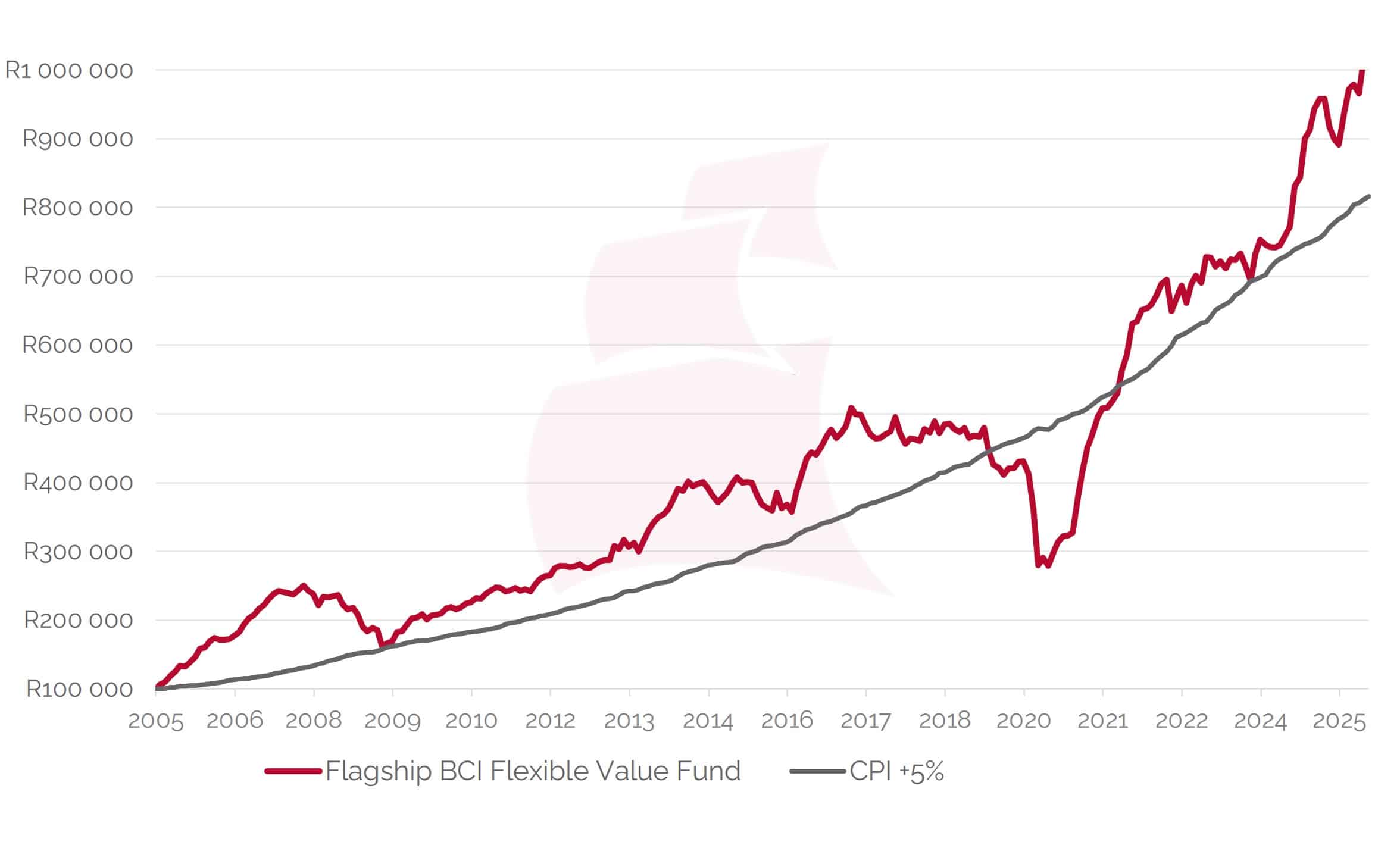

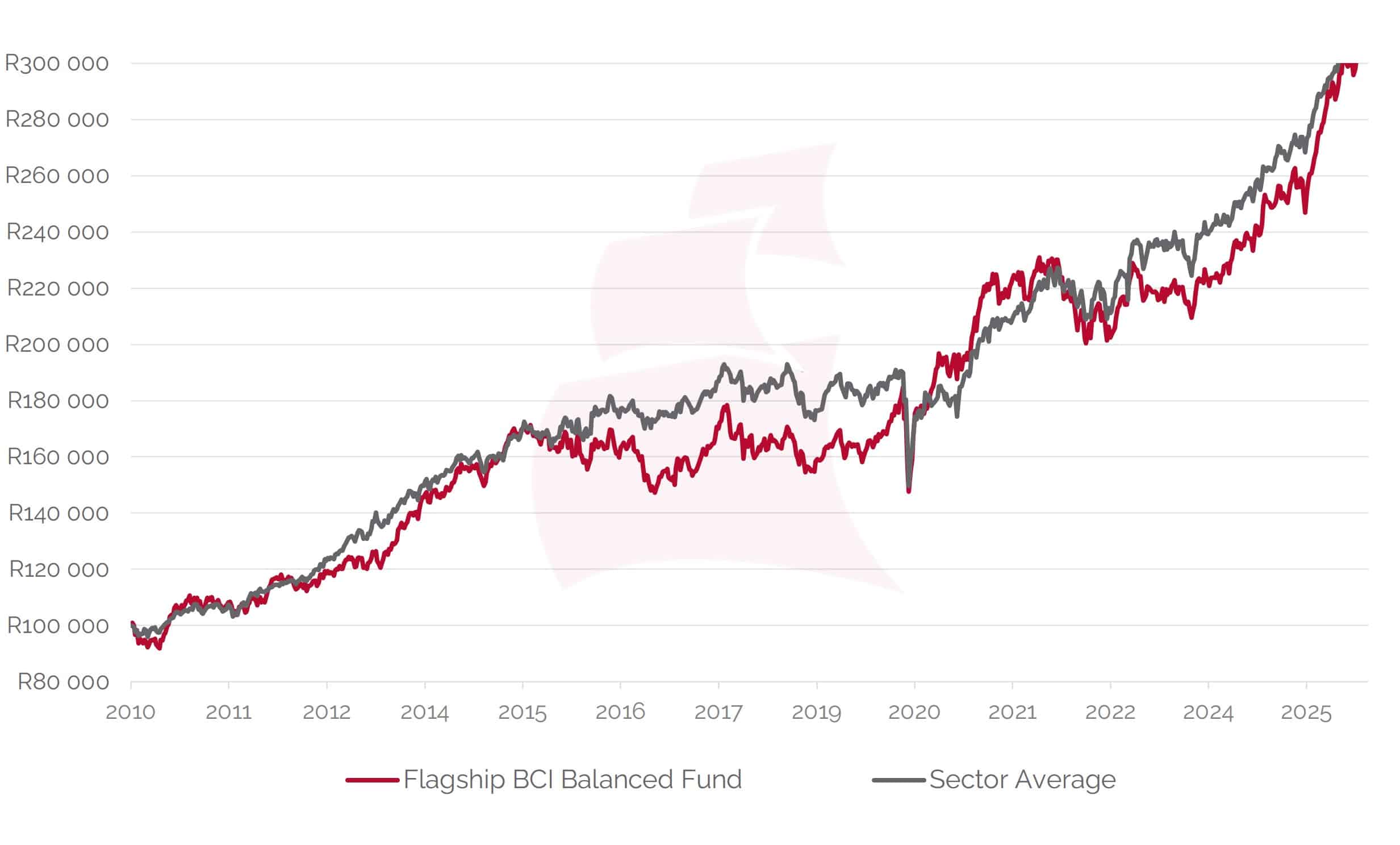

Our Domestic Specialist mandates offer investors two entry points: a Regulation 28 compliant Balanced Fund and a Flexible Value Fund that employs a deep value approach to equities. The Flexible Value Fund offers an actively managed strategy for long-term investors seeking a differentiated perspective.

Invest with us

Investing with Flagship Asset Management is a simple process. You can download the investment form or fill it out online. If at any stage in the process you are uncertain, please call us on +27(0)21 794 3140.

Invest with us

Investing with Flagship Asset Management is a simple process. You can download the investment form or fill it out online. If at any stage in the process you are uncertain, please call us on +27(0)21 794 3140.