After ending 2023 on a strong note, global equity indices delivered a mixed batch to start off 2024. In the US, both the S&P 500 and Nasdaq improved by 1.68% and 1.04% respectively. The Russel 2000 had a tough start to the year though, dropping by 3.89%. In the UK, the FSTE 100 fell 1.27%, while in the east there were vastly different results on opposite sides of the East China Sea. In Japan, the Nikkei gained 8.4%, while Hong Kong’s Hang Seng Index lost 9.16% in the first month of the year.

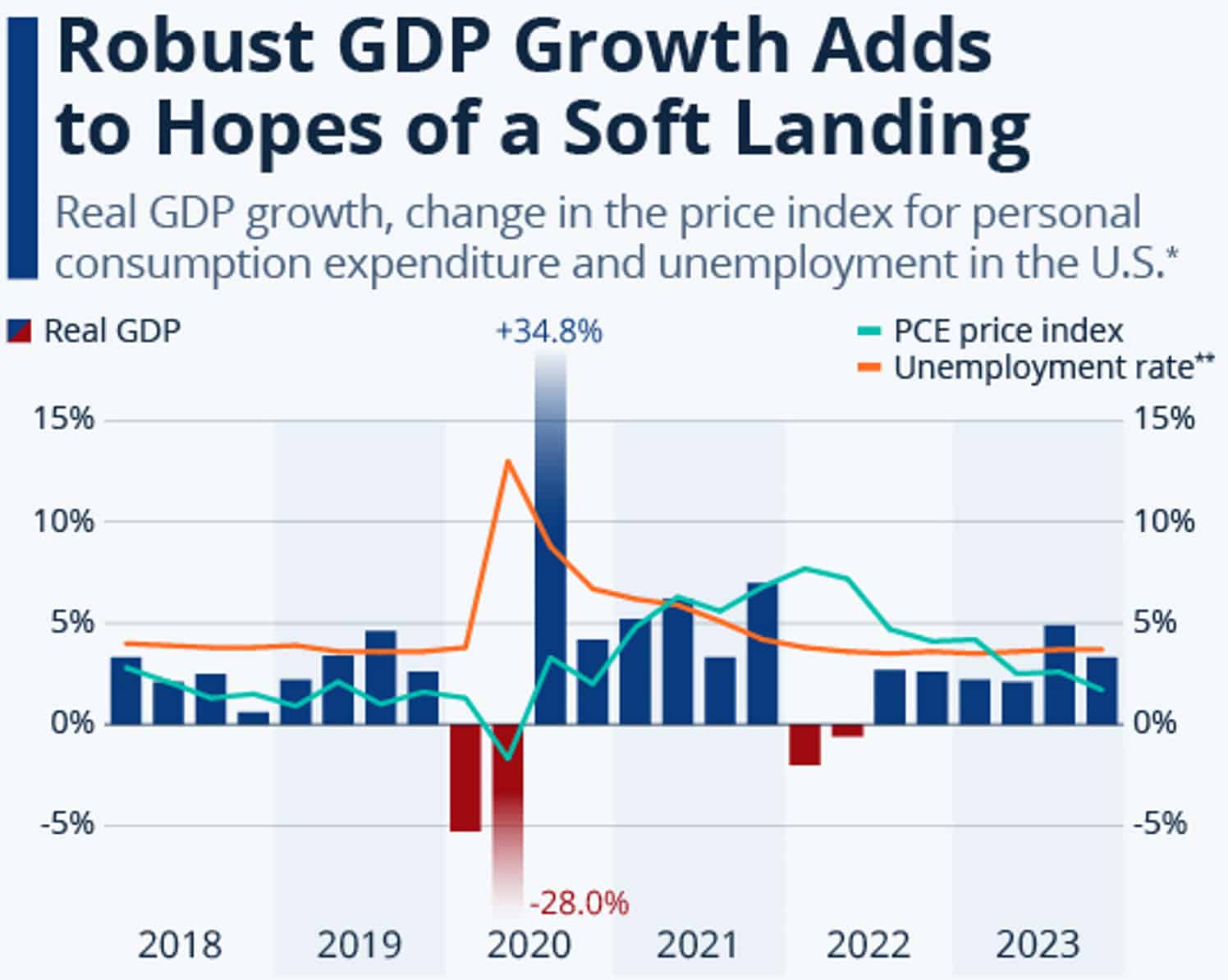

The latest CPI reading in the US showed an uptick, increasing by 3.4% on a year-over-year basis, ahead of the estimated 3.2% and previous reading of 3.1%. This would have contributed to the Fed’s latest round of minutes where they revealed they were more tentative on cutting interest rates than the market might have assumed. January has delivered some signs of weakness in the job market, though, with UPS alone announcing 12 000 job cuts. The Fed continues its tightrope balancing act between taming inflation and maximum employment.

In US politics, the race for the top 2 nominees is as good as done. Donald Trump started the election campaign strongly, winning both Iowa and New Hampshire. This led to his main rival, Florida Governor Ron deSantis, dropping out very early in the race, and almost guaranteeing Trump the position of Republican nominee. Reports have emerged that Trump is targeting a massive trade war with China if re-elected as president. This would obviously cause ripple effects across global markets.

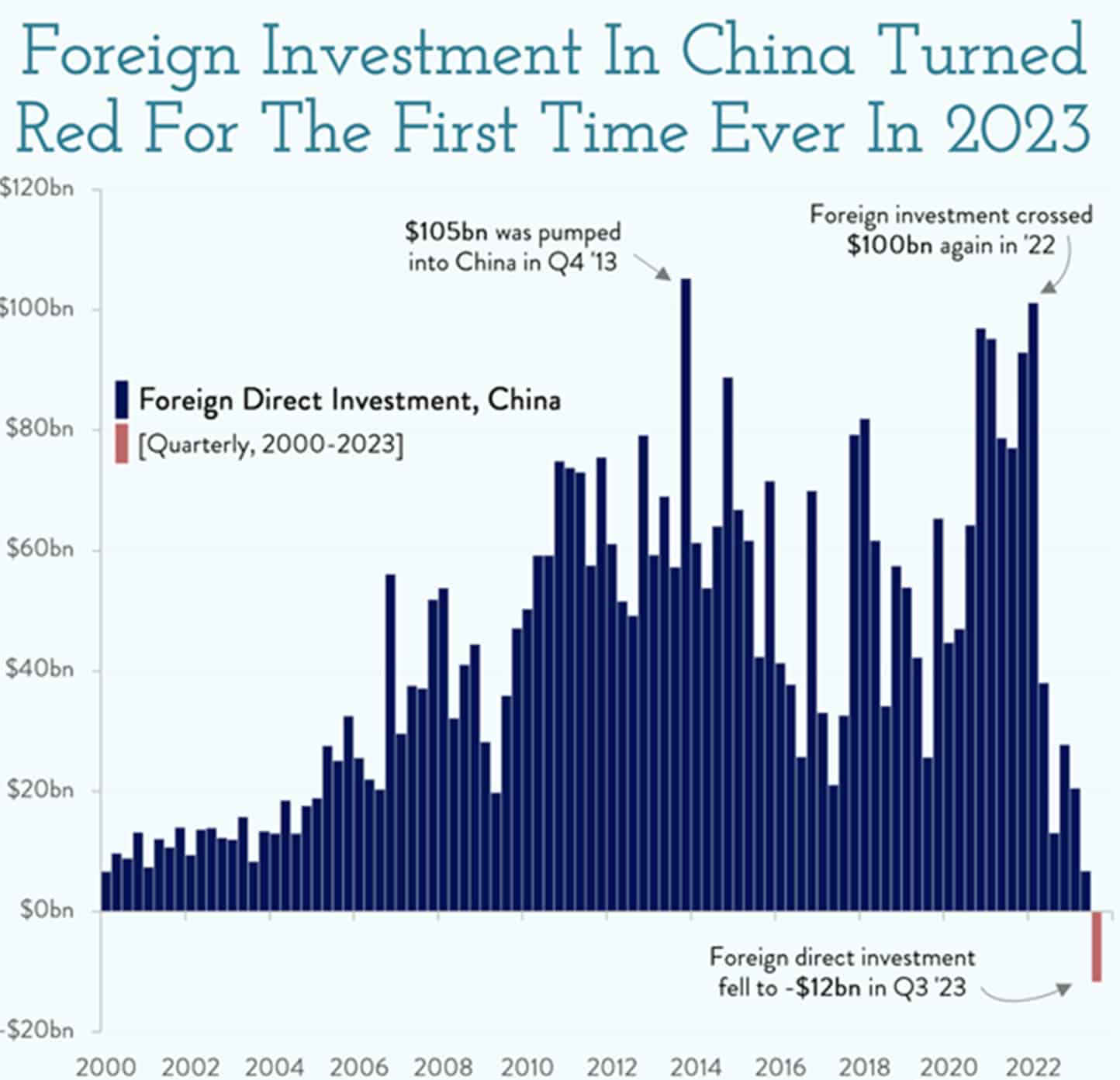

The US is only one of more than 50 countries holding elections this year – in what is being billed as one of the biggest elections years in history. The first of these already took place in Taiwan, with a victory for the pro-democracy (and thus anti-China) party in that country. This represents another blow to the struggling Chinese economy, which is reeling from blows to its property sector and rising unemployment numbers. The ruling Communist Party have tried a number of approaches to stem the subsequent bleeding in its stock market, but these efforts have largely failed.

Local investors experienced a red month to start of the new year. The JSE All Share lost 2.93%, while the JSE Resources index dropped 6.31% for the month. On top of this, the Rand also experienced a weak month, as it lost 1.76% against the US Dollar.

The year ahead will almost certainly be dominated by the looming general election, with 2024 having the possibility to be a pivotal year in South Africa’s history. The ANC, after more than 30 years in power, for the first time faces the real possibility of losing their majority, as the party continues to be plagued by corruption, maladministration and internal power struggles. This would open the door for a number of different coalition options. In what promises to be the first of many, the looming election has already produced its first shake up, as former president Jacob Zuma was officially suspended from the ANC after backing the newly formed MK party. Perhaps this is a sign of things to come for South Africa’s governing party…

James Hayward BEng (Civil)

Equity Analyst

James, or JD as he prefers to be known, is an equity analyst in the global investment team, having joined Flagship in 2021. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and has passed all 3 levels of the CFA exams.