After a couple of blockbuster months, equity markets were more subdued in November, while Asian markets ended mostly in the red. In the US, the S&P 500 gained 0.3%, while the Nasdaq Composite declined by 1.5% as tech stocks retreated from elevated levels. The numbers, above, mask considerable volatility, as the Nasdaq slid 3% during the first week of the month, its worst weekly performance since April’s ‘tariff tantrum’. Across the pond, both London’s FTSE 100 and the Euro Stoxx 50 made slight gains, closing 0.4% and 0.1% higher respectively. Asian markets retreated, with Japan’s Nikkei 225 ending 4.1% lower, while Hong Kong’s Hang Seng declined by 0.1%. The Shanghai composite declined by 1.6%.

Where commodities are concerned, gold had yet another strong month, rising by almost 6%, though paling in comparison to silver, which was up 16%. Brent crude declined by almost 3% and is now down more than 15% YTD.

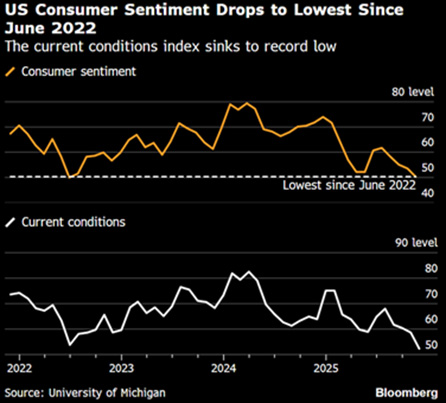

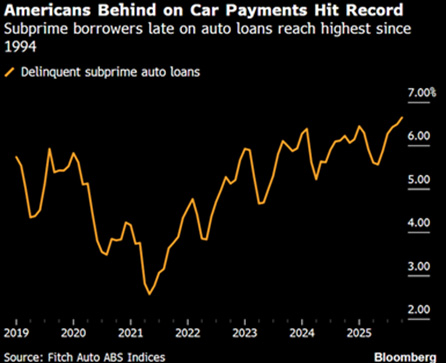

Overall, November was a relatively quiet month in terms of economic data, largely due to delays caused by the US government shutdown which turned out to be the longest on record. Amongst other data, private job’s numbers were strong, but US consumer sentiment continued to decline, hitting a 3-year low with persistent price increases. Once again, the government shutdown was cited as the main reason for these declines. Evidence of personal finance struggles is also evident in the percentage of Americans falling behind on their car payments, hitting the highest levels since 1994.

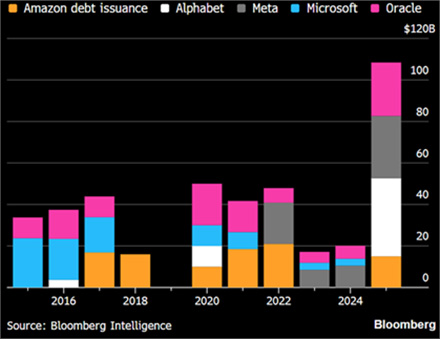

Investors still had plenty information to digest, though, with big tech’s spending spree blowing previous CAPEX plans out of the water. Investors grew concerned that an increasing portion of this CAPEX spend is being financed by debt, rather than free cash flow. The five major big spenders on AI — Amazon, Alphabet, Microsoft, Meta and Oracle – have raised a record $108 billion in combined debt in 2025, more than three times the average over the previous nine years, according to data compiled by Bloomberg Intelligence.

Politically, the divide across the US remains meaningful, and was on full display again this month. In NYC, arguably the centre point of the Western capitalistic system, a self-proclaimed socialist was elected as its new mayor.

From a geopolitical perspective, there were also several important developments. The US ratcheted up tensions against Venezuela which placed its entire military on alert; tensions between Japan and China simmered; and Japan reaffirmed plans to deploy missiles on an island near Tawain.

South Africa

Bucking the global trend, the JSE All Share index had another strong month, closing 1.6% higher. This return rises to 3.1% when measured in USD, thanks to another strong month for the ZAR, which gained 1.3% against the Dollar.

This was in no small part thanks to the official adoption of a lower inflation target of 3%, replacing the 3-6% band that has been in place since 2000. The rand strengthened below 17 per dollar for the first time since February 2023, hitting its strongest level in almost three years, on expectations the Central Bank will hold interest rates higher for longer to subdue price increases. Stocks and bonds also rallied after a mid-term budget update that included an improving fiscal outlook, prompting S&P to raise SA’s credit rating for the first time in 2 decades.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.