our lives is very.

Contradicting economic indicators

Several somewhat contradictory data points have emerged from the US over the last year. Drivers of a strong consumer have included a strong job market, resultant low unemployment, and inflation-beating wage increases. For the most part, these have all been strong over the past year, leading to continued consumer strength and ongoing GDP growth. US GDP growth in the second quarter came in at 2.8%, double the 1.4% achieved in the first quarter. Retail sales in the second quarter also grew reasonably strongly at 2.4% for the year.

Based on these numbers, the consumer is in a relatively strong position, which is echoed in the slight uptick seen in the latest consumer confidence polls, which hit their highest levels in over a year, depending on the measure used. The consumer is undoubtedly buoyed by the increasing possibility of a Goldilocks scenario, where the US completely avoids recession, and the labour market remains strong.

However, some negative data points have come through as well. When inflation runs as hard as it has, something typically needs to “break” to correct it. This is usually the Fed’s doing, with the central bank raising the borrowing rate, making money more expensive, and acting as a brake on an economy that is running too hot. The challenge for the Fed lies in attempting to apply the brakes smoothly – and avoid making a 180-degree handbrake turn – something that history has taught us is very hard to achieve.

In recent months, we have slowly seen US unemployment increase, albeit from very low overall levels. This number is also quite muddy, as the large influx of migrants into the US increases the labour force participation rate, somewhat distorting this number. Unemployment is a lagging indicator, though; by the time it rises, the damage has often already been done.

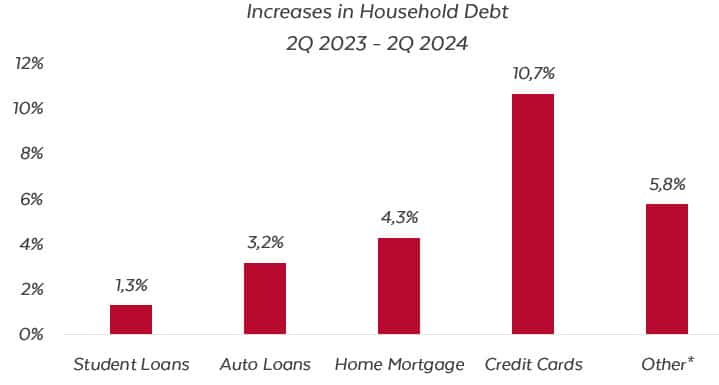

Total US household debt of $18 trillion has also steadily increased by roughly 4.3% in 2024. The more concerning factor is that credit card debt, while only a small portion at $1 trillion, is rising much faster than all other debt segments, see the chart below. This is concerning because consumers have spent most of their pandemic-era excess savings and are turning to credit cards, bad debt in the eyes of economics, to maintain their spending levels. On top of this, default rates on credit cards have slowly started increasing as higher borrowing rates have started to bite.

Source: Federal Reserve Bank of New York, Flagship Asset Management *Includes retail cards and consumer loans.

All in all, household debt as a percentage of disposable income sits at around 10%—which is not yet at scary levels and is quite a lot lower than the 13% debt levels seen in 2007. However, the combination of higher rates, increasing levels of credit card debt to fund expenses, and depleted savings is certainly worth a note of caution.

Investment Implications

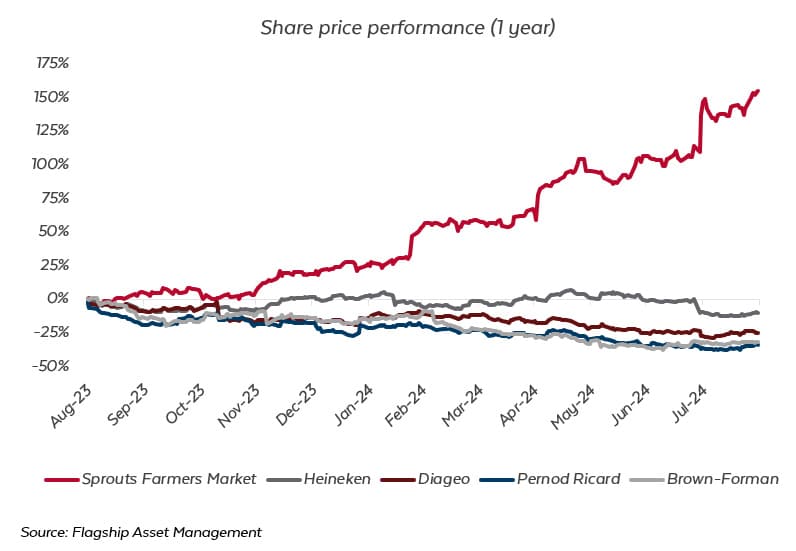

Where does this leave investors? Would you rather buy consumer-driven staples in a world where tech stocks are historically expensive – a strategy that would not necessarily have worked out well over the past year? Several traditional consumer staples have been struggling. Iconic beer brewer, Heineken, is a good example, despite being relatively inexpensive to begin with. Curiously, several of its liquor peers have suffered the same fate, with Diageo, Pernod Ricard, Remy Cointreau, and Carlsberg all suffering double-digit declines over the past year.

This is not the case for all staples, though. Surely, sustained consumer spending must benefit certain stocks. Well, look no further than Sprouts Farmers Market. While technically a consumer staple stock, according to the GICS classification, the case here is slightly more nuanced. Sprouts sits in a sweet spot between staple and discretionary spending, with an added healthcare angle, to boot. The company benefits from the ever-growing trend towards healthy living and eating, catering to every imaginable dietary preference.

Source: Flagship Asset Management

Share prices are generally driven by investor expectations of future returns. Over the past year, Sprouts has outperformed some of its better-known staple peers by leaps and bounds. If this is anything to go by, investors could easily conclude that while consumers are more discerning about where they spend their money, they remain willing to spend – and Sprouts Farmers Market has become a consumer favourite.

The diverging fortunes for these companies highlight the unpredictable impact consumer behaviour has on stocks. Though the consumer may be strong, shares you would expect to benefit have not necessarily done so, and new kids on the block, like Sprouts, have. This highlights how crucial it is to look below the hood for differentiated investments opportunities within the greater macroeconomic context, especially in the consumer-facing sectors.