After a fairly volatile July, the start of August saw more of the same, before relative calm returned to markets late in the month. The US unemployment rate climbing for the 4th month in a row sent markets into freefall over fears that the Fed might have left interest rates too high, for too long – effectively steering the economy into a recession. These fears proved temporary, though, and markets clawed back some of the losses. At month end, the S&P 500 had rallied to gain 2.4% for the month, outpacing its tech-heavy Nasdaq peer, which return 0.7%. The small-cap Russell 2000 declined, giving up 1.5% during the month. In Europe, the Stoxx 50 gained 2.4%, while London’s FTSE 100 advanced by 0.8%. Indices in the East were mixed, with Japan’s Nikkei losing 1.1%, while the Hang Seng index had a strong month, returning 3.9%.

CPI numbers in the US came in below 3% for the first time in nearly 3.5 years. This, along with a downward revision of jobs data, basically guaranteed rate cuts were on the way, and all eyes turned to the Fed’s Jackson Hole symposium where Chairman Jerome Powell delivered the strongest confirmation yet that borrowing rates would be reduced at the next Federal Reserve meeting in September.

On the geopolitical front, the situation in the Middle East remains tense after Iran vowed retaliation against Israel after a political assassination, prompting the US to send an aircraft carrier and submarines to the region. Russia received somewhat of a bloody nose as Putin was forced to divert troops from his Ukrainian invasion back to Russia to defend the motherland after Ukraine made strong advances in their counterattack in the Kursk region. Putin and the Kremlin were outraged, calling it a major provocation. Quite rich.

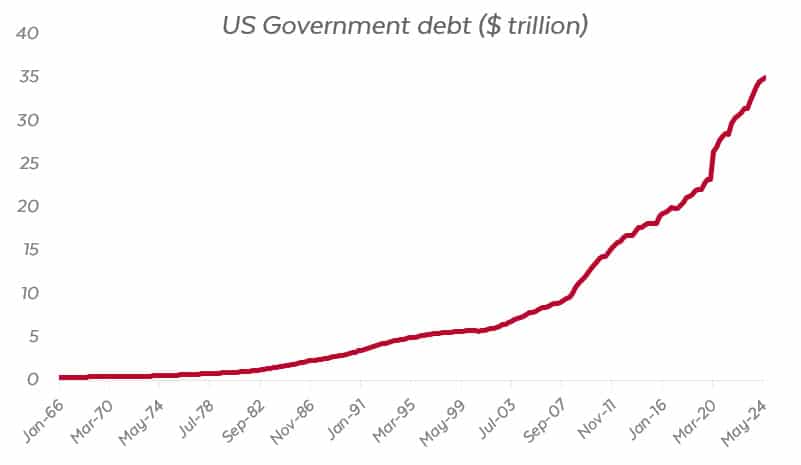

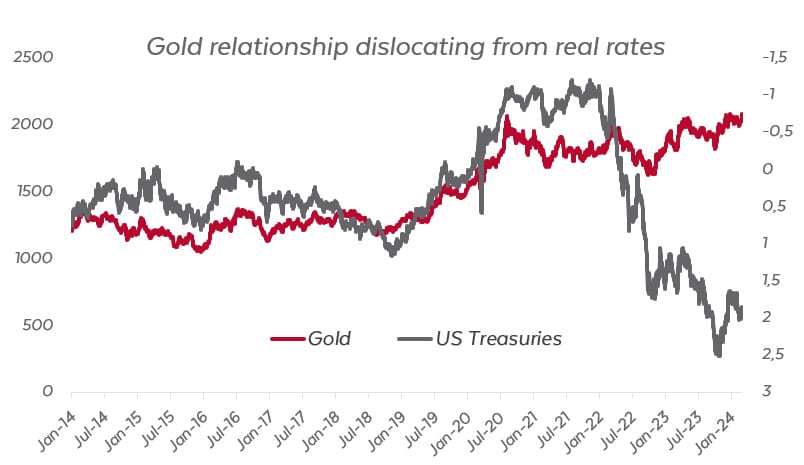

The ongoing global conflicts, coupled with US debt breaching $35 trillion, meant investors still sought out safety in gold. The metal hit several record highs during the month, gaining 3.8% and closing above $2,500 per ounce. This means one standard bar of gold is now worth more than $1 million.