After a strong start to the year, US markets pulled back in February. The S&P 500 declined by 1.3%, while the tech-heavy Nasdaq declined by 3.9%, as growth stocks retreated from their highs after Nvidia results failed to impress the market. The small cap Russell 2000 had a particularly bad month, declining by 5.4%. UK and European markets continued their strong performance for the year. London’s FTSE 100 was up 2%, while the Euro Stoxx 50 increased by 3.3%. Asian markets experienced very different outcomes, as Japan’s Nikkei 225 decreased by 6%, while Hong Kong’s Hang Seng gained an enormous 13.4% during the month.

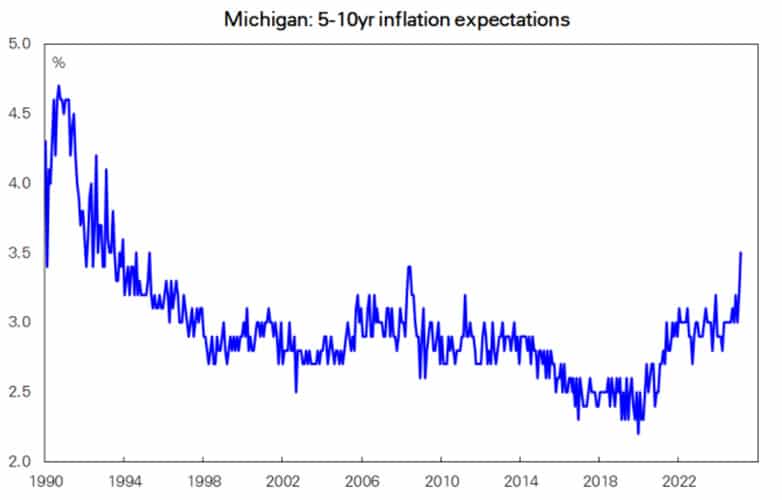

US economic data was a mixed bag. Both normal and core CPI, which excludes food and energy, were higher than expected, with the Fed noting they are in no hurry to further reduce rates. On top of this, average hourly earnings data also came in stronger than forecast, potentially leading to further upward pressure on prices. Looming Trump administration tariffs may also add to this. The result is US 5–10-year inflation expectations at 3.5%, the highest number recorded since April 1995.

On the flipside, services PMI numbers came in well below estimates, dropping into contractionary territory. Walmart, a proxy for the strength of US consumers, delivered weak guidance, leading to more concerns about the real strength of US consumers. All of these factors combined were reflected in the consumer confidence index, which dropped nearly 7% in January. Notably, this is the largest decline since 2021, as Americans increasingly worry about their financials prospects.

Divisions in the US market are clear. The top 10% of US earners, being households who make more than $250,000 annually, are responsible for 50% of the spending. This is the highest percentage since Moody’s began tracking in 1989.

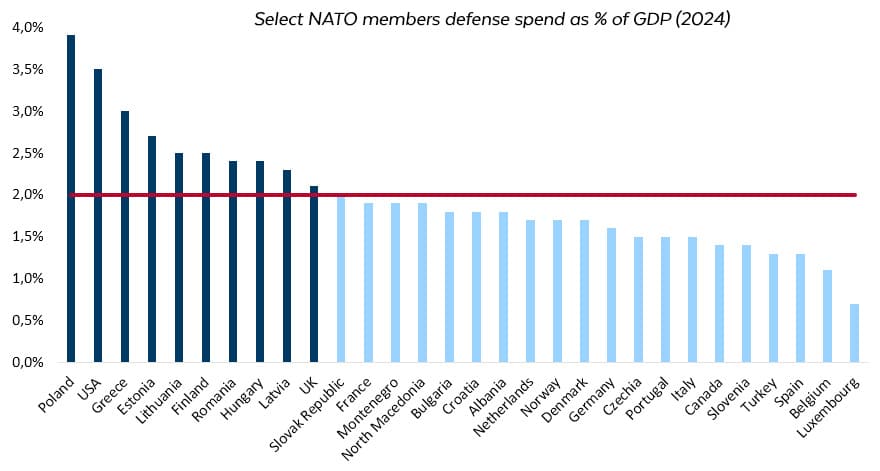

The main news items this month undoubtedly came from a geopolitical perspective. As the world marked three years since Russia’s invasion of Ukraine, there were profound shifts in long-standing diplomatic ties. Trump, diverging from past approaches, held direct talks with Putin on potential ways to end the conflict, sidelining Ukraine and European allies. The US refused to back UN resolutions condemning Russian aggression. US Vice President Vance then made more enemies than friends in Europe, as he slammed leaders for pressuring free speech and ignoring the will of voters.

At month-end, a heated meeting between Trump and Ukraine’s Zelensky laid bare the deterioration of their relationship, and odds are now increasing that the US will withdraw all support for the Ukrainian war effort. The EU will need to step up to try and fill the void, as they face a number of tough questions regarding security over the coming months.

Local markets delivered a mixed bag of results for the month: the JSE All Share was flat; the financials index rose by 1%; and the resources index decreased by more than 7%. Local inflation rose 3.2% YoY in January, slightly higher than in December ‘24, and the SARB has maintained its hawkish outlook for prices going forward, indicating limited scope for monetary easing.

The biggest local news headline was the postponement of the budget speech due to the ANC’s proposed VAT hike. While the immediate market impact appeared negative, with bond yields rising and the ZAR weakening, the main takeaways would seem to be positive. In previous administrations, this budget would simply have been rubber stamped and implemented. The 2nd largest partner in the GNU, the DA, refused to vote for the proposal, hopefully indicating that there is finally some form of accountability in government.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.