Most global indices started Q3 in the same way they ended Q2 – in the green. In the US, the S&P gained 2.2%, while the Nasdaq improved by 3.7%. London’s FTSE 100 rallied 4.3%, while the Euro Stoxx 50 only managed to eke out a 0.3% gain. In the East, Japan’s Nikkei rose 1.4%, while Hong Kong’s Hang Seng Index ended the month 3.1% higher.

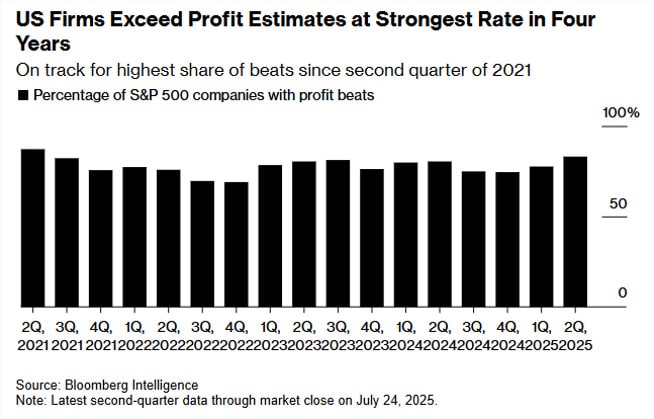

July was another eventful month, with a barrage of often contradictory economic indicators. A large portion of S&P 500 companies reported, with a vast majority beating estimates. The US consumer also appears resilient, as retail sales continue to surprise on the upside. These positive datapoints led markets to new highs, and Nvidia became the first company ever to reach a $4 trillion valuation, followed by Microsoft less than 2 weeks later.

There are, however, some darker clouds on the horizon: ISM manufacturing PMI’s came in below 50 (contractionary) for the 4th month in a row; Trump tariffs returned (even though mostly at lower rates than before); and political interference at the Fed remains front and centre. The big shocks came from PCE and jobs data, with PCE (the Fed’s preferred inflation gauge) coming in at 2.8% YoY, remaining stubbornly higher than the 2% target. Jobs data for July proved to be much weaker than anticipated, and there were also major downward revisions to May and June data. Following this report, the odds of a September rate cut shot from below 50% to north of 80%. Due to a weakening job market, the Fed faces a tricky period, and there are signs that inflation is starting to trickle down to the consumer – the definition of stagflation.

From a geopolitical standpoint, the month saw light being cast on Gaza, and increased pressure on Israel to provide safe access to humanitarian aid as the crisis deepened. France went one step further, indicating it would recognize Palestine as a state at the upcoming UN General Assembly in September. Russia’s continued invasion of Ukraine also hit a bump, as Trump grows increasingly irritated with Putin. Aside from more weapons, the US is on the verge of secondary tariffs on Russia’s trading partners (India, for one), potentially isolating their economies. There were also reports that Trump asked Zelensky whether Ukraine could, if provided with long-range missiles, hit Moscow or St Petersburg. Worrying signs indeed.

Domestically, the JSE All Share index experienced another green month, ending 2.3% higher. However, the USD regained some strength during the month, gaining 2.9% against the ZAR, erasing the ALSI returns when measured in dollars.

South Africa remains in Trump’s firing line. Given what are described as SA’s ‘anti-American policies’, we were slapped with a 30% tariff rate. There was some consoling news, though, as the SARB relented in its restrictive policy stance, lowering borrowing rates by 25 basis points.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.