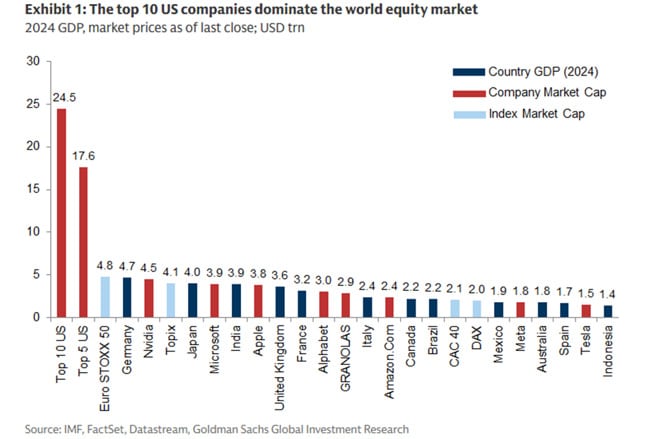

Equity markets continue to defy sky-high valuations, fiscal deficits (now $38 trillion in the US, only 2 months after breaching $37 trillion), and geopolitical and trade uncertainty. During October, most global indices kicked off the 4th quarter in the same fashion they ended the 3rd – up! In the US, the S&P 500 gained 2.3%, while the Nasdaq closed 4.7% higher. This was the 7th straight month of gains for the Nasdaq, its longest monthly winning streak since 2018. Much of this performance was spurred by the seemingly unstoppable “mega caps”, as Nvidia became the first company to reach a market cap of $5 trillion, while both Apple and Microsoft joined the $4 trillion club. The biggest 5 tech companies in the US now have a collective value that exceeds the combined size of the Euro Stoxx 50, the UK, India, Japan, and Canada. The 10 largest US stocks (8 of which are technology-related) account for nearly 25% of the global equity market and are worth almost $25 trillion.

Monthly Commentary October 2025

Outside the US, performance was equally strong. Though the FTSE 100 gained 4.1%, and the Euro Stoxx 50 gained 2.4%, both pale in comparison to Japan’s Nikkei, up 16.6% during October, after election results that point to a more dovish policy stance going forward. This also led to concerns over stimulus, sending bond yields higher and the Yen lower. A notable laggard, Hong Kong’s Hang Seng, declined by 3.5%, as China and the US, the world’s 2 largest economies, briefly renewed their trade-spat before extending their existing truce for another year.

Looking at commodities, the price of Brent Crude declined by 2.9%, as OPEC signalled more production increases ahead, following similar hikes in October and November; and a ceasefire, albeit fragile, was established in the Middle East. Gold, up 3.7% for the month, breached $4,000/ounce for the very first time, driven by safe haven demand, a weak yen, and the US government shutdown (which is on the verge of being the longest in history), but experienced notable intra-month volatility as it rallied north of $4,300, before retreating sharply towards the end of the month.

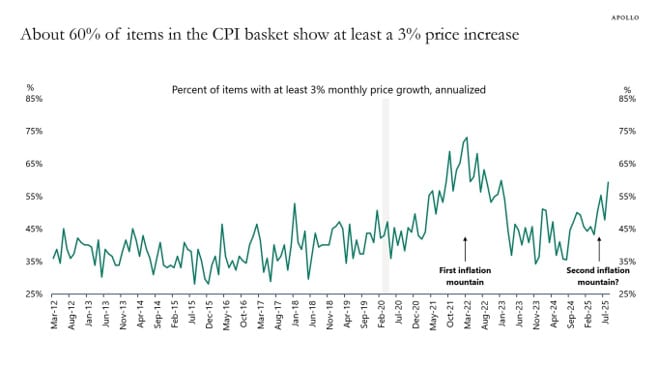

With the bulk of S&P500 companies reporting their Q3 results, several datapoints proved interesting. CEOs continue to point towards resilient consumer spending, but evidence is mounting that this is driven by the top income brackets only and could rapidly change in the event of a market sell-off. Job numbers also remain concerning, with private companies cutting 32 000 jobs in September, the biggest decline in more than 2 years. After the predictable Fed rate cut last month, attention now turns to the December meeting, with odds of another cut dropping notably following hawkish tones from the Fed, as inflation remains sticky above the Fed’s target.

South Africa

The JSE also experienced another strong month, rising 1.6%. The rand was slightly weaker against the dollar, eroding some of those gains when measured in USD.

Amongst a deluge of depressing insights into the state of corruption across SA’s government structures (Thembisa Hospital, Madlanga Commission etc etc), there was also some good news this month from a regulatory point of view – South Africa was officially removed from the Financial Action Task Force grey list, following a reform period lasting more than 2 years.

James Hayward BEng (Civil) CFA

Fund Manager

James (JD) is a fund manager of Flagship’s global funds, having joined in 2021 as an equity analyst. At the completion of his degree, JD worked in the engineering and fintech start-up industries while pursuing further studies in investments. JD holds an Engineering degree from Stellenbosch University and is a CFA charter holder.