Buoyed by the Trump trade, US market delivered strong returns during the month, notching a number of all-time highs along the way. The S&P 500 and Nasdaq Composite were up 5.9% and 6.3% respectively, while the small-cap Russel 2000 jumped 11.0%. Year-to-date (YTD), these indices have now all gained more than 20%, with the S&P and Nasdaq within touching distance of 30%. London’s FTSE 100 also had a green month, gaining 2.6%, but indices across Europe and Asia ended in the red. Japan’s Nikkei and Hong Kong’s Hang Seng indices lost 2.2% and 4.2% respectively, as tariff-related fears weighed on Chinese stocks.

Global affairs this month were dominated by the US Presidential election. What at one point looked like it might be a close affair, turned out to be a runaway victory for Donald Trump, as he won all the swing states, capping off a remarkable political comeback. The immediate results (and reasons) were rallying equity markets (due to less regulation), higher bond yields (due to fears of an increasing budget deficit), and a stronger dollar (due to possible higher inflation leading to rate hikes).

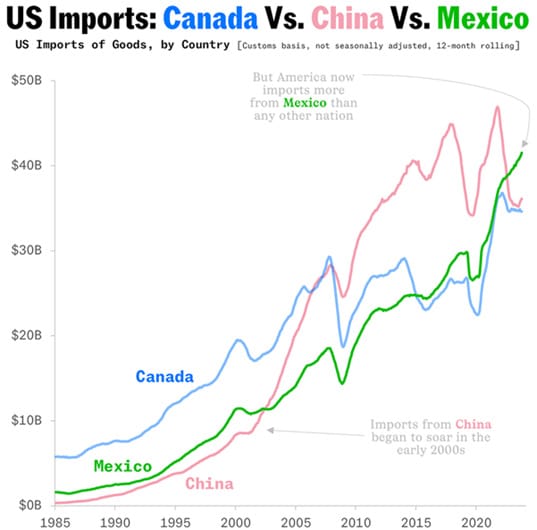

The latest US CPI numbers were largely in-line, leading to the Fed cutting rates by another 25 basis points. While they reiterated that the economy is not sending any signals indicating a hurry to lower rates, Trump’s threat of massive tariffs, including against major trading partners Mexico and Canada, would potentially lead to an inflation uptick.

It was also a busy month from a geopolitical standpoint. Joe Biden for the first time gave Ukraine permission to use US-supplied long-range missiles to strike within Russia’s borders. Putin’s response, predictably, was an angry one, increasing his rhetoric on the use of nuclear weapons. In the Middle East, a ceasefire agreement has tentatively been reached between Israel and Lebanon-based Hezbollah. The war in Gaza, however, appears no closer to a resolution. And in China, Xi Jinping indicated that China is ready to work with the new US administration but warned that Washington should not cross its four red lines, which include matters related to Taiwan.

Locally, the JSE All Share did not share in the optimism of US markets in November, declining by 0.9% over the month. The resources index declined 6.6%, while the financials and industrials indices managed small gains.

Like most global peers, the ZAR lost ground to a strong US Dollar this month, ending 2.6% lower. Putting further pressure on the ZAR was the latest SA CPI print which, at 2.8%, came in below estimates and below the lower end of the SARB’s 3%-6% target range, potentially leading to additional rate cuts.

Ominously, our friendly ties with BRICS partners could soon be cast into the spotlight after Trump threatened tariffs as high as 100% on all BRICS countries unless they commit to stand by the USD, and refrain from establishing an alternative currency to challenge the Dollar’s role as the de-facto global trade default.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.