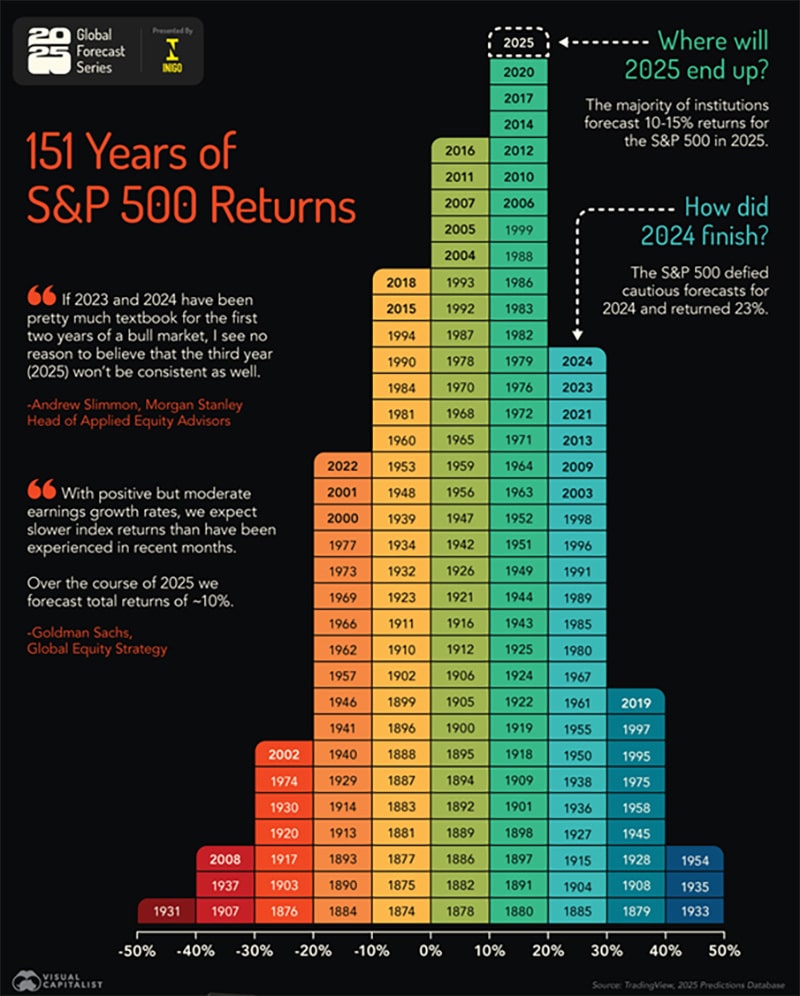

2024 proved to be another blockbuster year for US markets, but the absence of a December Santa rally to cap it all off, left investors slightly disappointed. The benchmark S&P 500 declined by 2.4% during the month, while the small-cap Russell 2000 declined by more than 8%. The tech-heavy Nasdaq held up surprisingly well, ending 0.6% higher. Elsewhere, London’s FTSE 100 lost 1.3%, the Euro Stoxx 50 increased by 1.9%, Japan’s Nikkei 225 increased by 4.5%, while the Hang Seng also ended 3.3% higher. When looking at annual returns for the S&P 500, this was the best two-year stretch in a quarter century, setting 57 new all-time highs during 2024 alone.

Monthly Commentary December 2024

The last time the S&P delivered two consecutive years of 20%+ returns was all the way back in 1997 and 1998, in the lead up to the dot.com crash. There were several reasons that led to the strong 2024 performance, primarily inflation in the US easing to around 3%. The US job market once again proved to be remarkably strong. The most recent print of 256,000 new jobs was much stronger than the 155,000 expected by the market. This was the 48th consecutive month of net hiring, tied for the second longest streak on record. The last time the US economy experienced a loss of jobs was all the way back in December 2020. However, the latest US inflation print was slightly less rosy, and improvement appears to have stalled as the numbers continue to be above the Fed’s 2% target. This, along with the blowout jobs report, gave the Fed all the data it needed to change their interest rate outlook for the year ahead.

The hawkish message that followed made it clear that the rate-cut-party will not continue in 2025. The Fed previously indicated that they expected four cuts in 2025, but this has now changed to no more than two. This cloudy outlook sent major indices down more than 3% in one trading session and turned out to be the main factor behind a lacklustre month of returns for US markets. Adding to pressure on markets was the uncertainty of another looming government shutdown, which was narrowly avoided at the last minute.

December saw a myriad of geopolitical events, and the increased market volatility saw the VIX index spike 30% during the month, at one point spiking by as much as 100%. In South Korea, President Yoon briefly tried to enforce Martial Law, however parliament voted against this by 190-0. He is currently facing impeachment proceedings. In Syria, President Bassar Al Assad’s regime crumbled spectacularly as rebel forces took Aleppo and Damascus in a matter of days. This brings an end to the brutal Assad regime, with Syrians around the world celebrating the event. Lastly, Canadian Prime Minister Trudeau stepped down, as support for his vision of Canada within his own party waned. Canada has seen a steep rise in housing costs, rising unemployment and an increase in the number of Canadians visiting food banks.

The JSE All Share ended the year with a negative print, declining by 0.3% for the month. In USD terms, this looks a lot worse at -4.9%, due to the ZAR weakening by 4.4% against the USD. Both the resources and financials indices also closed in the red, declining by 5.4% and 1.3% respectively.

In a hammer blow to the local industrial sector, ArcelorMittal will be closing their steel operations in Newcastle and Vereeniging at the end of January, which will lead to the loss of 3,500 jobs. Industry experts have warned that the ripple effects of this could be profound. Having to import certain products that were previously produced locally will make other industries, such as auto manufacturing, uncompetitive, leading to further industrial declines and job losses.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.