US equity indices followed on from strong performances in May to close the 2nd quarter well in the green. The S&P 500 closed 5.1% higher for a total gain of 10.9% during the quarter. The Nasdaq rose by 6.6% and is up an impressive 17.9% during the quarter – its best quarterly performance in the last 5 years. Notably, the S&P 500 closed the quarter at a new all-time high. The sharp rally this quarter marks the index’s swiftest ever recovery back to all-time highs following a decline of at least 15% (post-Trump tariffs).

Over in the UK, the FTSE 100 was more muted, ending flat for the month, and up 3.2% during the quarter. European stocks pulled back slightly this month, declining by 1.2%, but still ended the quarter 1.1% in the green. Markets in the East were strong. Japan’s Nikkei 225 rose by 6.8% in June, while Hong Kong’s Hang Seng gained 4.1%. For the quarter, they gained 13.8% and 5.8% respectively.

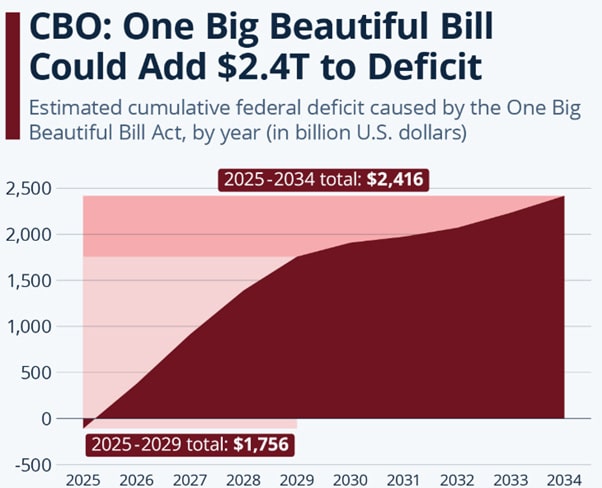

US fiscal concerns remain front and centre, reflected in the US Dollar hitting multi-year lows against a basket of peers. This is mainly driven by concerns around Trump’s tariffs and his Big Beautiful Bill Act, which at the time of writing, has been passed by the Senate and now waits for approval from the House. In contrast to the USD, the Euro is experiencing its strongest ever first half of the year performance, gaining 13.8%.

These same tariff-driven concerns are currently still preventing the Fed from lowering rates, much to Trump’s dismay. He renewed his attacks on Fed Chairman Jerome Powell, calling him a “numbskull” for not lowering rates sooner. He also hinted that he might appoint a successor soon, effectively undermining Powell and installing a new de-facto Governor. The Fed, however, remains steadfast. Its recent lower growth and higher inflation forecast indicate that stagflation concerns remain.

There was again no shortage of geopolitical flashpoints this month. Front and centre would be Israeli and US strikes on Iranian nuclear facilities. Initial fears of a large regional war led to the price of oil spiking dramatically, its largest daily move in 3 years. However, Iran’s tame response saw the commodity come back to pre-strike levels. Elsewhere, there was a step-change in the European defence landscape, as NATO agreed to up its spending target to 5% of GDP by 2035, more than doubling the recently achieved 2% target.

The JSE All Share index also continued its strong performance, rising 2.4% during the month, resulting in a quarterly gain of 10.2%.

Local inflation came in at 2.8% YoY, the third month in a row of inflation below the SARB’s 3-6% target range, potentially opening the door to another cut at the end of the month.

Lastly, the GNU is again facing friction. This after Ramaphosa fired a DA deputy-minister over unauthorized work-related travel, this as multiple corruption accused ANC ministers remain in positions of considerable power, seemingly immune to any repercussions.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.