Market volatility continues, but at least it was to the upside during May. US markets rallied this month, with the S&P 500 gaining 6.3%, while the Nasdaq was up 9.7%. It was the S&P’s strongest month since 2023. In the UK, the FTSE 100 gained 3.8%, while Europe’s Stoxx 50 rose by 4%. In the East, Japan’s Nikkei ended 5.3% higher, while the Hang Seng rallied nearly 6%.

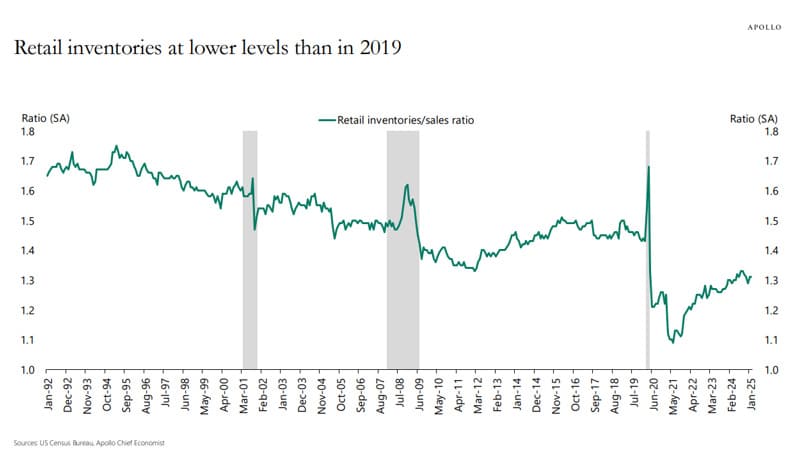

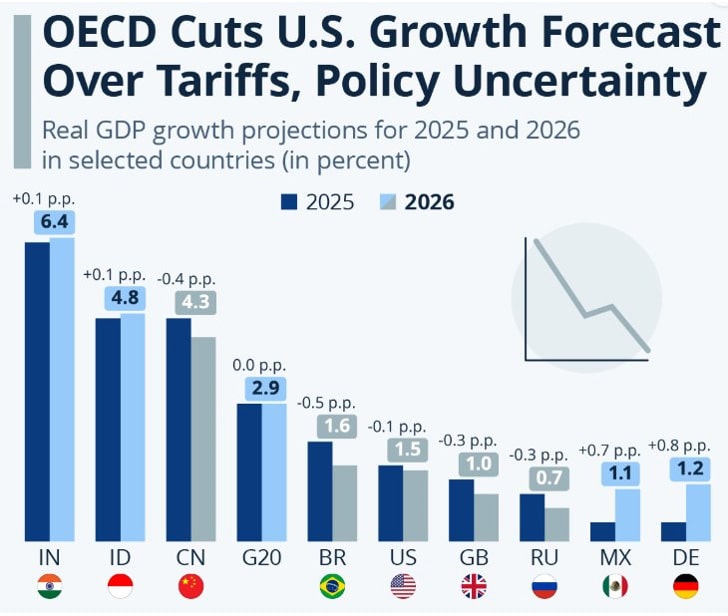

This performance was mainly driven by the easing of tariff-tensions between China and the US. It led to US tariffs on China coming down from 145% to 30%, while Chinese tariffs on the US decreased from 125% to 10%. This meant the average US tariff rate decreased from 25% to 12%, and while this is a major reduction, it is still nearly 10% higher than the average tariff level during the 2018 trade war with China. There was some deterioration towards the end of the month, however, as both countries accused the other of violating their earlier agreement. Whether the temporary truce was in time to prevent empty shelves in the US remains to be seen. US retailers were sitting on a 1.3x inventory-to-sales ratio at the announcement of Trump’s tariffs, less than the 1.5x before the Covid pandemic. Further adding to negative sentiment was Trump threatening 50% tariffs on Europe (which were postponed), as well as a doubling of steel and aluminium tariffs.

Concerns around the US fiscus and persistent deficits continue to pressure bonds, with the yield on 10-year treasuries again breaching 4.5% during the month. The yield on 30-year treasuries hit their highest level since 2007. This was, in part, driven by rating agency Moody’s downgrading US debt from its highest investment level, following similar moves by Fitch in 2023 and S&P in 2011. Potential relief might be on the horizon as April’s CPI print came in lower than expected. It was, in fact, the lowest year-over-year number since February 2021. This has led some commentators to believe we might still be on track for more than 1 rate cut this year. We remain conscious of the fact that tariffs are yet to reflect in the data, and we are likely to see upward pressure on inflation from this point.

Despite the apparent optimism in the market, we note that several other indicators remain weak. Consumer sentiment continues to decline, survey-based inflation expectations are up to 7.5%, and housing data is also weak, with new permits and housing starts at lower levels than a year ago. On the other hand, the job market remains resilient for now, while both services and manufacturing PMI numbers surprised on the upside. We continue to monitor the unfolding situation closely.

From a geopolitical standpoint, both the conflicts in Gaza and Ukraine appear no closer to a resolution. Russia and Ukraine both launched some of their biggest airstrikes and drone attacks of the war thus far, despite some attempts at peace talks hosted by Turkey.

The local market also benefitted from easing trade tensions, with the All-Share Index gaining 3.2% during May.

Local news flow was largely dominated by Ramaphosa’s White House meeting with Donald Trump. How the meeting went depends largely on one’s expectations beforehand. While not a complete trainwreck, it certainly produced some awkward moments.

Lastly, the SARB finally caved, reducing the repo rate by 25 basis points. Given the low levels of inflation, this hopefully marks the first in a number of cuts aimed at stimulating the economy.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.