10 Sep Look beyond Nvidia for lucrative investment chances in AI gold rush

By Philip Short

As published in Business Day (Late Final) on 8 September 2025

Capex boom creates compelling opportunities in power and infrastructure

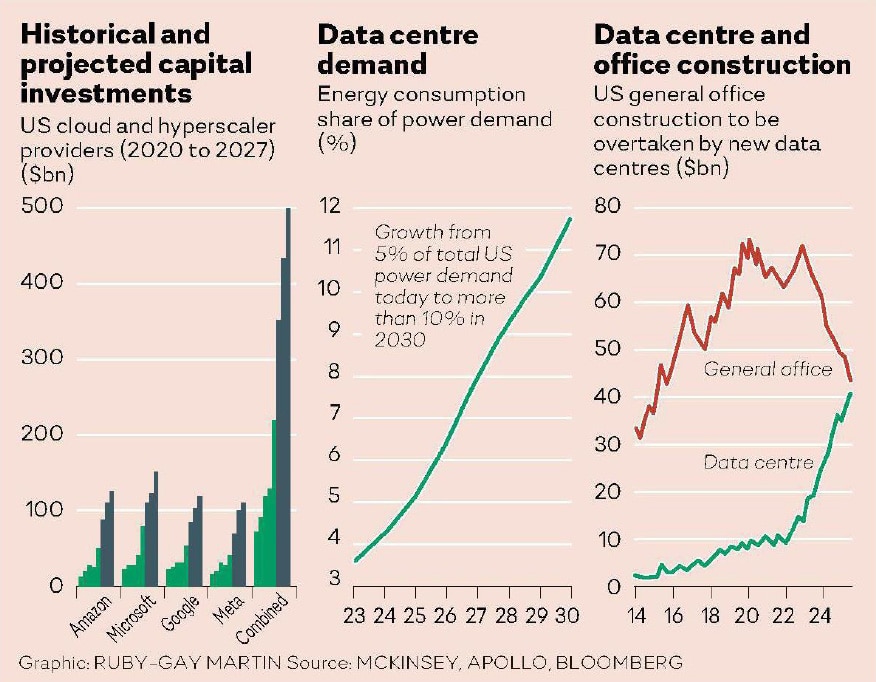

The numbers are staggering. Microsoft, Amazon, Meta, Google and Oracle have collectively announced capital expenditure capex plans that dwarf anything seen in modern corporate history.

Google alone has increased its 2025 capex estimate from $75bn to $85bn, while Meta’s CFO warns of “similarly significant capex dollar growth in 2026”. This represents a seismic shift in how these technology giants are deploying capital, with AI-driven infrastructure investment now adding more to GDP growth than consumer spending.

As manager of Flagship’s global funds, I’ve been closely tracking what I believe represents a once-in-a-generation investment opportunity. The AI-driven capex boom projects that spending will reach $497bn by 2027, compared with just $71bn in 2020 a 600% increase that is reshaping entire industries.

While most investors instinctively reach for Nvidia when thinking about Al infrastructure, the real bottleneck – and the most compelling investment opportunity – lies elsewhere. The constraint isn’t chips; it’s power. Data centres require enormous electrical loads to run these Al systems, and data centre energy demand is expected to double over the next five years to more than 10% of total power demand by 2030.

This power constraint has created what I call the “infrastructure imperative”: a fundamental shift in which the companies that provide power, cooling and connectivity infrastructure have become the gatekeepers of Al development. No matter how much money the hyperscalers have to spend, they cannot deploy Al without the underlying infrastructure.

There is evidence of this everywhere. Schneider Electric, which supplies critical power equipment to data centres, is completely booked until 2030. It is not negotiating on price. Customers are simply grateful to secure an order slot. This isn’t a temporary supply-demand imbalance; it’s a structural shift that will persist for years.

At Flagship we have positioned our portfolios to capture this infrastructure boom through carefully selected holdings in power utilities, connectivity providers and specialised equipment manufacturers. Our core positions include Dominion Energy, Constellation Energy, Celestica, Credo and CommScope, which form the backbone enabling Al infrastructure deployment.

This strategy has already delivered significant returns. When Amphenol announced its $10bn bid for CommScope’s connectivity and cable solutions unit, CommScope’s share price surged 86% in a day. This highlights the significant value that markets are now assigning to critical Al infrastructure components.

Dominion Energy operates in Virginia’s “Data Centre Alley”, connecting about 15 data centres representing about 1GW of capacity annually, with tens of gigawatts more in their development pipeline. Constellation Energy provides the bespoke energy solutions and long-term power purchase agreements that hyperscalers desperately need to underwrite their renewable energy commitments while ensuring a reliable supply.

The hyperscalers themselves are transparent about the scale of their infrastructure ambitions. Meta is constructing data centre clusters with footprints large enough to cover most of Manhattan, each drawing up to 2GW of power, equivalent to a large nuclear plant. Microsoft’s CFO states simply: “We will continue to invest against the expansive opportunity ahead, across both capex and operating expenses.”

When Apple’s traditionally capital-light CFO says, “You are going to continue to see our capex grow … substantially,” we’re witnessing a fundamental business model shift. These companies are transforming from asset-light software businesses into capital-intensive infrastructure operators.

What makes this opportunity particularly compelling is the supply-side constraints that create natural moats around incumbents. The specialised equipment required for Al data centres cannot be rapidly scaled. Manufacturing capacity for critical components such as Credo’s low-power SerDes chips and Active Electrical Cables is finite and takes years to expand.

CommScope’s infrastructure solutions, Celestica’s hyperscale hardware integration capabilities, and the specialised power distribution equipment these facilities require all benefit from these supply constraints. In an environment where demand vastly exceeds supply, these companies have immense pricing power.

While market volatility around Al has created concerns about returns on hyper-scaler investments, the infrastructure buildout continues unabated. That data centre construction is set to overtake general office construction highlights the extent of the shift. The hyperscalers aren’t pulling back on chip purchases or capex forecasts. Instead, they are shifting investment from Al training towards inference, which actually requires more distributed infrastructure and therefore more power capacity.

The infrastructure requirements are largely technology agnostic. Whether the next breakthrough comes from OpenAI, Google or a Chinese startup, it will still require enormous computing power, robust electrical infrastructure and sophisticated cooling systems. The companies providing these fundamental services will benefit regardless of which Al models ultimately prove most successful.

We are amid an infrastructure super-cycle. For investors willing to look beyond the obvious Al plays, the companies building the power grids, data centres and connectivity infrastructure that make Al possible represent some of the more compelling opportunities in today’s market.