Equity markets across the globe enjoyed a strong start to the new year. In the US, the benchmark S&P 500 increased by 2.8%, while the Nasdaq and small-cap Russell 2000 indices rose by 1.7% and 2.6% respectively. The UK and European markets were particularly strong, with London’s FTSE 100 returning 6.2% and the Euro Stoxx 50 returning 8% for the month. In the East, Hong Kong’s Hang Seng index climbed by 1.2%, while Japan’s Nikkei 225 was one of the few to close the month in the red, declining by 0.8%.

US Economic data for the month was a mixture of ‘in-line’ and ‘subdued’. December CPI came in at 2.9% YoY, in line with estimates, but still well above the Fed’s 2% target, initiating the Fed’s ‘hawkish pause’ in their rate cutting cycle. Rates were therefore kept constant as expected. US GDP for Q4, at 2.3% QoQ, came in below estimates of 2.6%. Full year GDP for 2024 grew at 2.5%, slower than the 3.2% seen in 2023, but still very strong relative to most economies. Other notable GDP numbers came from China, where GDP grew at 5% for the year, exactly on target, and Germany (the Eurozone’s largest economy), which shrank 0.2%, marking the first time GDP has declined for two years in a row since 1950.

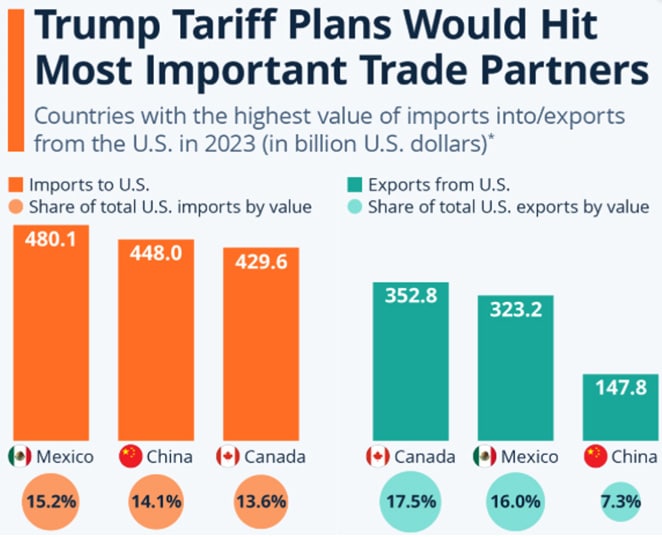

News flow during the month, predictably, was dominated by Donald Trump, who started his term with a flurry of executive orders. These included a withdrawal from the Paris climate accord; declaring the situation at the US-Mexico border a national emergency; and, towards the end of the month, introducing a host of tariffs on major trading partners Canada, Mexico and China, with Europe also in his sights.

The aftermath saw the Canadian dollar slipping to a 5-year low; global markets declining at the start of February; volatility and bond yields increasing; and the USD and gold surging as investors flocked to safe havens amid the uncertainty.

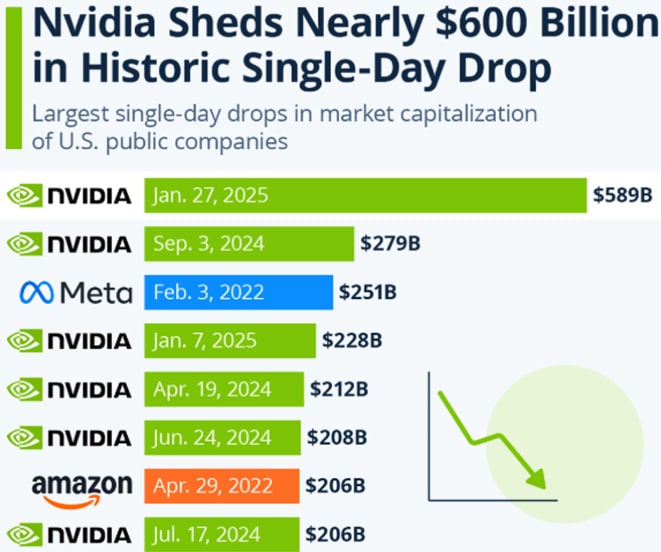

Adding to the month-end volatility was news of Deepseek, a Chinese rival to the West’s perceived AI-dominance, which cast doubt on all previous AI-related assumptions. This resulted in a rout in the tech market, evidenced by Nvidia erasing $589 billion in market cap in a single day. To put this into context, that is more than the market cap of all but 13 US companies.

Locally, the JSE All Share also had a positive month, gaining 2.3%. The JSE Resources Index had a remarkable month, increasing by 16.3%. Economic data was also mostly positive. December CPI of 3.0% delivered calendar 2024 inflation of 4.4% – much lower than 2023’s 6.0%. Retail sales were also strong, increasing by 7.7% YoY in November, much higher than estimates of 5.5%. This was driven mainly by the two-pot system, strong Black Friday sales, and cooling inflation. Worryingly for future growth was the Reserve Bank’s continued hawkish outlook. Although rates were cut by 0.25% (as expected), not all members were in favour of this. All members did, however, signal their concerns around global developments and the possible effect on medium term inflation in South Africa.

South Africa, as part of BRICS, did not escape Trump’s wrath. He issued a statement requiring a commitment from BRICS countries that they will not try to replace the USD with an alternative reserve currency, or risk being faced with either 100% tariffs or completely shut out of all US trade. First shots fired.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.