Welcome to our QUARTERLY TELESCOPE. We hope these quarterlies provide you with greater insight into our thoughts on global assets, as well as how our global funds are being managed. In this quarter’s Telescope, Kyle updates us on some of the happenings globally and at Flagship, and also takes us through the investment case for DS Smith, a large holding in the Flagship Global Funds. Dear investor, The 3rd quarter of 2019 brought further excitement and apprehension to an already event-laden 2019. Political tensions continue to dominate the global narrative, reflected in the on-again off-again trade war between China and the US; the increase in the likelihood of a no-deal Brexit; and the continued political protests in Hong Kong. Now entering their seventh month, the protests are taking their toll on the city’s economy, with August retail sales registering a -23% fall – the steepest decline on record. As if all of this wasn’t enough, a Democrat-led process to impeach the US president was initiated on September 24th. Economically, during the 3rd quarter the Fed further eased already accommodative monetary policy and, at Flagship, we continue to scratch our heads at the end-game to miniscule interest rates (discussed in our Q2 ’19 Quarterly Telescope1). In South Africa, relative underperformance of local assets compared to global assets continued, with the JSE gaining 7% YTD versus 17% for the MSCI ACWI. A deteriorating economic and fiscal situation – accompanied by continued government inaction – was largely to blame. A government white paper on ending private healthcare, as well as rising support for the reintroduction of prescribed assets, has raised already high levels of investor concern. As a reminder, should asset prescription become policy, local pension funds will be forced to buy certain types of assets (mostly government and State Owned Enterprise bonds) regardless of their investment merit, allowing government to borrow money at meaningfully lower rates. In our view, reintroducing prescribed assets, last seen under the apartheid government in the 1980’s, will harm the progress that has been made since 1994 in opening up South Africa’s economy. Should the reality of prescription appear on our horizon, you can be certain Flagship’s asset allocation to the South African economy will be tailored accordingly. We are pleased to say that the political and economic ructions of the 3rd quarter have had very little impact on the companies we hold on your behalf. This is largely due to their robust business fundamentals that enable them to outperform through choppy environments; and to our valuation discipline that enables us to buy these businesses at a margin of safety. Due to our fundamental adherence to a long-term investment horizon, the bulk of the short-term news flow, heard or read, should have little or no bearing on our assessment of your investments. At Flagship The 3rd quarter has been a busy one at Flagship. We keenly anticipate the launch of our new fund, the Flagship Global Icon Fund, a global equity fund that will provide clients with 100% exposure to a collection of high quality, undervalued global stocks, many of which we also hold in our Flagship International Flexible and Flagship IP Worldwide Flexible Funds. The Flagship Global Icon Fund will offer both USD and ZAR entry points, easily accessible via Flagship’s office or on local and international investment platforms. We have also implemented strategic changes to the underlying assets of the Flagship IP Worldwide Flexible Fund of Funds. The intention of the change is to include a ‘basket’ of best-in-class, global equity funds, providing our investors with the following fund attributes:

- Exposure to top performing global funds, normally only accessible to institutional investors

- Reduction of ‘single manger risk’ by diversifying underlying assets to a portfolio of world class fund managers

- Lower overall fund management fees due to our ability to bulk our investments into the funds

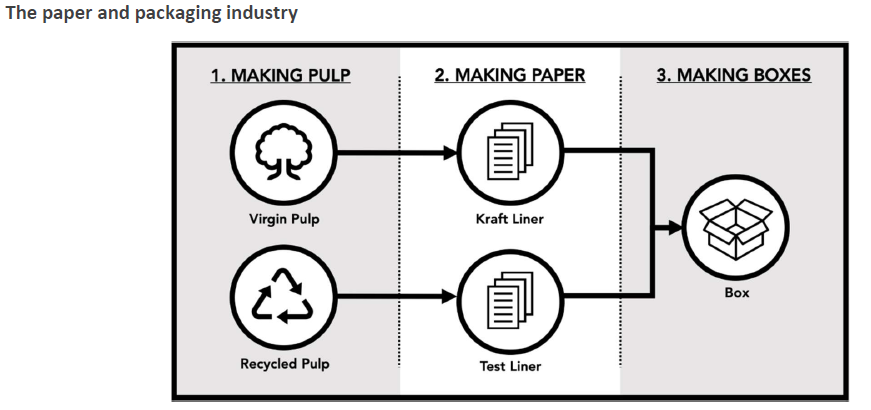

Importantly, the Flagship IP Worldwide Flexible Fund of Funds will retain its flexible mandate, allowing our Global Fund Management Team to increase or decrease equity exposure depending on global equity market valuations. DS Smith – Underappreciated and misunderstood One of the central aims of our Flagship QUARTERLY TELESCOPE is to introduce our investors to the investment cases behind our larger fund holdings. As of Q3 ‘19, DS Smith is the largest equity holding in our global equity strategies and, below, we detail for you the rationale behind our position’s sizing. DS Smith is one of the largest paper and packaging companies within Western Europe (together with Smurfit Kappa and Mondi) with a market share of 20% in 2018. Although it is listed in London, the UK makes up only 16% of its revenues, with the balance coming from mainland Europe and the US. We are positive on the broader structural drivers impacting the paper and packaging industry, and note the following tailwinds for companies operating in the sector: (1) Greater demand for packaging in general (due to e-commerce, the move away from big-box formats to convenience store formats); (2) greater demand for value-added packaging in particular which results in an increased box conversion margin because the value they add can be more easily demonstrated to clients (an example would be right-sizing packages for e-commerce so less ‘air’ is shipped); and (3) an increasing trend towards environmental sustainability (consumers favour paper over plastic). DS Smith has been an incredible success story since the arrival of current Chief Executive Miles Roberts. With a background in fast moving consumer goods (“FMCG”), he has changed DS Smith’s culture from being a commodity producer of paper towards being a customer centric “box-maker” for the FMCG industry (whose demand for paper is more stable). This strategy has borne fruit. Since Roberts’ appointment in 2010, group revenues have tripled from GBP2bn to GBP6bn and adjusted earnings per share (excluding amortization) have increased from 5.3 pence to 35 pence per share (up 7X). While share price performance has also been excellent, it has undershot EPS performance, having grown “only” 4X.