Equity markets around the globe marched onwards and upwards during August. In the US, the benchmark S&P 500 was up 2.0%, while the Nasdaq gained 1.7%. The standout was the small-cap Russell 2000 index, which gained 7%. Markets in the UK and Europe also ended in the green. London’s FTSE 100 gained 1.2%, while the Euro Stoxx 50 gained 0.6%. Looking East, there was, again, strong performance. Japan’s Nikkei 225 rose by 4.1%, while Hong Kong’s Hang Seng Index climbed 1.3%. The strongest performer was in mainland China, where the Shanghai Composite Index ended up 8.1%. Shanghai stocks are trading near their highest level in close to a decade as cash-rich local investors increase allocation to equities while rotating out of bonds.

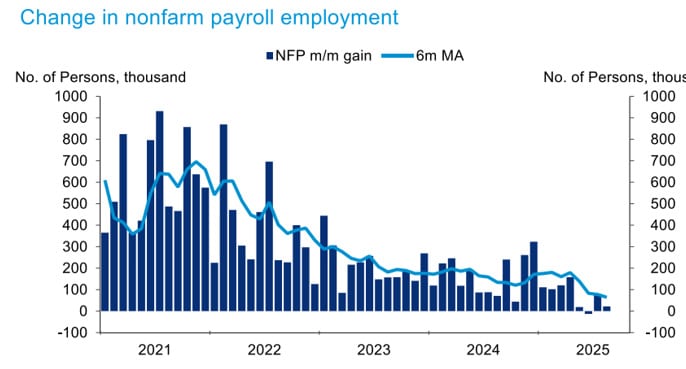

With second quarter earnings season coming to a close, US companies are proving remarkably resilient. More than 40% of companies in the S&P 500 increased their earnings projections, compared to 17% during Q1 reporting season. Much of the strong performance this month, and potentially the raised guidance, was sparked by signalling from the US Fed that the balance of risk has now tilted to the weakening job market (August headline payrolls at just 22,000 is well below the 6-month average of 64,000 – see chart below), with a rate cut at the September meeting now the most likely scenario. This explains the strong performance from US small cap stocks, given their normally elevated debt levels, as they benefit disproportionately from lower funding costs.

The strong market performance belies several concerning issues. Political pressure on the US Fed continues to increase, placing its independence under the spotlight. Treasury Secretary Scott Bessent also commented on Japan’s monetary policy and “inflation problem”, an almost unheard-of criticism of another independent sovereign central bank. Valuation and ‘bubble’ concerns also remain. Sam Altman, one of the most influential figures in AI, stated that we are possibly in an AI bubble, while an MIT Research paper found 95% of organizations are getting zero return on their generative AI investments. Also concerning was a steep increase in PPI or “wholesale inflation”, which rose at the sharpest monthly rate in three years, and could well be busy working through the supply chain until it hits CPI. Another non-traditional recession indicator is flashing red. Shipments of corrugated cardboard, the kind used to make boxes, fell to its lowest Q2 levels since 2015 according to the Fibre Box Association. Weakening demand often coincides with recession…

Despite these concerns, US Q2 GDP growth of 3.3% was ahead of expectations (3.1%) and Q1 (3.0%), lifted by healthy consumer spending and the booming AI sector.

From a geopolitical standpoint, all eyes were on the Trump-Putin peace talks in Alaska. The possibility of NATO-type security guarantees for Ukraine were also discussed with European nations, but progress seems to have stalled with Kyiv hit with some of the heaviest strikes of the war in the days following the summit. The situation in Gaza also gets more dire by the day, with Belgium becoming the latest country to indicate it will recognize a Palestinian State. Within Israel, support for Benjamin Nethanyhu’s continued campaign also seems to be faltering.

South Africa

Domestically, the JSE All Share Index did not miss out on the action, ending the month 3.5% higher. The ZAR also had a good month against the USD, rising by 3%. Local inflation ticked up to a 10-month high during July – reducing the chance of another rate cut. Y-o-Y CPI now sits at 3.5%, still on the low end of the SARB’s target range, but a meaningful uptick from the previous reading of 3%.

SA scored yet another own goal on the global stage, as the head of the South African National Defence Force expressed solidarity with Iran, a blow in attempts to reset trade relations with the US. Of bigger concern was the presidency’s statement that this visit was not known or approved by Ramaphosa, and that the SANDF does not represent the country on foreign policy matters, leading to the question of just how much control Ramaphosa has over his own military.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.