18 Oct US is headed in the wrong direction, whoever wins the election

Fiscal position is unsustainable regardless of whether the Democrats or Republicans are in power

By Philip Short

Philip Short talks to Jeremy Maggs on Moneyweb as to why neither presidential candidate is addressing the ballooning government deficit.

Predicting what markets will do depending on the outcome of the upcoming US elections is a difficult task. For one, you need to have all the available information condensed in front of you. All the nominees’ policies as well as their respective parties’ policies. Secondly, how far will those policies be implemented or resisted, nationally and internationally. Nationally, each party would need a clean sweep with a majority in the House and Senate to enact their policies without resistance. Internationally, it’s always a game of give and take, given that we live in an integrated global society. And thirdly, and probably the most unpredictable component, is relying on what politicians say they will do versus what they actually will do. So even if you can plug all the available information into your new handy Artificial Intelligence predictor model, it may still be rendered useless given the human tendency to say whatever they need to say to get elected into office. Having said that, it is interesting to explore some high-level themes when it comes to the two dominant political parties in the US, the Republicans and the Democrats.

Fiscal

One key issue we see developing in the US is its significant debt problem. At Flagship, we’ve done some deep-dive work on how the US’ debt is evolving and becoming a major problem for the country. Unfortunately, the common outcome regardless of who wins the elections, is continued fiscal deficits resulting in an ever-increasing debt burden for the country. On the face of it, Democrats want to increase corporate tax rates (Republicans want it lower), create a Wealth Tax, fiddle with Estate Tax, while also cutting tax rates for the middle class.

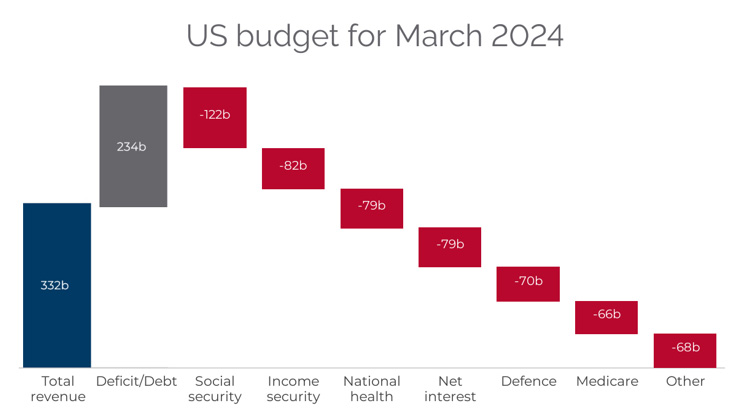

Unfortunately, the US’ current expenditure is so out of sync with what it earns via taxes that changes on taxes alone are not going to change the trajectory of its deficits. As can be seen in the chart below, looking at the US budget for March 2024, total revenue for the US was way short of meeting expenses. Total revenue for the month was $332bn. Expenses totaled $566bn. That’s a material difference, especially given the fact that currently the US has a strong GDP and low unemployment. Working at the margin on tax receipts means very little regarding fiscal deficits when your main issue is spending. And there has been little from either candidate to address the level of spending that would avoid further deficits.

Source: Flagship; US Congressional Budget Office

Trade

If we assume that the Democrats’ policy on trade under Harris will be a continuation of what we’ve seen under Biden, then the main difference when looking at Donald Trump’s trade policy is the increase in tariffs by the latter. Specifically, Trump wants 60% import tariffs on China and 10% on imports from all other trading partners. What are the potential outcomes of such a move? All things equal, inflationary. As the same goods imported are now more expensive. Or similar goods are sourced elsewhere but at a higher price but not as expensive as the original goods post the tariff implementation. Perhaps goods are onshored and manufactured locally, but this too would be more expensive otherwise the US wouldn’t have imported the goods in the first place. Alternatively, the US imports fewer goods which are now more expensive due to tariffs, meaning total value of imports is unaffected and thus not inflationary. However, under this latter scenario, fewer goods are circulating in the economy meaning slower economic growth.

Immigration

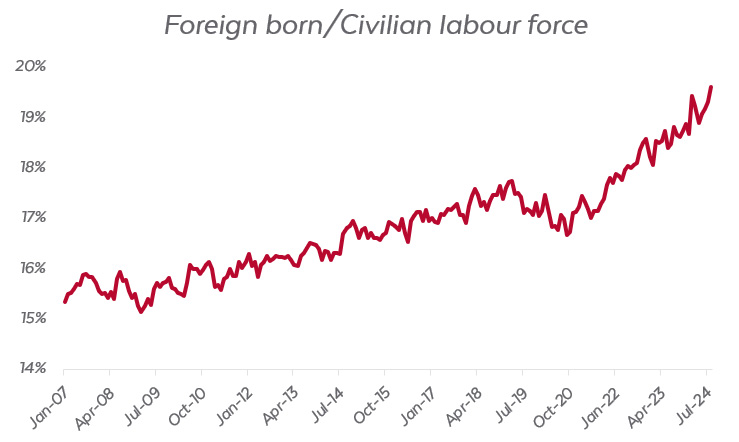

One of the major differences between the two political parties is their view on immigration. Some say the Democrats encourage immigration to expand a cheaper labour force while others say their motives are to expand their voter base, to ultimately naturalize the immigrants, who traditionally tend to vote Democrat. Whatever the reason, immigration does increase labour supply and at a lower cost, which translates into higher economic growth. If Republicans win the election, one should expect tighter regulation on immigration. Given that the current unemployment rate in the US is very low at 4.2%, meaning that most jobseekers are able to find employment, immigration participation in the work force is not a problem. However, if the economy weakens to a point where you have significantly higher unemployment, then tensions could be seen, as foreign-born workers in the US are taking up more and more of the jobs in the US, as seen in the chart below.

Source: Flagship; Federal Reserve

Winners and losers

There should be some broad winners and losers dependent on the outcome of the election. Given Trump’s slogan “Drill, baby, drill” when it comes to oil, oil field service companies for example, will do well. Renewable energy should fare better under Harris. Healthcare is a bit more nuanced: the Democrats want a more inclusive healthcare system whereas Republicans want to rely more on the private sector. Republicans want less financial regulation, so maybe more favourable for Banks. Trump seems more bullish for Technology companies as Democrats seek greater oversight in that sector. Both parties will continue spending on infrastructure in the US.

It’s difficult to base investment decisions solely on who will win the elections as there are many unknowns. We think there are better ways to navigate the markets by focusing more on the knowns than the unknowns. What are a company’s cash flows, return metrics, economic moats and level of gearing on its balance sheet? The one top-down factor that is largely known, but perhaps not fully appreciated, is that the fiscal position of the US is unsustainable, and the trajectory is going in the wrong direction, regardless of who comes into office.