Equity markets showed no signs of cooling, closing out the 3rd quarter with strong gains. In the US, the S&P 500 gained 3.7% while the Nasdaq gained an impressive 5.7%. This puts their gains for Q3 ’25 at 8.1% and 11.4% respectively. Interestingly, these gains were less than the small-cap Russell 2000 index, up 12.4% during the quarter. London’s FTSE also experienced a positive month, ending 1.8% higher. European stocks, too, were stronger, up 3.3%. Performance was particularly strong in the East, with Japan’s Nikkei gaining 5.8% while the Hang Seng gained 7.6%. The MSCI All Country Index ended 3.7% higher, while the Emerging Markets index was even stronger, gaining 7.2%. All these indices, strong as they were, paled in comparison to gold and silver. The price of gold bullion rose 12% during the month, while silver a massive 17% higher.

The performance of equity indices, as well as the price of gold and silver, were assisted by the continuation of the US rate cutting cycle, following a pause of 9 months. This led to a weakening of the USD, making the price of gold bullion (and other precious metals) more attractive. The price of gold has now ballooned by 40% this year, the biggest yearly surge since the 1979 energy and inflation crises.

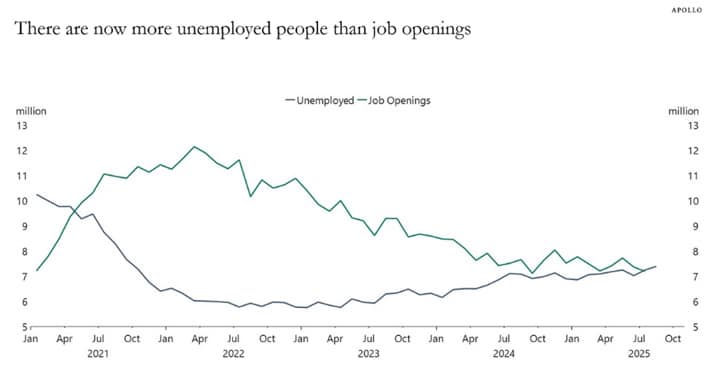

While inflation remains a concern, and comfortably above the Fed’s target, the balance of risk has now shifted to the labour market, where there are several worrying signs emerging, probably warranting an interest rate cut. Jobs data continues to weaken, with recent revisions pointing to contraction rather than expansion of the workforce, and for the first time since 2021, there are now more unemployed people than job openings in the US.

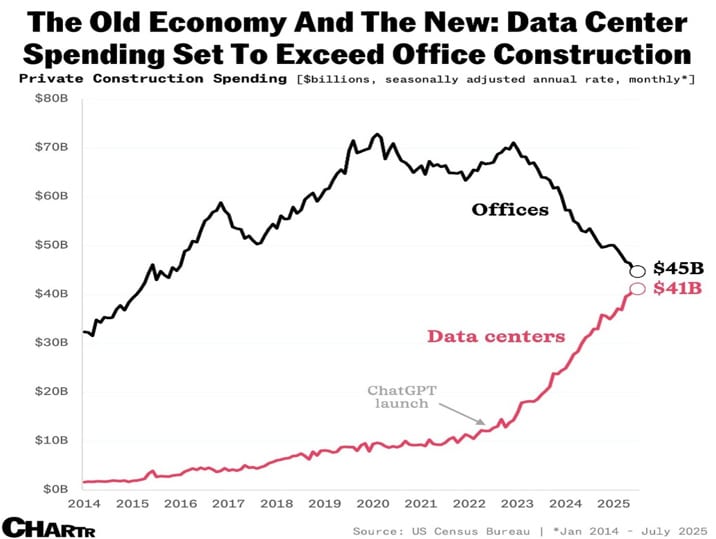

Concerns also remain around the speed of capital deployment that is funding the AI boom, and whether a bubble is close to popping. Spend on data centre construction now exceeds the cost of all private office construction in the US.

In summary, with red-hot and expensive equity markets, above-average inflation, weakening job-data, and rate cuts… we remain vigilant of this worrisome combination.

From a geopolitical perspective, Gaza and Ukraine continue to be flashpoints. Several countries have now formally recognized a Palestinian state at the UN General Assembly in New York, while NATO allies have warned Russia that it is ready to act with force should airspace incursions continue.

South Africa

Like its global peers, the JSE had a strong month in September, gaining 6.6%. This was largely driven by the Resources index, which ended a massive 25.5% higher. The Rand gained more than 2% against the US Dollar after the SARB held rates steady, in contrast to US Fed’s rate cut decision.

From a news flow perspective, there were positive and negatives. On the negative side, South African ports remain the worst-run in the world, and the scale of the Tembisa Hospital graft came to light – with at least R2 billion ‘stolen’ from a single hospital. On a more positive note, though, Eskom achieved profitability for the first time in 8 years, and South Africa is poised to be removed from a global financial grey list, possibly by the end of the month.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.