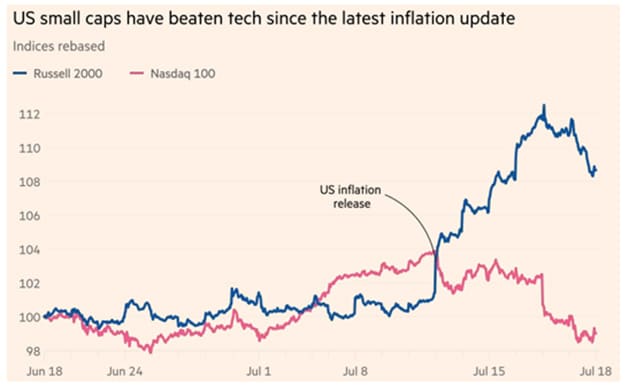

After months of seemingly plain sailing for US large caps and tech, July saw some volatility being thrown into the mix as earnings season got underway. The S&P 500 dropped 2.3% in a single day, breaking a 365-day streak without a 2% move or greater. Notably, this was the longest such streak since 2007 when the S&P notched a 943-day streak without a >2% move. At month-end, the S&P notched a 1.2% gain, while the Nasdaq declined by 0.7%. July also saw the start of what some are calling “The Great Rotation”. One particular week was the tech-heavy Nasdaq’s worst in 3 months, while the small-cap Russell 2000 simultaneously experienced its best week of the last 3 months, coming roaring back to life with a 10.1% gain. In the UK, the FTSE 100 gained 2.5%, but European shares slipped, with the Euro Stoxx declining by 0.4%. Asian markets struggled, with both Japan’s Nikkei and Hong Kong’s Hang Seng indices closing in the red.

Monthly Commentary July 2024

July delivered a myriad, and often contradicting, set of data points for the market to digest. The Federal Reserve’s Jerome Powell initially indicated that inflation data was improving, but would not commit to September rate cuts. This, coupled with robust jobs data (at the time), and very strong US advance GDP numbers (2.8% vs estimates of 2.0%), hinted that the Fed might have pulled off the ultimate soft-landing. Fast forward two weeks, and cautious commentary on consumer softness, together with weaker than expected US jobs data, threw a spanner in the works of the Fed’s Goldilocks-scenario.

Stepping away from economics and into politics, July was basically one, big highlight reel. Joe Biden stubbornly clung to his position as presumptive Democratic nominee and Donald Trump was millimetres away from being assassinated as US politics entered a dark, new era. This led to the head of the Secret Service stepping down amid bipartisan calls for her removal. Biden then relinquished his grip of the Democratic Party, paving the way for VP Kamala Harris to be the new presidential nominee, injecting some life into a particularly dull US Presidential race. In France, the centre-left coalition barely managed to keep Marine le Pen’s “Far right” National Rally out of power, while in the UK, the incumbent Conservative Party suffered its worst defeat in more than 130 years as the Labour Party took control of the House of Commons.

On the local front, investors had an excellent month. The ALSI returned 3.9%, while the JSE Resources index and JSE Financials index both returned more than 5% for the month. During the month, the Rand was basically flat against the US Dollar. Year-to-date, however, it has now strengthened by 0.87%. Local inflation, though still high, also came in at a 6-month low of 5.1%, more or less in line with expectations and within the SARB’s target range.

There was more good news in July, as South Africa passed the mark of 100 days without loadshedding. Eskom states that this is due to an aggressive maintenance plan that was started in March 2023. Andre de Ruyter left in February 2023. Something smells cyanide-y…

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.