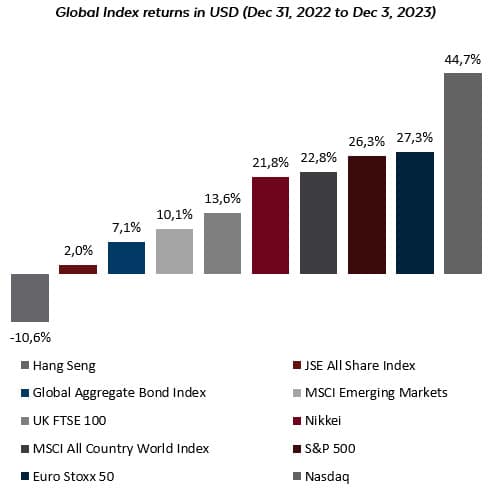

Most global equity markets finished the year on a canter, following strong performance in November. In the US, the S&P 500 improved by 4.5%, while the Nasdaq gained 5.6%. For the quarter, the S&P returned 11.7% and the Nasdaq 13.9%, while for 2023, the S&P returned 26.3% with the Nasdaq gaining an incredible 44.7%. What makes this performance even more staggering is that it occurred in a year where the prevailing narrative was whether the pending recession would be deep or shallow. These numbers again serve to emphasize the importance of staying invested in equity markets.

In the UK, the FTSE 100 was more muted, returning 3.8% for the month and 7.7% for 2023. Japan’s Nikkei Index was flat for the month and only gained 1.7% over the last 6 months, but its early 2023 rally means it returned a total of 30.9% for the year. Taking a broader perspective, the MSCI All Country World Index returned 4.8% for the month and 22.8% for the year, while the MSCI Emerging Market Index returned 3.8% during the month but only 10.1% for the year.

And then there was China. Its economic slowdown and unfriendly policies saw very few signs of easing, leading the Hang Seng Index to a loss of 10.5% for 2023. More concerns around the Chinese economy might, in fact, be surfacing, as CPI dropped 0.5% in November (vs estimates of 0.1%), following on from a 0.2% drop in October. Beijing now needs to try and boost demand to prevent a downward spiralling of prices.

News flow in December was dominated by several geopolitical issues. In the US, both the states of Colorado and Maine have now banned Donald Trump from running in elections due to his role in the January 6 insurrection. There are also more indications that US support for the Ukraine war effort is waning. The result of this would almost certainly be a slow, grinding defeat. To the south, Argentina’s new firebrand president has made it clear that he sees no benefit in joining BRICS, citing his distrust of its Socialist regimes. The situation in the Middle East also continues to deteriorate, as Houthi rebels in Yemen continue their unprovoked attacks on freight carriers in the Red Sea. The hope is that this will put upward pressure on oil prices, forcing Israel’s allies to push for an end to the war in Palestine. The global response has seen a combined naval operation by the US, UK, Canada and France, amongst others. Lastly, Xi Jinping didn’t want to be left out of the spotlight, and again referred to the reunification of China and Taiwan as inevitable during his televised new year’s address.

Investors in the local bourse also experienced gains, but not to the same extent as international peers. The JSE returned 2% during the month and 9.4% for 2023, while the JSE Resources Index was flat for the month but lost 11.6% during the year. The Rand strengthened against the Dollar in December, but it closed the year 7.8% weaker.

Aside from experiencing Transnet’s rail and port woes, the resources sector is now also being hit by underground “sit-ins”, as unions wage a damaging war to be crowned as the main negotiating power. In some cases, thousands of workers remain underground for extended periods of time, many of them as hostages. This not only shuts down the mine, hurting production, but it also further erodes investor confidence in the country and the sector.

The year didn’t end without another political farce as Jacob Zuma announced his support for the new MK political party (named after the disbanded ANC Military wing). However, he also stated that he will remain a loyal member of the ANC until his death. Somehow, he seems to think these ideas don’t clash…

James Hayward BEng (Civil)

Equity Analyst

James, or JD as he prefers to be known, is an equity analyst in the global investment team, having joined Flagship in 2021. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and has passed all 3 levels of the CFA exams.