Equity markets started the year strongly. In the US, the S&P 500 and Nasdaq gained 1.4% and 1.0% respectively, while London’s FTSE 100, off to a flyer, gained 3.0% for the month. The strongest performance came from the East, as Japan’s Nikkei 225 rose by 5.9%, while the Hang Seng was up a meaningful 6.9% for the month. The USD was again weak compared to most of its peers, boosting all the above non-US returns, when measured in dollars.

Partly responsible for the weak dollar was a Justice Department criminal investigation into Fed chairman, Jerome Powell, which is widely considered to be politically motivated, drawing condemnation from both sides of the political divide. Powell himself called it an attack that “brings the US closer to emerging markets with weak institutions”. Later in the month, the Fed kept borrowing rates constant, while two Fed dissenters called for a 25-basis point cut. Cutting rates is certainly not required to spur growth, as the US economy expanded by 4.4% during the third quarter, marginally higher than expected. Inflation was also in line, and the base case expectation remains two cuts for 2026.

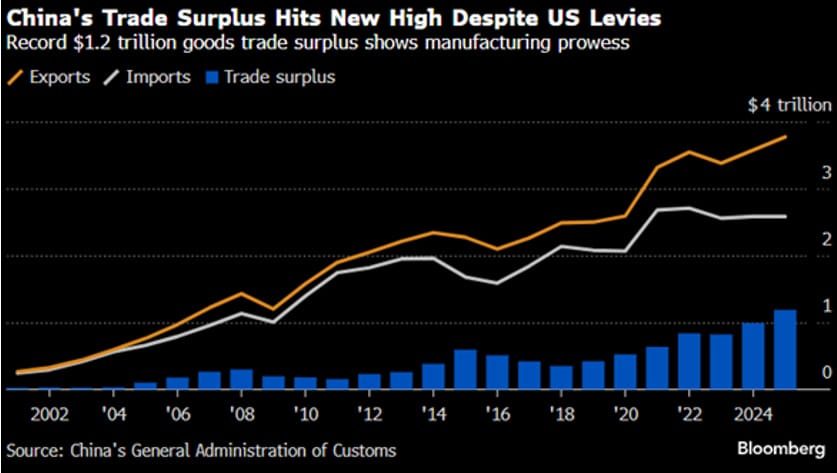

Chinese economic growth for the last quarter came in at 4.5%, its weakest level in nearly 3 years. This, despite a record year for Chinese exports in 2025. They recorded a record $1.2 trillion trade surplus, despite Trump tariff heat, as they successfully re-routed sales to Southeast Asia, Africa, and Latin America.

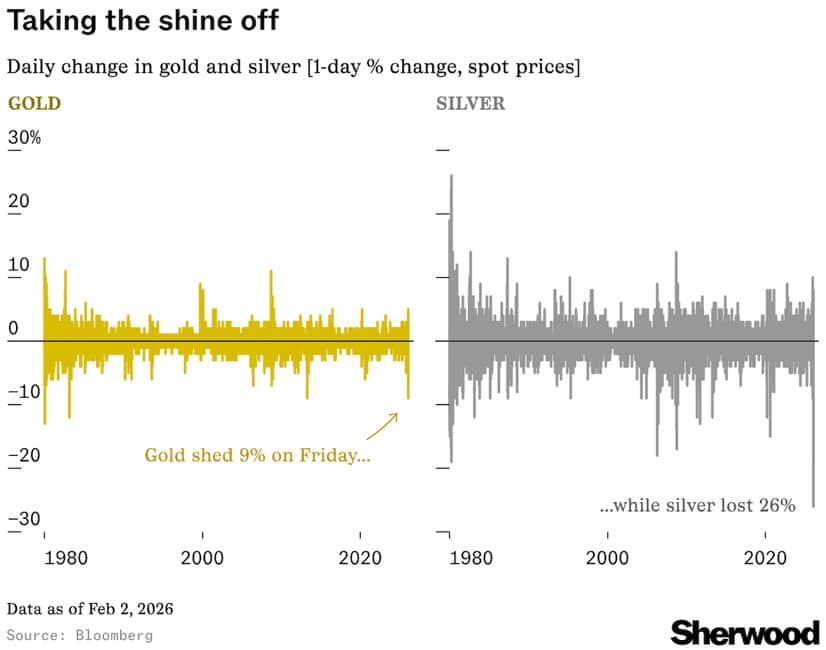

The real story this month was in the commodity space. Gold hit $5,000 for the first time ever and continued climbing a further 10% on top of that, breaching $5500. Silver, meanwhile, had its biggest one-day jump (+14%) in 40 years. The exuberance was short lived, though. Trump’s announcement of a new Fed Chair, perceived by many to be more hawkish, led to an historic collapse in metal prices. Gold fell 11% and silver 31% in a single session – the latter’s 2nd worst day on record.

The geopolitical landscape across the globe remains volatile. After a ruffling of feathers between the US and NATO, there seems to be progress towards an agreement on Greenland. This will be closely monitored, though, and we are seeing increasing evidence of many countries (Canada-China and Europe-India) looking to diversify away from the US and the Dollar. Treasury Secretary Scott Bessent calling allies like Denmark “irrelevant” is not helping the US cause. This unease between allies was a large contributor to the historic rallies in various precious metals. US-Iran tensions are also building as the US ramps up its military presence in the region, with strikes against Tehran reportedly being considered. The Islamic regime’s brutal crackdown on protestors, with estimates of 30 000 or more casualties, certainly did not win them any favours.

South Africa

The JSE All share continued with its strong performance from last year, gaining 3.7% during the month. Again, these ZAR returns were elevated when measured in USD, as the greenback declined by another 2.5% against the Rand.

Consumers expecting more interest rate relief were left disappointed after the SARB held rates steady. The split-decision saw 2 of the 6 voting members opt for a 25-basis point cut, after the near-term inflation outlook was further lowered to 3.3% from 3.8%. The MPC now sees rates reaching a neutral level in 2027, conditional on a further 0.75% of cuts. The economy needs these cuts as a matter of urgency, as our GDP growth forecast for the next 2 years is less than 2% and lags our EM peers.

Lastly, the SA military is again trying its utmost to upset the West, hosting war games and inviting Russia and Iran (the latter freshly accused of a brutal two-day anti-democracy crackdown), amongst others, to participate. These apparently unauthorised activities begs the question: does Ramaphosa, as Commander-in-Chief of the SA armed forces, have control of the military? This is certainly not a good look.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.