15 Oct AI’s quiet revolution: Industries you didn’t expect

As published by Sanlam Glacier on 20 September 2024

By Gerhard Janse van Vuuren

The relentless media coverage of all things AI (artificial intelligence), ChatGPT and other developments, might make one feel that the hype is overblown. There is, however, more to it than meets the eye. Sure, some people might have found a new best friend in ChatGPT, some have even married AI characters, but there are several less obvious beneficiaries of the new hyperfocus on the AI industry. A fair few unexpected winners will emerge, and no doubt quite a few will fail – as is the case with all major booms – even if this technology ends up changing the world.

Unlike ChatGPT, which only launched in November 2022, the term AI has been around since the 1950’s! In the 1997 historic rematch, an AI-configurated program beat World Chess Champion, Garry Kasparov, in a six-game match, marking the first victory by a computer under tournament conditions. We have already seen several beneficiaries directly attributable to AI, evident in industries such as logistics, healthcare and cybersecurity which have been using more basic versions of AI for years. But the new, spectacularly improved, versions of AI will lead to significantly enhanced productivity and efficiency gains.

FactSet did a search of earnings calls and found that 199 of the 500 companies in the S&P500 mentioned the word “AI” in their most recent set of results. Out of these, 12 companies, including Meta, Nvidia and Microsoft, mentioned it at least 50 times. Technology companies are leading the pack with 91% of them mentioning AI. While this clearly has elements of a gold rush, some are opting to sell shovels instead. Companies like Nvidia, who sell the most advanced chips, are enabling other companies to train their own AI models. Others, like Amazon and Google, are providing cloud computing services to companies who need processing power to train their AI models.

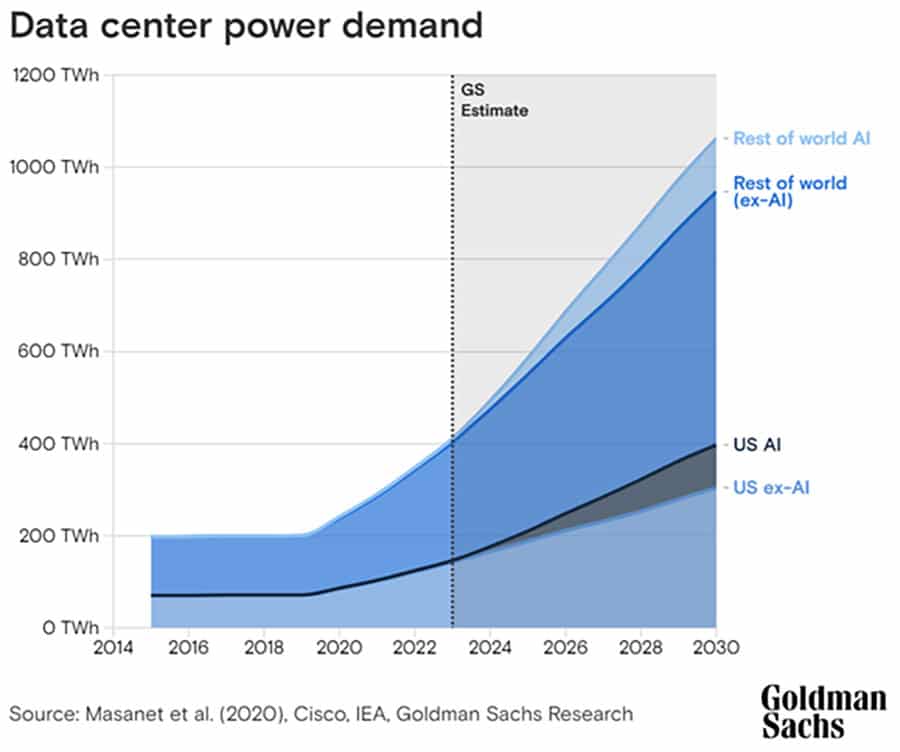

Amidst the world’s transition to renewables, data centers used to train AI models are turning small towns, where they are often located, into power hungry beasts. An example of companies who stand to benefit indirectly from the AI craze are the ones providing power to these centers, the data center owners themselves, and the providers of data storage solutions. In fact, it is estimated that in the last two years, humans have created 9x more data than in the entire history before that. It is estimated that 30 trillion gigabytes of data will be created between 2024 and 2025. During that time, only 2 trillion gigabytes of storage capacity will be manufactured. According to Goldman Sachs, data center power demand will grow 160% by 2030. Currently, data centers consume 1-2% of global power, but this percentage will likely double to 3-4% by the end of the decade.

Power generation

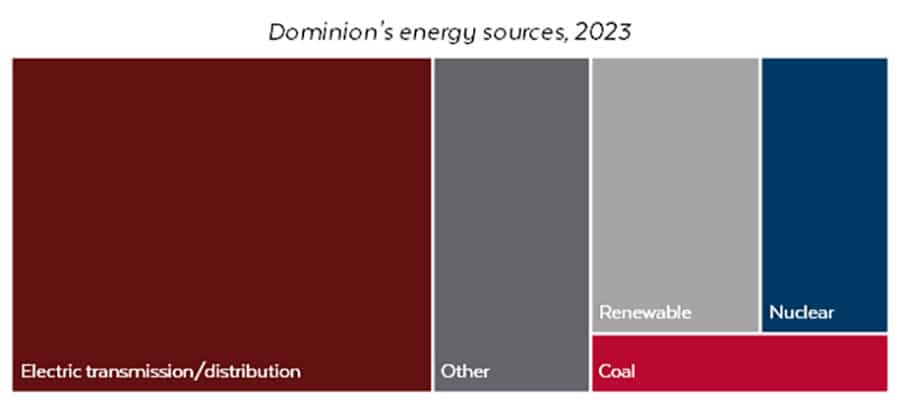

One example of a company that is well placed to benefit from AI, but also from the effect of increased computing demand on power grids in general, is Dominion Energy. Dominion utilizes a wide range of energy sources to produce power, with renewables making up a bigger portion than coal and others.

Source: Dominion Energy Financials, Flagship Asset Management

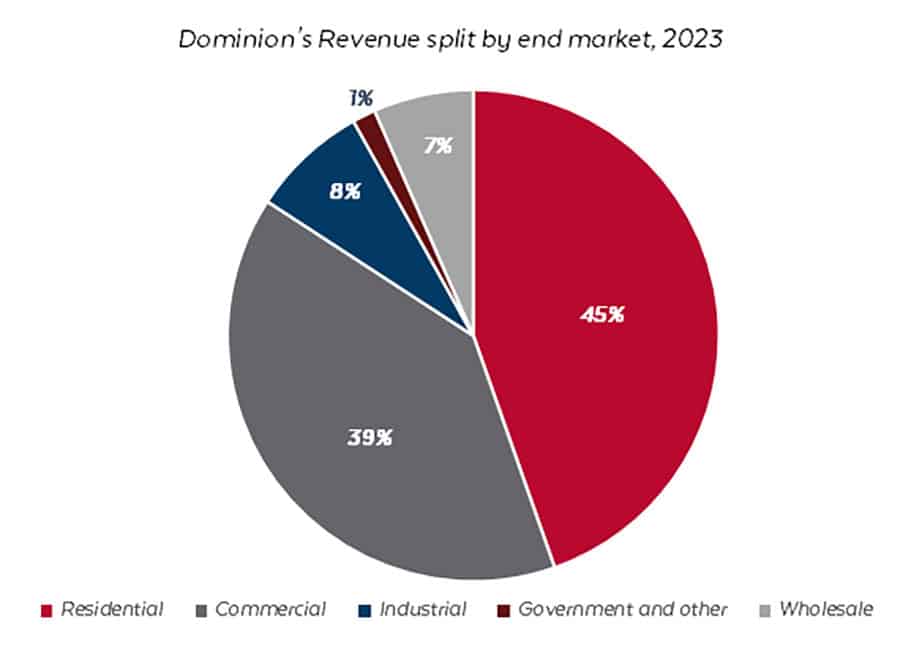

Whilst it is set to benefit from increased power consumption, it should also be a bit more insulated if the AI merry-go-round slows down, given that they service 5 distinct groups of customers, including more than 3 million households. It also has operations that are conveniently located near Ashburn, Virginia an area dubbed as “Data center alley.” The company is also starting to tilt increasingly towards renewable energy sources, which helps to future-proof the business model. Their asset portfolio includes 25 000+ megawatts of electricity, 9 700km of transmission lines and 87 000 km of distribution lines. Of this impressive asset base, data centers make up 18.7% of group net income.

Source: Dominion Energy Financials, Flagship Asset Management

Data storage

With the massive amount of data generated, storage will play a big role in the transition to this information-hungry world. Regarding storage, there are three main factors to consider: 1) cost 2) power-usage and 3) storage capacity.

Data centre storage capacity is expected to grow at 18.5% p.a. over the next 5 years. This is driven by a new need for data relating to AI but also by the pace of “on-premises” data shifting to the “cloud”.

It is important to have a basic grasp of the different types of storage to identify potential beneficiaries of this trend. Almost all (90%) of the data centre industry uses HDD (hard disk drives) over SSD, (solid-state drives) with the latter being faster and more power efficient. The drawback of SSD’s is that their Total Cost of Ownership (TCO) is currently 6x that of HDD’s, which you will find in modern PCs. Over the next decade, HDD capacity is expected to offset any decline in SSD costs. The result being that the TCO of an HDD will still be around 1/6th that of an SSD drive. This is mainly a function of the high cost of producing an SSD.

A beneficiary of this outlook will be Seagate Technology. The company manufactures storage products across multiple categories such as personal, gaming, video, and cloud storage. Seagate addresses all three of the previously mentioned factors simultaneously. They have products in multiple price categories, their products are optimized in terms of power usage, and they are continually improving how much data they can fit into the same product size as before.

Pharmaceutical industry

The pharmaceutical industry will be another beneficiary of the progress being made in AI. These companies will be able to use AI in several ways, including drug discovery, predicting the properties of a drug and predicting the efficacy and toxicity. Eli Lilly and Novo Nordisk have both recently announced their intentions to use AI for these purposes. In June, Eli Lilly announced a partnership with OpenAI to leverage their expertise to develop novel antimicrobials that can help treat drug-resistant pathogens. The company also revealed that it will be partnering with RNA specialist Genetic Leap, to further its AI-enabled drug discovery ambitions, in a deal worth up to $409million in upfront and objective-based payments.

In May this year, Novo Nordisk announced it will be investing $200million in quantum computing startups. Novo Nordisk has also revealed the results of its partnership with Microsoft in assessing cardio-vascular disease risks (such as a heart attack), leading to an 8% increased accuracy when compared to the best clinical standards. Scientists believe one of the biggest advantages of AI will be to help increase the speed with which cures can be found and developed. In some cases, an AI model might be able to develop its own hypothesis, test it, analyse the results, and then run an improved experiment.

As AI continues to reshape the world, its impact extends far beyond the tech sector. Industries once considered peripheral to the AI conversation are now reaping significant benefits. By embracing the innovative capabilities of AI, these industries are transforming their processes, enhancing productivity, and unlocking new avenues for growth. The AI revolution is just as much about the unseen players as it is about the tech giants, making it a pivotal force across the globe.

About the author

Gerhard Janse van Vuuren BCom (Hons)

Equity Analyst

Gerhard is an equity analyst for the global team, having joined Flagship in 2022 via the internship program.

Gerhard completed several investment internships while concluding his degree in Investment Management at Stellenbosch University. Gerhard is a CFA Level II candidate and has completed his Honours degree in Finance at the University of Cape Town.