After starting the year on the trot, equity markets finally paused for breath in April. In the US, the benchmark S&P 500 gave up 4.1%, while the tech-heavy Nasdaq lost 4.4%, and the small-cap Russell 2000 lost 7.0%. Markets fared better across the pond, with the UK’s FTSE 100 index rising by 2.7%. In the East, there was a large swing in the trend of recent performance, as Japan’s Nikkei declined by 4.9% while Hong Kong’s Hang Seng gained 7.5%, putting it back into green territory for the year.

In the US, it was a 3rd consecutive, higher-than-expected, inflation report that was partly to blame for the weaker performance. This dashed hopes of any rate cuts in the near future, particularly as the job market has remained incredibly resilient up to this point. Economic data published during the first days of May provided a different perspective, however, as cracks seemingly appeared in the jobs numbers. This highlights the tightrope on which Jerome Powell and the Federal Reserve currently find themselves, as different data points now suggest different required courses of action.

The uncertainty around the best path forward for US monetary policy led investors to seek some safety in traditional havens with gold reaching a new all-time high during the month. Other commodities also had good gains, as the price of copper and iron ore increased by 13.9% and 12.8% respectively.

It was another concerning month from a geopolitical perspective. As was widely expected, Iran launched a retaliatory attack against Israel, directly from Iranian soil. The attack reportedly consisted of more than 300 drones and missiles, most of which were shot down by Israeli defence systems. Thankfully, the situation was largely defused, lessening the chances of a broader regional conflict. The US House of Representatives approved another $60 billion aid package for Ukraine, fast tracking the delivery of much needed equipment, vehicles and long-range missiles to the frontlines. The US is also drafting sanctions against Chinese banks that are reportedly aiding the Russian war effort. Although China has heeded Western calls not to provide any arms directly to Russia, it has now become the primary supplier of circuitry, aircrafts parts and machines, allowing Russia to rebuild its military capacity.

Back home, local investors experienced a good month, as the JSE All Share rose 2.1%, with the resources index gaining more than 7.1%. The Rand also put in a good performance, strengthening by 0.9% against the US Dollar.

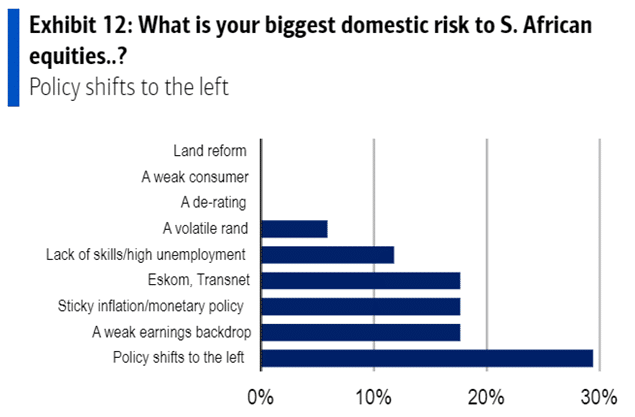

All eyes this month will be on the national and provincial elections, likely to be a pivotal election year in the history of South Africa’s democracy, as all polls now point to the ANC losing their majority – with odds suggesting the country’s first coalition government at national level. The result will, no doubt, have a large impact on the value of the Rand, with some studies suggesting it could drop to R21.50 to the USD if the ANC goes into coalition with Julius Malema’s Red berets. This concern, along with others, is front of mind for South African Fund Managers, as noted in the latest Bank of America Merrill Lynch South African Fund Manager Survey.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.