Equity markets gave up some recent gains with the US’s S&P 500, Nasdaq and small-cap Russell 2000 index declining by 0.9%, 0.5% and 1.4% respectively. UK and Europe fared worse with London’s FTSE falling 1.5% and the Euro Stoxx losing 3.5%. One of the lone indices ending the month in the green was Japan’s Nikkei 225, gaining 3.1%, however this gain was eroded when measured in USD, as the Yen declined by nearly 6% against the greenback.

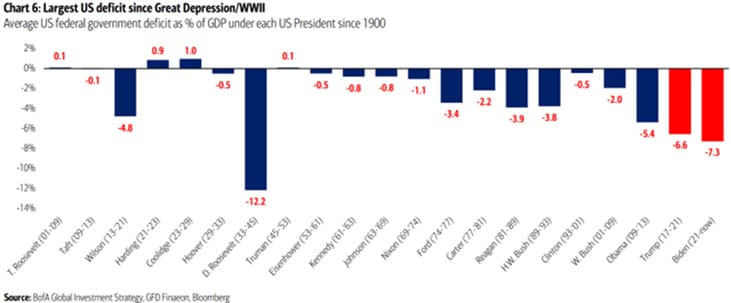

In the US, all eyes were focussed on the election, which Donald Trump won by a much wider margin than most had anticipated. One issue Trump will have to tackle is the substantial US debt problem. According to the Wall Street Journal, Trump’s economic agenda could add a further $7.5 trillion to US debt over the next decade. Investors are taking note, and the long end of the yield curve rose as investors demand higher compensation for the “risk” involved with owning long-term US debt.

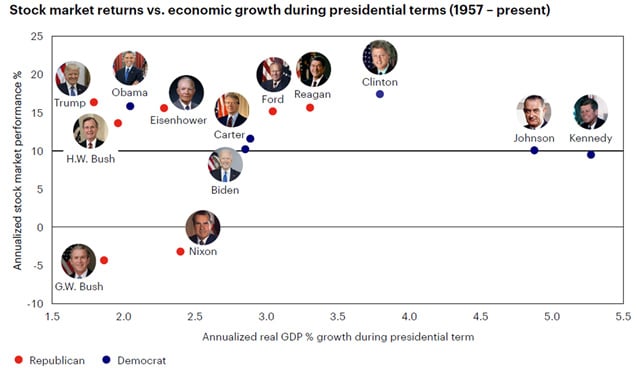

Aside from this, Trump will inherit a very strong US economy. Retail sales continued to rise in September, new jobs data in September smashed estimates (254k vs 132k) and, according to the Bureau of Labour Statistics, 159.1 million Americans are now employed, the most on record. CPI data came in 2.4% YoY, slightly higher than estimates, and core CPI came in at 3.3% YoY, slightly higher than the previous reading, but still well under control. US GDP growth also remains strong. Although last quarter’s 2.8% advanced print was lower than Q2 (3%) and economist estimates (3.1%), it still contributes to a 2-year streak of strong growth in the face of very high borrowing rates. The IMF also expects the US economy to grow 2.8% this year, compared to 0.9% on average for the G7 countries as a whole. All in all – a rosy picture – if you manage to look past the enormous debt problem.

From a geopolitical standpoint, September marked the 1-year point in the Israel Hamas war. Tensions in the region are only increasing, with the involvement of Hezbollah and Iran, and with the elimination of numerous Hamas and Hezbollah leaders. The situation in Ukraine also took a dangerous new turn, with up to 10 000 North Korean troops being deployed to the region, marking a deeper military alliance between Kim Jong Un and Vladimir Putin.

Like global peers, the JSE All Share also struggled in October, declining by 1.3%. The resources and financials indices fared much better though, returning 3.0% and 2.8% respectively. These returns are more muted in US dollar terms, as the Rand weakened by 1.9%. Local inflation prints came in at 3.8% YoY, lower than the forecast of 3.9%. The continued downward trend of these prints provides even more reason for the Reserve Bank to lower borrowing rates, however the conservative path they have alluded to might prevent this.

There were more good noises coming out of the GNU. Leon Schreiber’s reforms at the Department of Home Affairs should make it much easier for skilled professionals to get visas and ply their trade locally, potentially leading to much-needed economic growth and job creation.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.