Equity markets had another strong run in March – which led to the S&P 500 closing out its best first quarter since 2019 – gaining 3.2% (outperforming the Nasdaq which gained 1.9%). The S&P also outperformed the Nasdaq for the quarter, gaining 10.6% vs the Nasdaq’s 9.3%, as the market’s rally began to broaden in depth. In the UK, the FTSE 100 closed 4.8% higher, but it was up just 4.0% for the quarter. Over in the East, the Nikkei continued its bull run, rising 3.2%, ending the quarter 20.8% higher. The notable underperformer for the quarter was, again, the Hang Seng index, which closed 2.5% lower.

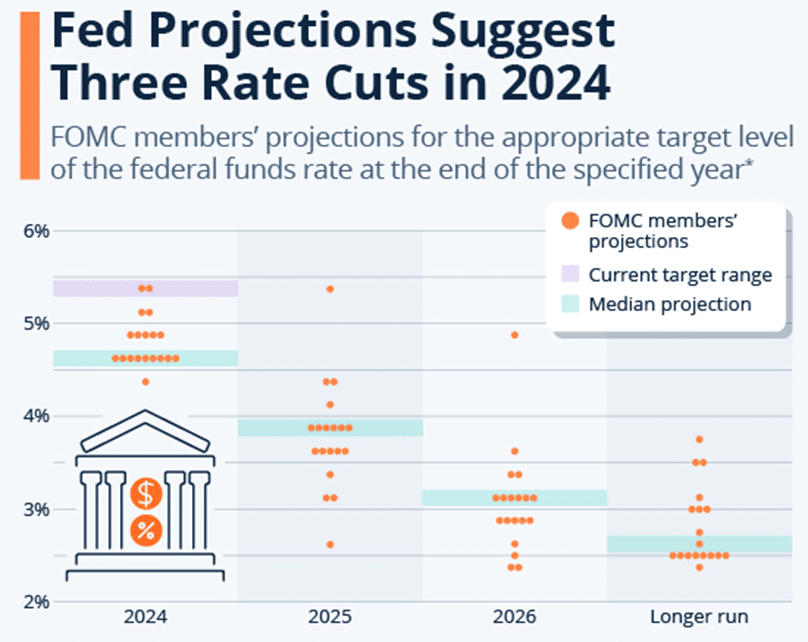

US Federal Reserve Chairman Jerome Powell’s statement, that they are getting close to the level of confidence required to start easing their restrictive policies, contributed to strong returns.

Commodity markets were also strong during March with Brent up 4.5%, but the real winners were gold and silver, rising 9.6% and 11.2% respectively. There are several drivers behind this recent rally, chief among them being increasing tensions in the Middle East and the OPEC+ decision to extend its production cuts. After talks of a potential truce in Gaza earlier in March, tensions took a turn for the worse at the end of the month, as Iran accused Israel of striking its embassy in Syria, killing a senior Iranian general. Iran has promised retaliation, and a larger regional conflict is now a real possibility.

Regional tensions also remain top of mind in the EU, as Germany and France added their support to other EU countries, calling for the European Investment Bank to increase financing on defence in order bolster the bloc’s security.

Stepping away from geopolitics, Japan entered a new era of economic policy, after the Central Bank raised interest rates for the first time in two decades.

Local investors also had a good month in March, with the JSE All Share index ending 3.2% higher. However, this caps off a disappointing quarter, as the index lost 2.2%, significantly underperforming both world and other emerging markets. Over one year, the All Share index is now barely in the green, lagging the S&P and Nasdaq by about 30% over the period. On a brighter note, the Rand did strengthen by 1.7% against the dollar during the month.

From a political perspective, the battle lines between parties are becoming murkier by the day. The latest surveys indicate that the ANC might well fall below 40% on a national level, with support for Jacob Zuma’s new MK Party surging north of 10%, with a particularly strong showing in KwaZulu-Natal. The multi-party charter will likely still be too small to govern, leading to the plausible scenario where the ANC is looking for a kingmaker. No doubt, there will be some turbulence as we move closer to election day.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.