Investors who thought the first quarter was volatile were in for a nasty surprise at the start of the second quarter. April started with one of the steepest two-day declines in market history as the S&P 500 plunged 10%, on par with Black Monday in 1987, the Lehman Brothers rout in 2008, and the Covid plunge in 2020. Both the Nasdaq and S&P 500 briefly flirted with bear markets. The S&P went on to record its worst four-day loss since the 1950’s to start off the month. During the latter half of the month, markets recovered much of the losses suffered during the first few days.

At the end of it all, the S&P 500 closed the month 0.7% lower, while the small-cap Russell 2000 lost 2.3%. Surprisingly, the Nasdaq composite ended in the green, gaining 0.9%. In Europe and the UK, both the Euro Stoxx 50 and FTSE 100 recorded losses, declining by 1.7% and 0.7% respectively. Hong Kong fared even worse with the Hang Seng losing 4%. Japan stood firm as the Nikkei 225 gained 1.2% for the month.

The main reason for stocks recovering most of their early losses were the postponement (again) of US tariffs. The 90-day reprieve gives negotiators more time to piece together trade deals. On the back of this optimism, the Nasdaq Composite recorded its best day in 24 years, rising more than 12% on the day. The S&P 500 rose more than 9.5%, its biggest move since 2008. The combination of aggressive retail buying, mixed with hedge fund short covering, led to the biggest ever trading volume on 9th April, with nearly 30 billion shares changing hands on the day.

This reprieve, though, was basically the Trump administration blinking under pressure from the bond market, as a selloff in US treasuries led to bond yields rising dramatically. This is likely due to inflationary fears, which could lead to the Fed keeping rates higher for longer or even raising them if necessary. It could also be that US debtholders just engaged in a mass selloff of US treasuries due to policy uncertainty and distrust in the current US administration. Indeed, Japan’s Finance Minister this month raised for the first time explicitly his country’s leverage as the largest holder of US debt, roughly $1 trillion. This could prove to be a valuable tool in the coming trade negotiations.

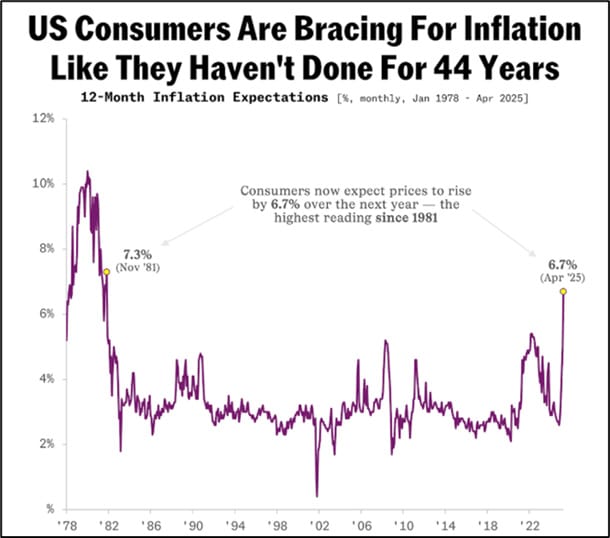

Economic indicators painted a fairly bleak picture in April. The IMF sharply lowered its forecasts for world growth this year (from 3.3% to 2.8%) and for next year (from 3.3% to 3%) as a global trade war continues to loom. And despite US CPI data coming in slightly lower than expectations, consumer sentiment continues to decline. The share of Americans expecting unemployment rates to rise was at its highest level since 2009, while inflation expectations rose to the highest level in 44 years.

Commodity markets did not escape any of this volatility. Gold had another strong month, gaining 5.3%, despite some weakness towards the end of the month. The oil price declined by a mammoth 15.5% over the course of the month (14% of this over the course of two days), as tariff-induced recession fears and increased OPEC outputs drove demand down and supply up.