Equity markets around the world delivered varying performance for the last month of the year. Despite the slightly subdued numbers for December, it was still another very strong year for markets, with most notching double-digit gains. In the US, the S&P was flat for the month, while the Nasdaq composite declined by 0.5%. For 2025, however, they gained 17.9% and 21.2% respectively. This now marks 3 years of back-to-back double-digit gains for the S&P. London’s FTSE 100 was slightly stronger, gaining 2.3% for the month to close 25.8% higher in 2025. European markets also ended in the green, gaining 2.2% for the month and 22% for the year. In the East, the Nikkei gained 0.3% for the month, and an impressive 28.6% for the year. Hong Kong’s Hang Seng closed December slightly lower but delivered an incredible 32.5% for the year. It is worth noting that the US Dollar depreciated by more than 10% versus the Pound and Euro during the year, greatly increasing those index returns when measured in USD.

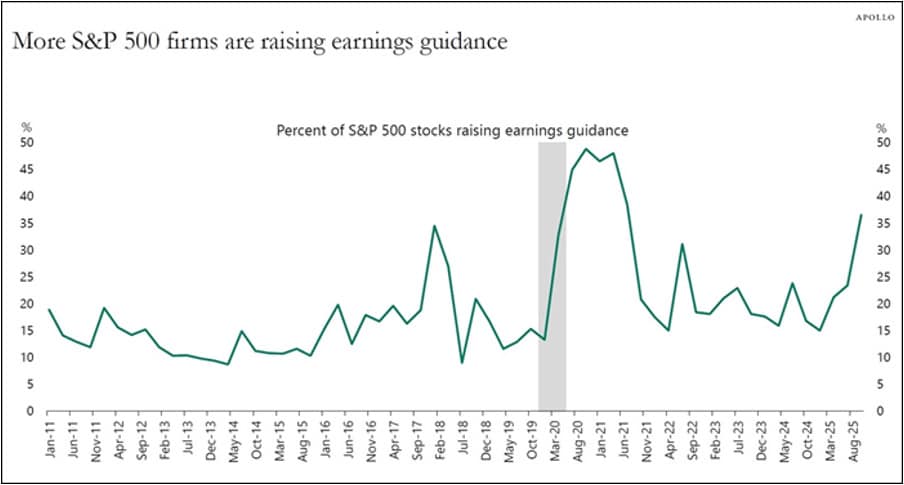

This strong performance continues, especially in the US, despite lingering concerns around overall valuation levels, with investors seemingly emboldened by the increasing number of upward earnings revisions for S&P constituents. Job and inflation data were both sufficiently subdued for the Federal Reserve to deliver another 0.25% rate cut in December, leading to further cheer from markets. This was the 3rd straight cut since September, but the Fed now expects only 1 cut in 2026, citing greater uncertainty looking forward. The US unemployment rate, which at 4.6% hit its highest level in more than 4 years, and the lower-than-expected inflation rate, does provide more room for potential cuts.

On the commodity front, the oil price was weaker, declining by 3.7% during the month, and by 18.5% during the year. This is in stark contrast to gold and silver, up 1.9% and 26.8% respectively during the month, and both having their strongest year since 1979 – as gold rallied more than 60% and silver more than 140%.

Any non-economic news in December was overshadowed by what happened in early January, as the US launched an unprecedented operation in Venezuela, arresting and ‘deporting’ its longtime strongman leader, Nicolas Maduro. This was followed by threats made against fellow NATO member Denmark suggesting a possible US takeover of Greenland, in a spectacular breakdown of international diplomacy. In the East, Japan is embarking on its biggest military buildup in at least four decades as relations with China deteriorate and, in Europe, Baltic nations are fortifying their borders against Russian threats and preparing for potential conflict. Lastly, Iran is seeing a wave of unprecedented protests against the Islamic regime, in what is being touted as a potential generational secular shift in the Middle East.

South Africa

The local JSE All Share had another strong month, gaining 4.6%, putting its annual gain for 2025 at 42.5%. Given the ZAR strength over the last year, these returns are even stronger in USD, with the annual return coming in at an incredible 62.5%.

On the back of several good-news headlines, SA business confidence surged to its highest levels since 2011. Unfortunately, our politicians remain intent on shooting SA in the foot, as our hosting of a BRICS group military exercise including warships from China, Russia and Iran, will no doubt draw the ire of Washington.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.